- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7701

Will Shimadzu's (TSE:7701) AI Imaging Push Reshape Its Competitive Edge in MedTech?

Reviewed by Sasha Jovanovic

- Shimadzu Medical Systems USA recently introduced the Trinias series with SCORE Opera ST, an advanced angiography system for catheterization and vascular procedures, in the United States.

- This launch showcases voice recognition capabilities designed to streamline clinical workflows, marking a new step in Shimadzu’s medical imaging innovation.

- We'll explore how the integration of SMART Voice technology into Shimadzu's Trinias series shapes the company's evolving investment story.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Shimadzu's Investment Narrative?

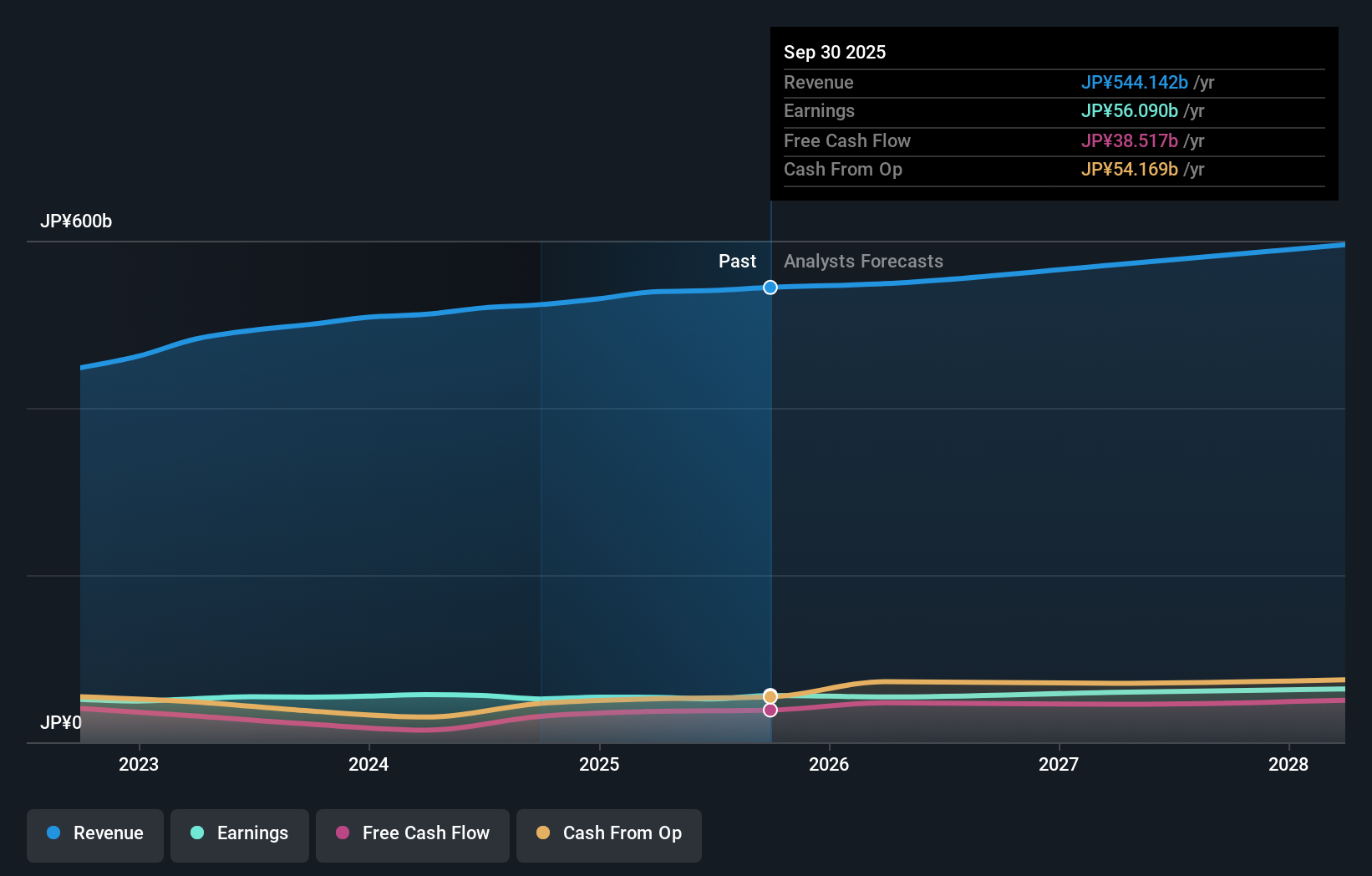

For an investor to have conviction in Shimadzu, it's crucial to believe the company can leverage innovation in medical imaging to drive sustainable earnings and maintain competitive relevance. The recent launch of the Trinias series with SMART Voice highlights fresh product capabilities and enhances Shimadzu’s profile in healthcare technology. However, given the measured pace of overall revenue and earnings growth relative to peers, and recent consensus analyst targets that already weigh in expected catalysts, the immediate impact from this launch may not be material in the short term. It has potential to influence the narrative around productivity gains and future sales. Meanwhile, the key risks, such as a premium valuation compared to sector norms and lagging near-term share price returns, deserve close attention, as they frame how much latitude the market is giving the company to prove new products can move the needle.

On the other hand, investors should weigh the premium valuation against sector peers. Shimadzu's shares are on the way up, but they could be overextended by 13%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Shimadzu - why the stock might be worth just ¥4892!

Build Your Own Shimadzu Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shimadzu research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Shimadzu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shimadzu's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7701

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success