- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7480

Suzuden (TSE:7480) Margin Dip Challenges Valuation Narrative Despite Five-Year Earnings Growth

Reviewed by Simply Wall St

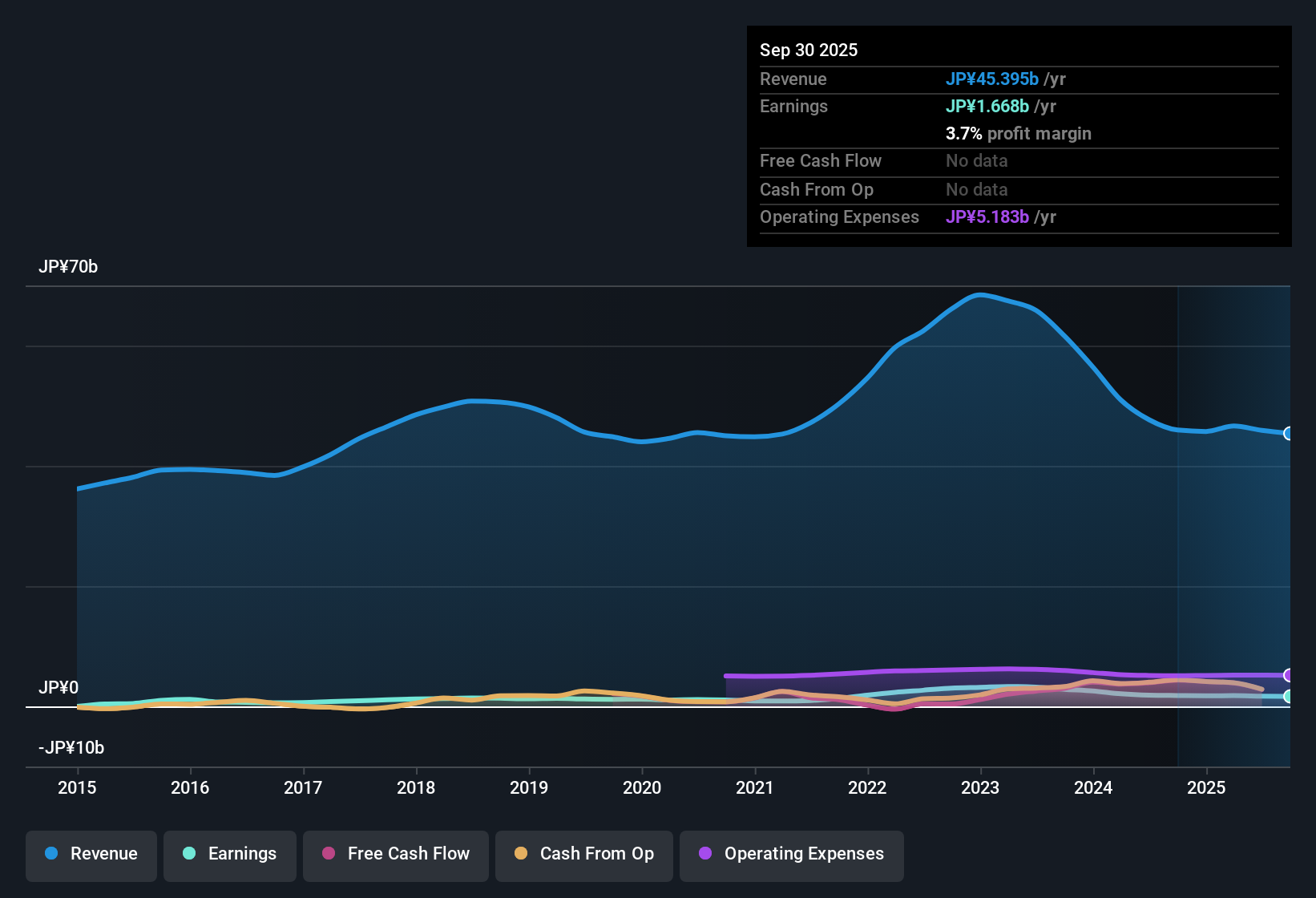

Suzuden (TSE:7480) posted net profit margins of 3.7%, coming in just under last year’s 3.9%, and has delivered a 9.1% average annual earnings growth over the past five years. Its shares, which now trade at ¥1,636, remain at a significant discount compared to both the Japanese Electronic industry’s 15.3x and peer average of 21.4x Price-To-Earnings ratios. The stock is also trading well below its estimated fair value of ¥3,738.49. While the most recent results reveal a dip in year-on-year earnings growth, the long-term picture points to high quality earnings and an attractive valuation. Ongoing scrutiny of dividend sustainability is warranted.

See our full analysis for Suzuden.Now, let’s see how these headline results measure up against the prevailing narratives. In some areas, consensus may hold, but there could also be surprises in store.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Under Pressure Despite Historical Growth

- Net profit margins fell to 3.7% this year, down from 3.9% the prior year, putting an end to Suzuden’s uninterrupted five-year stretch of average annual earnings growth at 9.1%.

- The prevailing market view highlights Suzuden’s long-term stability even as the recent slip in profitability stands out.

- The five-year trend of strong, high-quality earnings is unmistakable. However, the recent margin contraction and negative year-on-year earnings growth challenge the idea that Suzuden’s upward trajectory is guaranteed to continue.

- Investors focused on durability may see the margin dip as a minor bump if sector tailwinds return. At the same time, it serves as a reminder that macro shocks and supply chain disruptions can still disrupt performance.

Dividend Sustainability Faces New Scrutiny

- Dividend sustainability is flagged as a minor risk, given the combination of declining profit margins and the negative earnings growth recorded this year.

- The prevailing market view acknowledges that, while Suzuden’s fundamentals have supported consistent distributions in the past.

- The recent moderation in profitability may limit the company’s flexibility to maintain or boost dividend payouts in the near term, raising questions for income-oriented investors.

- Despite this, Suzuden’s high-quality earnings record over five years suggests the board could prioritize stability unless further margin pressure becomes persistent.

Valuation Discount Remains Substantial

- Suzuden trades at ¥1,636 per share, notably below its DCF fair value of ¥3,738.49 and lower than the Japanese Electronic industry’s 15.3x and peer average of 21.4x Price-To-Earnings ratios. Suzuden’s is just 13.5x.

- The prevailing market view suggests this deep discount supports the idea of Suzuden as a “value play.”

- Although recent weakness in earnings growth could keep the stock under the radar, the valuation gap encourages long-term investors to weigh Suzuden’s history of high-quality earnings against short-term profit headwinds.

- Comparative metrics imply opportunity if the company’s core profitability can rebound, potentially leading to a re-rating closer to its sector peers.

See our latest analysis for Suzuden.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Suzuden's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Suzuden’s declining profit margins and new questions about dividend sustainability may concern investors seeking more reliable income streams and payout stability.

If steady and resilient dividends are a priority for you, check out these these 1988 dividend stocks with yields > 3% to discover companies offering higher, more sustainable yields even during changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7480

Suzuden

Engages in purchasing and selling products related to electrical and electronic components in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives