- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7701

Shimadzu (TSE:7701): Reviewing Valuation After Optimistic UBS Outlook on China Growth and New Launches

Reviewed by Kshitija Bhandaru

Shimadzu (TSE:7701) recently grabbed investors’ attention after UBS shared a positive view on the company’s outlook. The optimism centers on anticipated new product launches and strengthening private-sector demand in China, which are key themes for potential growth.

See our latest analysis for Shimadzu.

Shimadzu’s share price has gained strong momentum recently, climbing 7% over the past month and 13.7% over 90 days. This likely reflects renewed optimism about growth opportunities in China and new product launches. However, its 1-year total shareholder return remains negative, suggesting that while sentiment may be turning, the recovery is still taking shape.

If you’re interested in spotting what else is gaining ground right now, take a look at our fast growing stocks with high insider ownership for a fresh crop of fast-moving companies with insiders deeply invested in their future.

With shares rebounding and analysts upbeat on future catalysts, investors may wonder whether Shimadzu is now offering an attractive bargain or if the market has already factored in all the expected growth ahead.

Price-to-Earnings of 21.7x: Is it justified?

Shimadzu’s stock is commanding a price-to-earnings ratio of 21.7x, which is noticeably higher than typical valuations both within its industry and among its peers. At a last close of ¥3882, this premium suggests that the market is pricing in more robust future earnings than what might be immediately apparent.

The price-to-earnings (P/E) ratio shows how much investors are willing to pay for each yen of current earnings. In a technology and electronics context, this measure is especially important as it reflects not only present performance but also anticipated growth and profitability.

However, Shimadzu’s P/E stands well above the Japanese Electronic industry average of 14.3x and the peer group average of 17.1x. In addition, it is higher than the estimated fair price-to-earnings ratio of 17.3x, indicating the market could be overestimating future profitability or is particularly optimistic about the company’s prospects relative to its fundamentals.

Explore the SWS fair ratio for Shimadzu

Result: Price-to-Earnings of 21.7x (OVERVALUED)

However, slower-than-expected revenue or earnings growth, or a shift in market sentiment, could quickly challenge the current optimistic outlook for Shimadzu.

Find out about the key risks to this Shimadzu narrative.

Another View: What Does Our DCF Model Say?

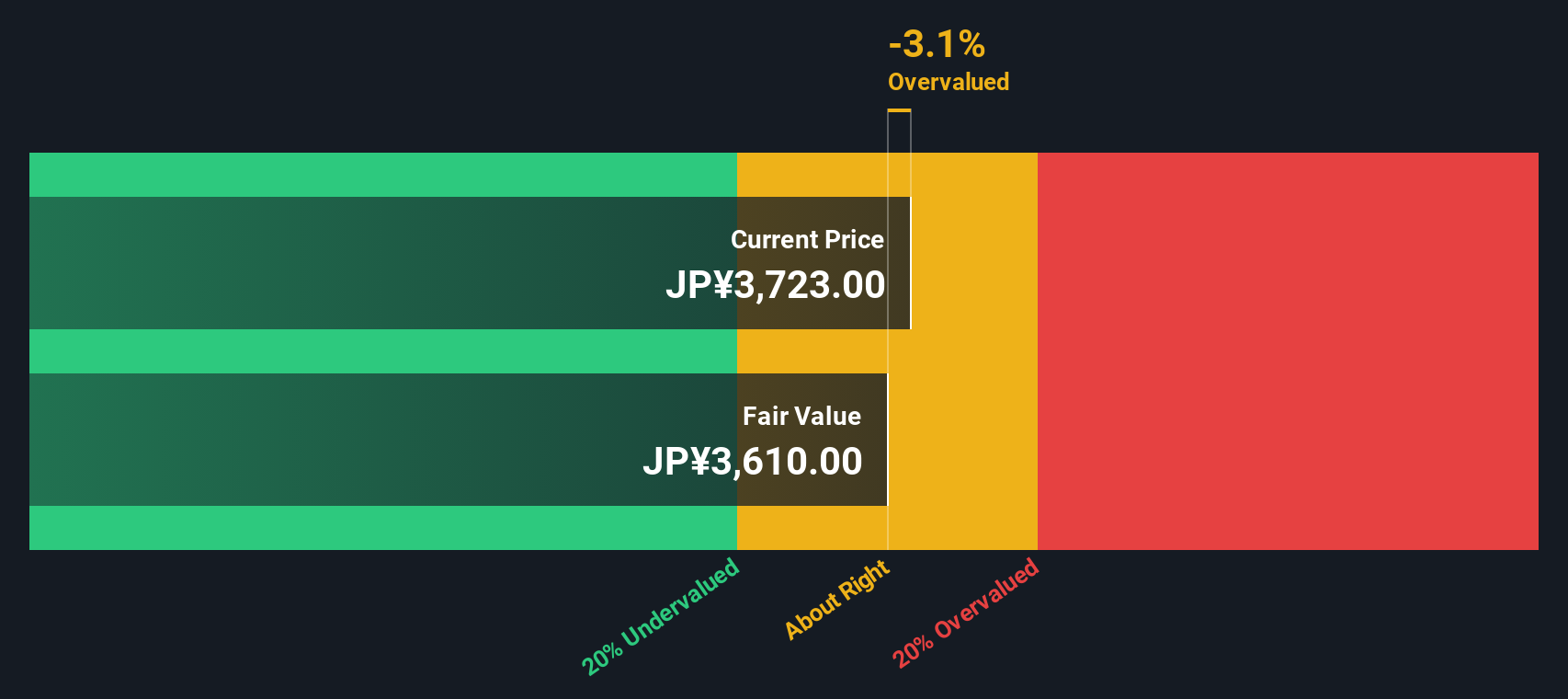

Looking from a different perspective, the SWS DCF model estimates Shimadzu’s fair value at ¥3,581.49 per share. This is below the current trading price of ¥3,882, which suggests the stock may be somewhat overvalued even when accounting for future cash flows and growth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shimadzu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shimadzu Narrative

If you’d rather come to your own conclusions or have a different perspective, you can dig into the numbers yourself and shape your own story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Shimadzu.

Looking for more investment ideas?

Don’t miss your chance to spot the next big winner. Use the Simply Wall Street Screener to quickly uncover companies with serious potential and unique market positions.

- Unlock growth potential by zeroing in on these 24 AI penny stocks, which are shaping innovation across industries.

- Maximize income opportunities through these 19 dividend stocks with yields > 3% offering attractive yields above 3% for steady returns.

- Tap into value by pinpointing these 891 undervalued stocks based on cash flows, currently trading below their intrinsic worth based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7701

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026