- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6976

Does Taiyo Yuden (TSE:6976) Hold a Competitive Edge in the Next Wave of AI Hardware?

Reviewed by Sasha Jovanovic

- Taiyo Yuden has commercialized and begun mass production of an embeddable multilayer ceramic capacitor (MLCC) achieving 22-mF capacitance in a compact 1005M size, engineered for decoupling applications in AI servers and advanced information devices.

- This innovation leverages advanced external electrode formation technology, meeting the increasing demand for small, high-capacity MLCCs placed closer to ICs in power-intensive, next-generation electronics.

- We’ll explore how Taiyo Yuden’s breakthrough in embeddable MLCC technology could reshape its investment narrative amid AI-driven hardware demand.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

What Is Taiyo Yuden's Investment Narrative?

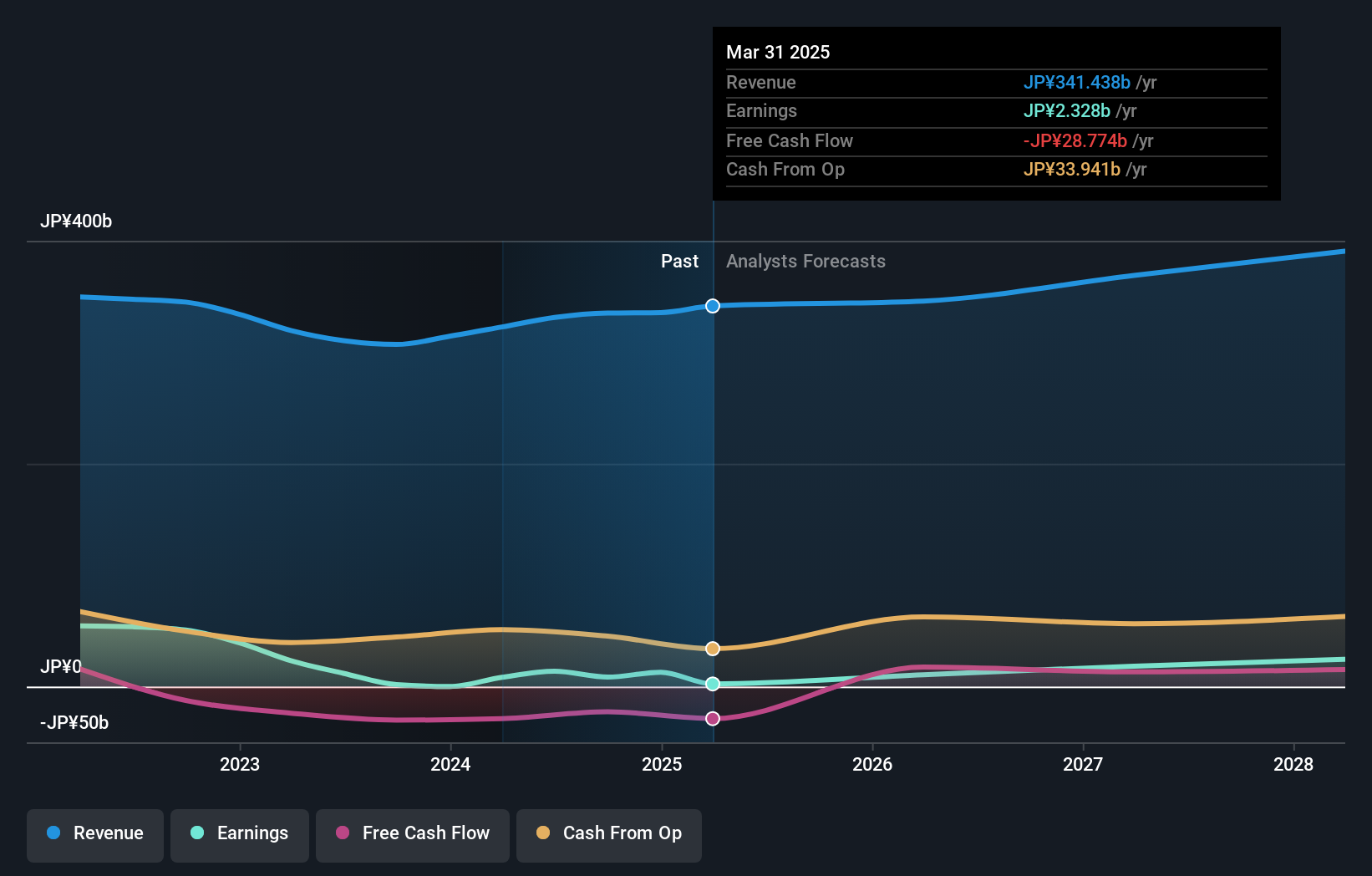

For most investors, the Taiyo Yuden story hinges on whether you believe in the long-term, AI-driven demand for advanced electronic components. The recent move into mass production of an embeddable 22-mF MLCC puts the company squarely in the spotlight, potentially shifting the short-term catalysts that have historically centered on incremental product launches and automotive demand. This fresh capability could help Taiyo Yuden better capitalize on high-growth AI server markets, but the immediate financial impact remains to be seen, especially given the company’s current unprofitability and recent price volatility. Previous analysis positioned Taiyo Yuden’s biggest risks as continued losses and a board that’s been turning over, but this new MLCC breakthrough might ease margin worries if adoption is strong. Investors are likely to watch upcoming earnings for concrete signs that this product can change the story.

However, share price swings and an inexperienced board are factors investors should not overlook.

Exploring Other Perspectives

Explore another fair value estimate on Taiyo Yuden - why the stock might be worth just ¥4643!

Build Your Own Taiyo Yuden Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Taiyo Yuden research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Taiyo Yuden research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Taiyo Yuden's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiyo Yuden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6976

Taiyo Yuden

Develops, manufactures, and sells electronic components in Japan, North America, China, Europe, Hong Kong, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives