- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7609

Daitron (TSE:7609) Delivers 42.7% Profit Growth, Reinforcing Bullish Community Narratives

Reviewed by Simply Wall St

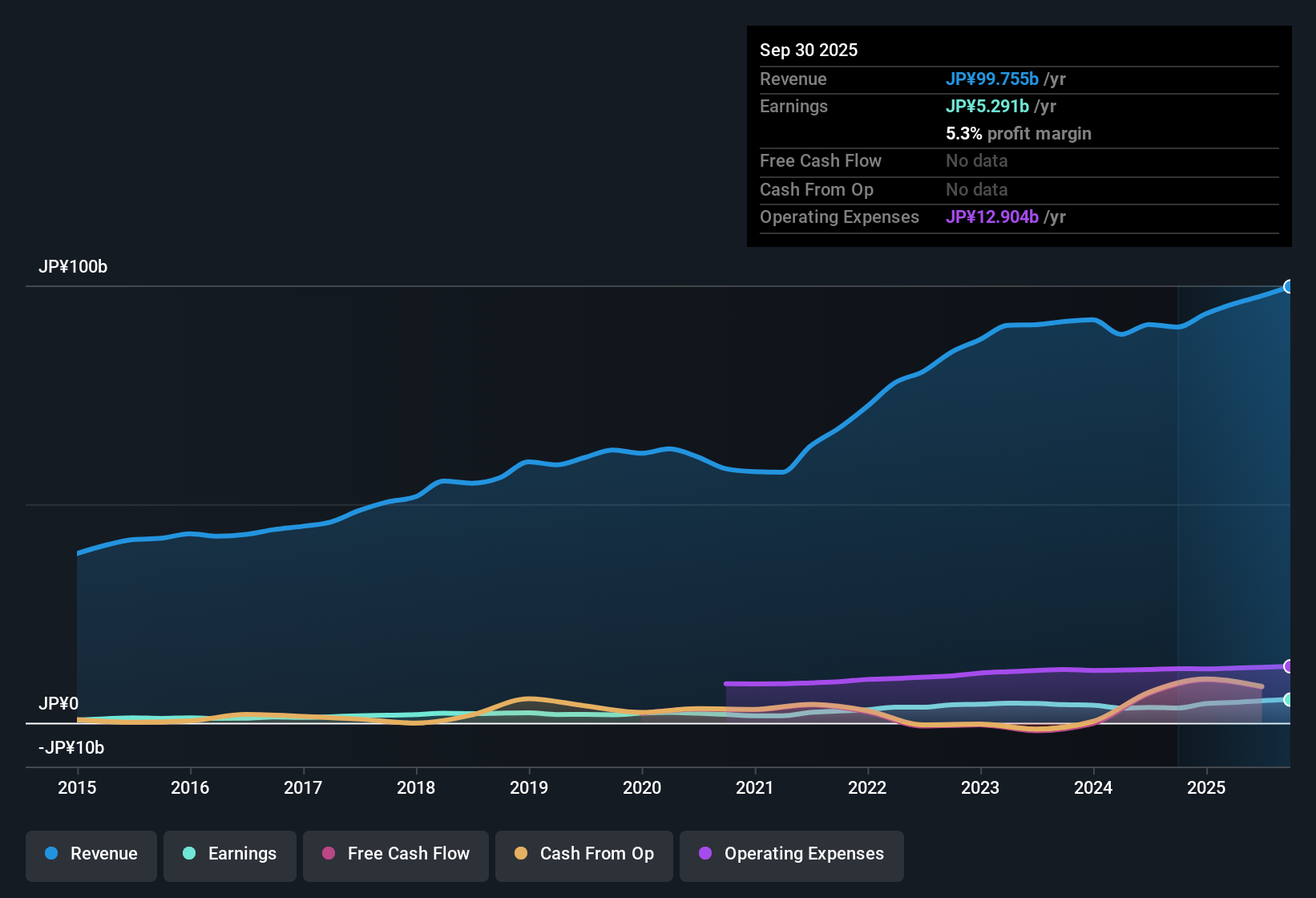

Daitron (TSE:7609) posted standout earnings this year, with profit expanding 42.7%, far outpacing its five-year annual growth rate of 16%. Net profit margins improved to 5.2% from last year’s 3.9%, underscoring rising profitability and consistent high-quality earnings according to recent filings. With a price-to-earnings ratio of 9.4x, which is well below industry and peer averages, the current share price may catch the eye of investors searching for value, even as a minor risk around dividend sustainability remains.

See our full analysis for Daitron.Next, we’ll line up these fresh results with prevailing narratives in the market to see which outlooks are validated and where surprises might shake up expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margins Climb to 5.2%

- Net profit margin increased from 3.9% to 5.2% over the past year, reflecting more efficient operations and a higher proportion of revenue converting to bottom-line profit.

- Profitability momentum strongly supports the view that Daitron’s business fundamentals are improving, especially as recent sector trends favor companies able to drive margin expansion.

- With margins reaching 5.2%, the company is now well above last year's level and this reinforces optimism about its ability to navigate sector volatility.

- Expanded margins contrast with some retail investor concerns around supply chain pressure and underscore Daitron’s operational discipline despite broader industry headwinds.

Five-Year Profit Growth Outpaces Peers

- Average annual profit growth of 16% over five years highlights a consistently strong performance. This figure stands out beyond sector averages and demonstrates resilience even before this year's earnings acceleration.

- Expansion above peer benchmarks highlights recognition for Daitron’s proven business model. Ongoing growth at or above this pace is typically rare in cyclical industries like electronics.

- The long-term trend counters the idea that recent strong results are a one-off and instead illustrates a pattern of sustained progress.

- This extended growth story attracts attention from value-driven investors seeking solid performers with a track record rather than just a fortunate year.

Share Price at a Discount to DCF Fair Value

- Daitron’s current share price of ¥4,520 trades significantly below its DCF fair value of ¥14,986.75 and at a price-to-earnings ratio of 9.4x compared to industry and peers at 15.3x and 16.6x, respectively.

- The wide valuation gap to both intrinsic value and industry multiples draws in investors searching for undervalued opportunities. The lower P/E may indicate attractive entry but also prompts questions about why the market has not closed this gap.

- While recent profit momentum supports a case for re-rating, the persistent discount could reflect market caution around issues like dividend sustainability as noted in risk disclosures.

- The share price trading well beneath DCF fair value may signal either an overlooked bargain or require investors to look closer at underlying risks before proceeding.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Daitron's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite accelerating profits and an undervalued share price, Daitron still faces lingering risks surrounding dividend sustainability. These risks could limit total returns for income-focused investors.

If stable and consistent dividends matter to you, check out these 1980 dividend stocks with yields > 3% to spot companies offering higher yields and more reliable income streams.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7609

Daitron

An electronic engineering trading company, engages in electronic equipment and components, and manufacturing equipment businesses in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives