- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7537

Marubun (TSE:7537) Profit Margins Beat Peers, Undervalued Shares Reinforce Bullish Narratives

Reviewed by Simply Wall St

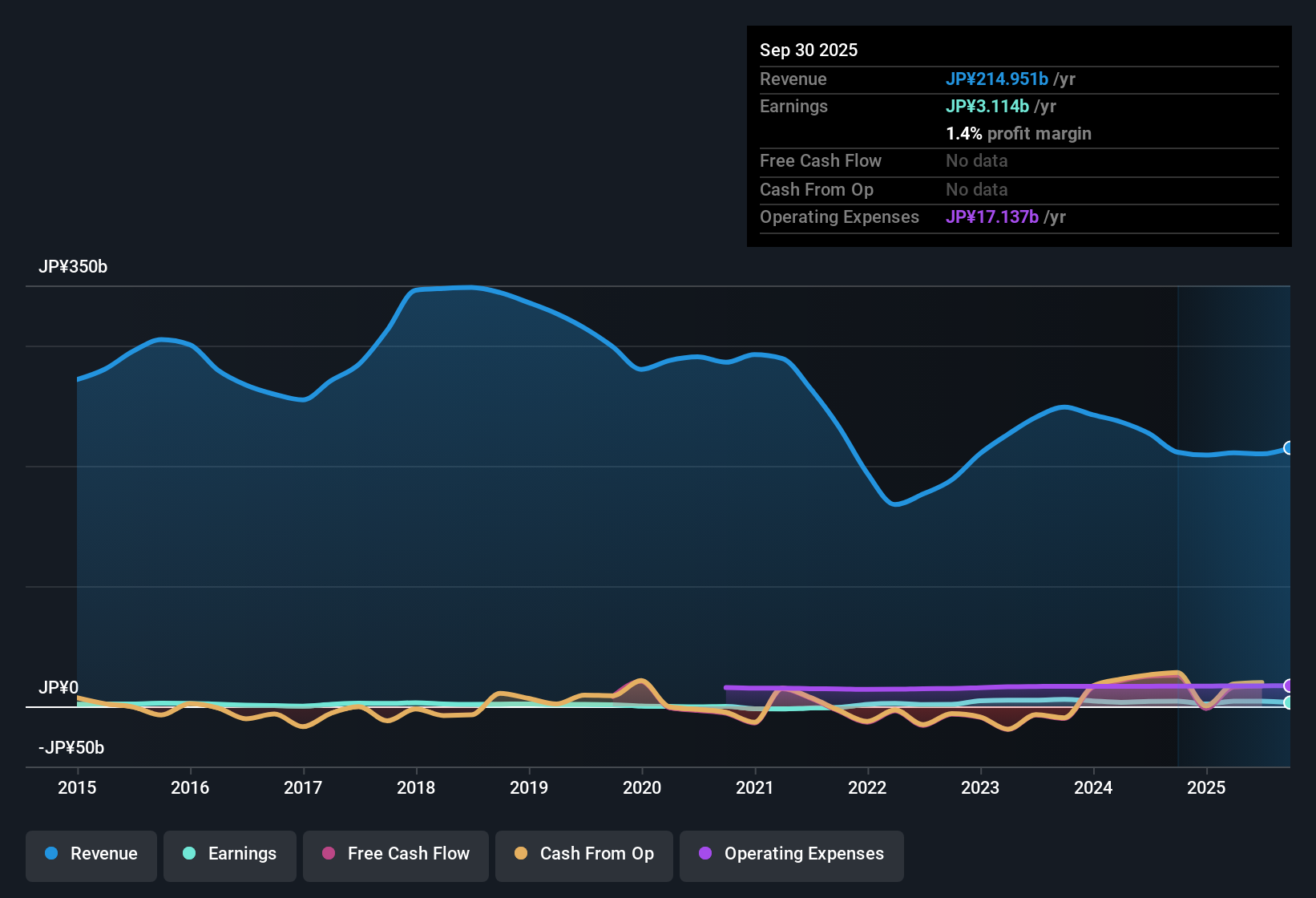

Marubun (TSE:7537) posted net profit margins of 2.1% for the latest period, an improvement from last year’s 1.8%. The company has maintained a five-year average earnings growth of 43.3% per year, although the most recent year came in at 5.8%. The company’s strong earnings outlook is highlighted by forecasts of 23.2% annual earnings growth for the next three years, which are expected to outpace both its 5.6% revenue growth forecast and the broader Japanese market averages. With a price-to-earnings ratio of 6.9x, which is well below industry and peer norms, investors may observe a combination of profit growth momentum and attractive valuation. However, financial stability and dividend sustainability continue to be important discussion points.

See our full analysis for Marubun.Next, we place Marubun’s headline numbers alongside key market narratives to assess what aligns and what may be challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Outpace Industry Averages

- Net profit margins have reached 2.1%, a notable improvement from last year's 1.8% and currently surpass the Japanese market average of 1.7% for peers.

- While recent narrative analysis focuses on Marubun's resilience in distribution and steady sector presence,

- profit margin expansion demonstrates the company is maintaining pricing power even amid sector headwinds, as peers are seeing margin pressure and inventory normalization.

- This margin trend aligns with analysts’ expectation that Marubun serves as a relatively stable, lower-volatility holding in electronics distribution, which appeals to long-term and conservative investors.

Growth Forecasts Lead Market Trends

- Earnings are projected to rise at a robust 23.2% annually over the next three years, outpacing Marubun’s own revenue growth outlook of 5.6%, and well above the Japanese market benchmarks (7.8% earnings, 4.5% revenue).

- Forecasts showing profit growth heavily support views of Marubun as a strong sector participant, not just a passive barometer,

- with the company’s five-year average earnings growth sitting at 43.3%, even if the latest year was a softer 5.8%.

- This level of growth attracts investors seeking durable upside in a traditionally cyclical sector, especially when sector-wide demand for electronics trends positively.

Valuation Discount Signals Opportunity

- Marubun trades at a price-to-earnings ratio of 6.9x, significantly below both the industry average of 15.3x and the peer average of 11.2x, suggesting shares are undervalued by traditional metrics.

- This valuation gap presents a compelling entry point for investors,

- as the company’s current share price of 1,165.0 is detached from growth forecasts and profit improvements, lending credence to claims that Marubun is a low-risk, attractively priced option within the sector.

- A bullish case is further supported when considering the stock may move closer to peer multiples if earnings momentum is sustained through sector shifts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Marubun's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Marubun's attractive valuation and strong profit growth, there are lingering concerns around the sustainability of its financial stability and dividend reliability.

If you want companies with stronger financial footing and durability in challenging markets, use our solid balance sheet and fundamentals stocks screener (1981 results) for stocks built on more resilient balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7537

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives