- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6981

Murata Manufacturing (TSE:6981) Valuation in Focus After New Guidance and Share Buyback Completion

Reviewed by Simply Wall St

Murata Manufacturing (TSE:6981) just released updated financial guidance for the year ahead and completed a significant share buyback. Both moves are drawing attention to the company's strategy and what it could mean for shareholders.

See our latest analysis for Murata Manufacturing.

Murata Manufacturing’s new guidance and share buyback appear to have sparked investor optimism, as reflected in an impressive 12% share price jump in just the past week and a 34% price return year-to-date. Recent collaborations, such as deeper integration with Cadence’s EDA tools, contribute to the positive sentiment. The company’s 1-year total shareholder return of 32% shows that momentum is picking up in both the short and long term.

If you're curious what else is capturing investor interest after Murata's strong move, now’s the perfect time to discover fast growing stocks with high insider ownership

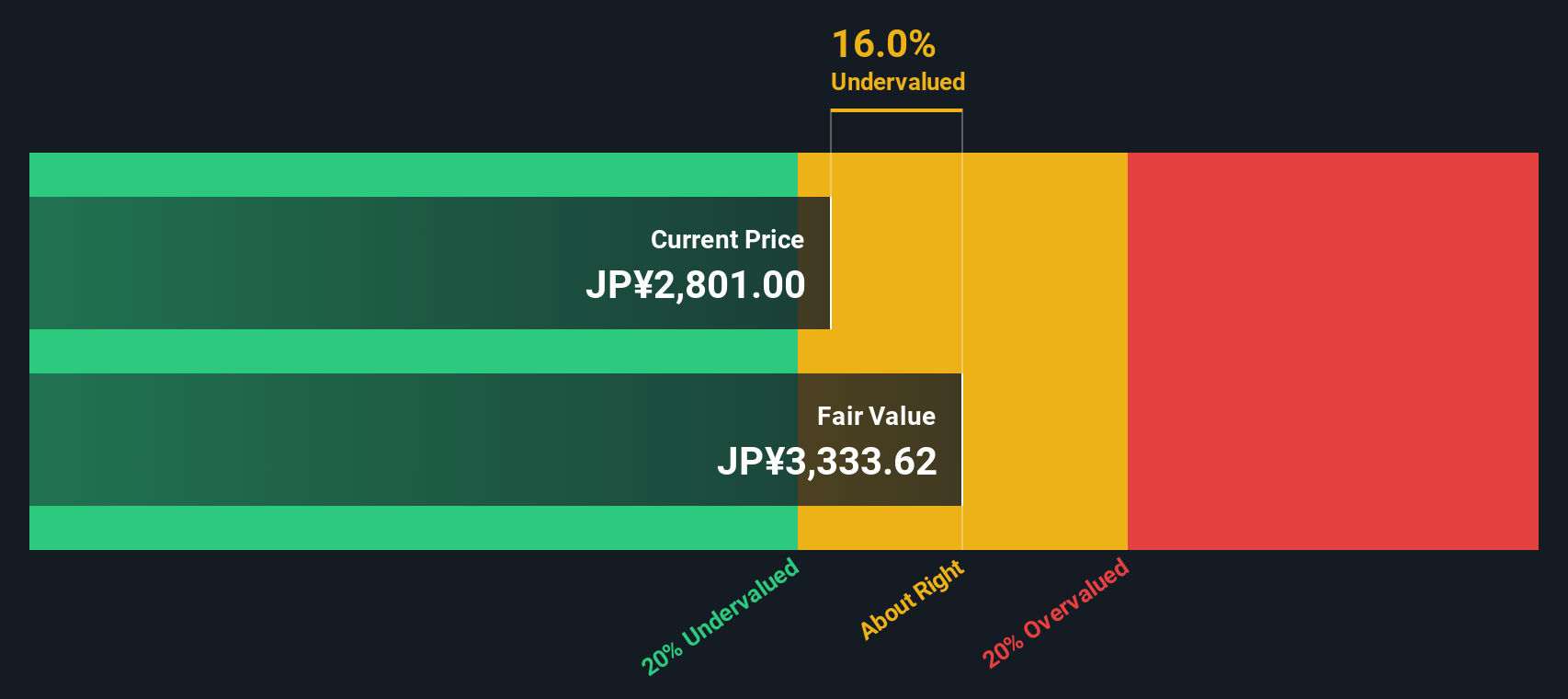

But with shares now rallying sharply and the latest price hovering close to analyst targets, the key question becomes whether Murata is still undervalued or if the market has already priced in the company’s growth story.

Price-to-Earnings of 28.6x: Is it justified?

Murata Manufacturing trades at a price-to-earnings ratio of 28.6x, which is well below its peers but significantly above the sector average. The stock’s last close was ¥3,392, reflecting this elevated valuation level.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each yen of current earnings. For technology manufacturers like Murata, a higher P/E can signal optimism around earnings growth and future prospects, but it can also pose risks if those expectations are not met.

While the market appears to value Murata’s earnings more highly than the average JP Electronic industry, which stands at a 15.2x P/E, this premium may be justified by recent profit growth acceleration and consistently high-quality earnings. However, the ratio is still above the estimated fair P/E of 24x. This suggests some stretch in valuation if growth momentum falters. The fair ratio gives a sense of where the valuation could settle if market sentiment normalizes.

Explore the SWS fair ratio for Murata Manufacturing

Result: Price-to-Earnings of 28.6x (OVERVALUED)

However, slowing annual revenue growth and the stock’s current discount to analyst targets could limit further upside if market sentiment shifts.

Find out about the key risks to this Murata Manufacturing narrative.

Another View: The SWS DCF Model

Taking a different angle, our DCF model values Murata Manufacturing at ¥3,311 per share, slightly below the recent closing price of ¥3,392. This suggests the stock might be a bit overvalued according to this method, even though multiples suggest peer value. Does this more conservative outlook paint a truer picture of today’s risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Murata Manufacturing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Murata Manufacturing Narrative

If you’d rather dig deeper or take a different view, you can quickly explore the numbers and build your own perspective in just a few minutes. Do it your way

A great starting point for your Murata Manufacturing research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop with Murata when you could tap into high-potential opportunities others might miss. Use the Simply Wall Street Screener to confidently take the next step in building your winning portfolio.

- Fuel your search for standout returns by spotting major growth trends with these 26 AI penny stocks, focusing on companies redefining artificial intelligence.

- Lock in income potential with these 22 dividend stocks with yields > 3%, showcasing stocks that offer strong dividend yields and reliable payouts for steady cash flow.

- Capture tomorrow’s leaders in breakthrough technology by checking out these 28 quantum computing stocks, where quantum computing pioneers are shaping the next frontier.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6981

Murata Manufacturing

Develops, manufactures, and sells ceramic-based passive electronic components and solutions in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives