- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6971

Kyocera (TSE:6971) Profit Margin Hit by ¥40.1B Loss, Challenging Recovery Expectations

Reviewed by Simply Wall St

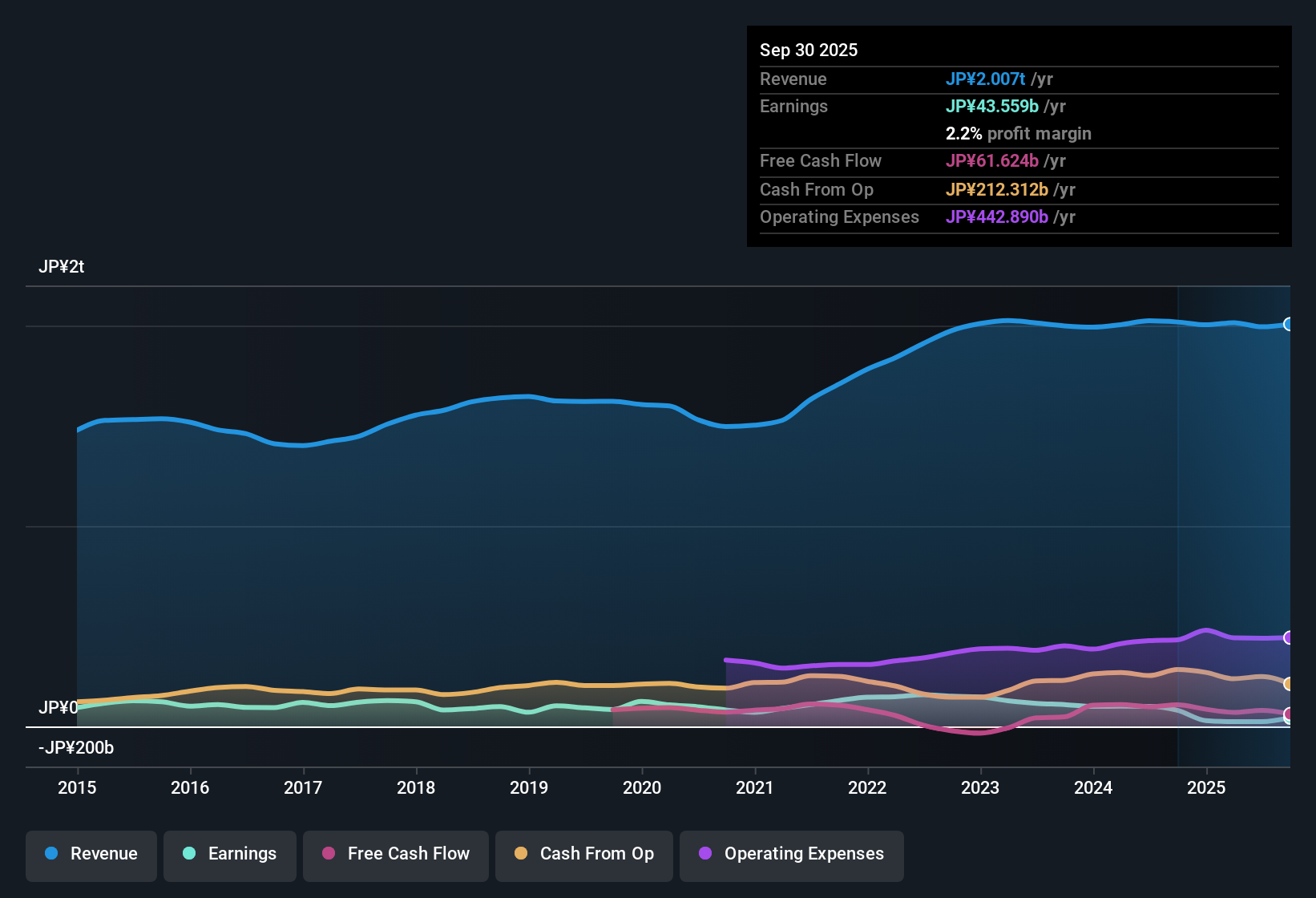

Kyocera (TSE:6971) reported a net profit margin of 2.2%, down from 4% in the prior year, as the company absorbed a one-off loss of ¥40.1 billion. Over the past five years, earnings have declined by 15.1% annually, while revenue is forecast to grow at just 2% per year, lagging the broader Japanese market’s expected 4.5% pace. With analysts projecting a sharp rebound in earnings growth of 21.8% per year ahead, investors are weighing whether future gains will balance out recent profitability setbacks.

See our full analysis for Kyocera.With the headline numbers established, it’s time to see how the results compare to the prevailing narratives. Some long-held views may get reinforced, while others could be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Large Exceptional Loss Weighs on Profits

- The one-off loss of ¥40.1 billion this period stands out as a major hit to Kyocera’s bottom line, dramatically compressing profitability even before any return to normal operations.

- Cautious investors note this exception overshadows the underlying trend, raising questions about how much of any future recovery will simply be a rebound from this one-time setback.

- Because the net profit margin dropped to 2.2% after the loss, more pressure falls on operational performance to drive improvement, not just the removal of the one-off item.

- What is surprising is that, despite the hit, analysts forecast a rapid 21.8% annual jump in earnings ahead. This is considered a tall order if underlying earnings quality does not improve alongside headline numbers.

Growth Outlook Lags Market Pace

- Although Kyocera’s revenue is projected to rise by 2% per year, this is less than half the expected 4.5% annual growth of the broader Japanese market, highlighting a lag versus competitors.

- Prevailing market analysis emphasizes that Kyocera’s slower top-line momentum could limit upside, especially as sector peers benefit more from Japan’s industrial recovery.

- Investors face a debate: strong forecasted earnings growth relies on an assumption that margins will bounce back, despite only modest sales improvements.

- The main risk is that if revenue trends stay subdued, Kyocera could fall further behind industry averages in both growth and scale, with operational improvements bearing the full burden of future progress.

Valuation: Discount to Fair Value, But Premium to Peers

- Kyocera trades at ¥2,050, which is below its DCF fair value of ¥2,582.61. This suggests some upside. However, it posts a steep 65.1x price-to-earnings ratio, far higher than both its peer group (36.6x) and industry average (15.2x).

- The numbers highlight a valuation gap: on one hand, a discount to fair value tempts investors, but on the other, paying well above peer multiples for a business with sluggish revenue growth and recent profit pressures creates hesitation.

- What stands out is how Kyocera trades at a premium even as its earnings record is weighed down by one-off losses and margins trail better-performing rivals.

- This sets up a classic test: whether the anticipated rebound in profitability materializes soon enough to justify the current price, given investors have cheaper, faster-growing alternatives in the same sector.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kyocera's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Kyocera faces sluggish revenue growth, elevated valuation multiples, and pressure for operational improvement following profit setbacks and a hefty one-off loss.

Favor proven, reliable expansion instead? Use stable growth stocks screener (2103 results) to discover companies that consistently deliver steady revenue and earnings growth, even when rivals struggle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyocera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6971

Kyocera

Develops and sells products based on fine ceramic technologies in Japan, China, rest of Asia, Europe, the United States, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives