- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6971

Kyocera (TSE:6971) Valuation: Assessing Share Price After Major Tech Advances and CES 2026 Reveal

Reviewed by Simply Wall St

Kyocera (TSE:6971) is drawing attention after announcing new breakthroughs in its technology portfolio. The company recently demonstrated an advanced Underwater Wireless Optical Communication system and unveiled a Triple Lens AI-Based Depth Sensor. Both innovations are set to be showcased at CES 2026.

See our latest analysis for Kyocera.

Momentum has been strong for Kyocera, with the stock delivering a 30.4% share price return so far this year and a standout 41.2% total shareholder return over the past twelve months. Recent breakthroughs in communications and imaging technology appear to be reinforcing growth expectations, even as market attention shifts toward next-generation mobility and industrial applications.

Curious what else is on the cutting edge? Now may be the perfect time to discover See the full list for free.

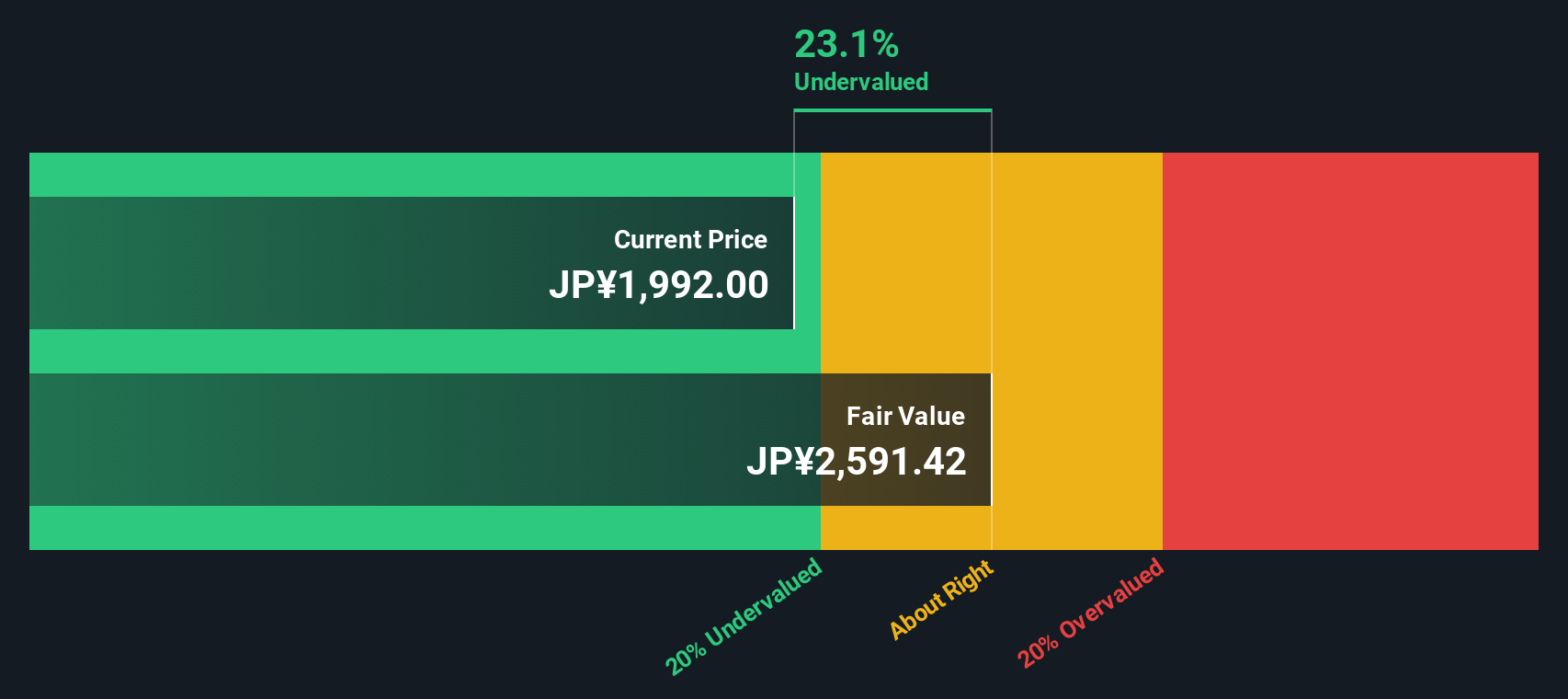

With a surge in returns and groundbreaking product launches, investors now face a pivotal question: are Kyocera shares undervalued after recent gains, or is the market already pricing in the company’s future growth prospects?

Price-to-Earnings of 63.7x: Is it justified?

Kyocera shares are currently trading at a price-to-earnings (P/E) ratio of 63.7x, a level that signals a significant premium compared to various benchmarks. The last close price of ¥2,025.5 reflects investors’ willingness to pay a high multiple for recent and projected earnings.

The P/E ratio expresses how much investors are paying for each ¥1 of earnings. For technology and electronics companies, higher P/E ratios can reflect strong growth expectations or optimism around new products and innovations. However, they can also suggest the market is pricing in future earnings growth that may not be guaranteed.

When compared directly to peers and industry averages, Kyocera’s P/E stands out as notably expensive. The JP Electronic industry average sits at 14x, while peer companies average 30.3x. Even against the estimated fair P/E of 25.5x for Kyocera specifically, the current multiple looks stretched. This gap suggests the market is either highly optimistic about near-term profit rebounds or recent enthusiasm may have run ahead of fundamentals.

Explore the SWS fair ratio for Kyocera

Result: Price-to-Earnings of 63.7x (OVERVALUED)

However, any slowdown in revenue growth or margin pressure from increased competition could quickly challenge current market optimism regarding Kyocera’s valuation.

Find out about the key risks to this Kyocera narrative.

Another View: Discounted Cash Flow Perspective

While the price-to-earnings ratio paints Kyocera as overvalued, our DCF model arrives at a different conclusion. Based on forecasted cash flows, Kyocera appears to trade about 16% below its estimated fair value. This suggests potential upside that the market multiples may not reflect.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kyocera for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kyocera Narrative

If you want to see the figures from a different angle or feel inspired to dive deeper, you can easily shape your own perspective in just a few minutes. Do it your way

A great starting point for your Kyocera research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Start building a winning portfolio now by targeting stocks that fit your goals. There’s no need to wait when these unique opportunities are within reach.

- Spot companies with resilient income streams by checking out these 15 dividend stocks with yields > 3% to see which stocks yield over 3% today.

- Catch the next wave of innovation with these 27 AI penny stocks to see which cutting-edge AI players are gaining ground right now.

- Grow your wealth by targeting value opportunities through these 895 undervalued stocks based on cash flows and invest where the market sees potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyocera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6971

Kyocera

Develops and sells products based on fine ceramic technologies in Japan, China, rest of Asia, Europe, the United States, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives