- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6994

The Market Lifts Shizuki Electric Company Inc. (TSE:6994) Shares 34% But It Can Do More

Despite an already strong run, Shizuki Electric Company Inc. (TSE:6994) shares have been powering on, with a gain of 34% in the last thirty days. The last 30 days bring the annual gain to a very sharp 92%.

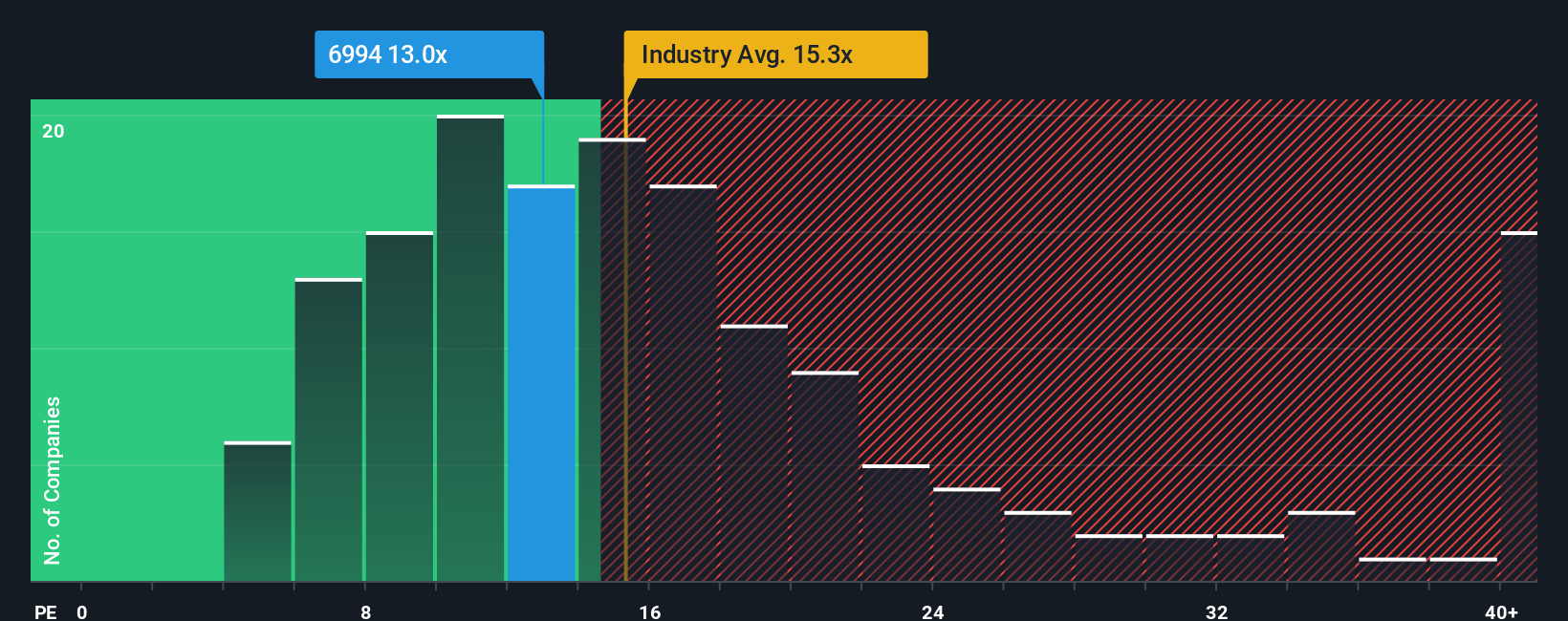

Although its price has surged higher, there still wouldn't be many who think Shizuki Electric's price-to-earnings (or "P/E") ratio of 13x is worth a mention when the median P/E in Japan is similar at about 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Shizuki Electric certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Shizuki Electric

How Is Shizuki Electric's Growth Trending?

In order to justify its P/E ratio, Shizuki Electric would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 250% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 112% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 11% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it interesting that Shizuki Electric is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Shizuki Electric's P/E?

Its shares have lifted substantially and now Shizuki Electric's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Shizuki Electric currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Shizuki Electric (at least 1 which can't be ignored), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6994

Shizuki Electric

Provides capacitors, and related equipment and facilities in Japan and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives