- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6971

A Fresh Look at Kyocera (TSE:6971) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Kyocera.

This comes on the back of a notable year for Kyocera, with momentum picking up as the share price returned nearly 12% over the past three months and a robust 31.7% gain year-to-date. Total shareholder return has also been strong, up 39.6% in the past year and 60.7% over five years. This suggests both short-term and long-term performance has remained impressive amid shifting sentiment and renewed optimism about the company’s growth potential.

If you’re watching Kyocera’s rally and wondering what else is gathering steam right now, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With Kyocera’s impressive momentum drawing attention, the real question now is whether the share price still offers upside, or if the market has already factored in the company’s future growth prospects. This could leave little room for new buyers.

Price-to-Earnings of 115.8x: Is it justified?

Kyocera’s stock currently trades at a lofty price-to-earnings (P/E) ratio of 115.8, which stands far above both the electronic industry average and its closest peers. With a recent close of ¥2,046.5, this rich valuation signals that the market is pricing in highly optimistic future growth or discounting short-term profit volatility.

The price-to-earnings ratio is a widely used metric to gauge how much investors are paying for each unit of earnings. For technology companies like Kyocera, a high P/E can sometimes reflect strong growth expectations or confidence that earnings will rebound sharply after a cyclical dip.

However, Kyocera’s P/E of 115.8 is much higher than the Japanese electronic industry average of 15.2 and the peer average of 35.7, highlighting a significant premium that may not be justified by current profitability levels. The fair price-to-earnings ratio is estimated at 27.5, which indicates the current market price reflects much higher expectations than what typical models suggest the company deserves. If sentiment shifts or earnings growth underdelivers, this multiple may revert closer to industry norms.

Explore the SWS fair ratio for Kyocera

Result: Price-to-Earnings of 115.8 (OVERVALUED)

However, any slowdown in earnings growth or a market correction in tech valuations could quickly challenge the bullish outlook for Kyocera’s shares.

Find out about the key risks to this Kyocera narrative.

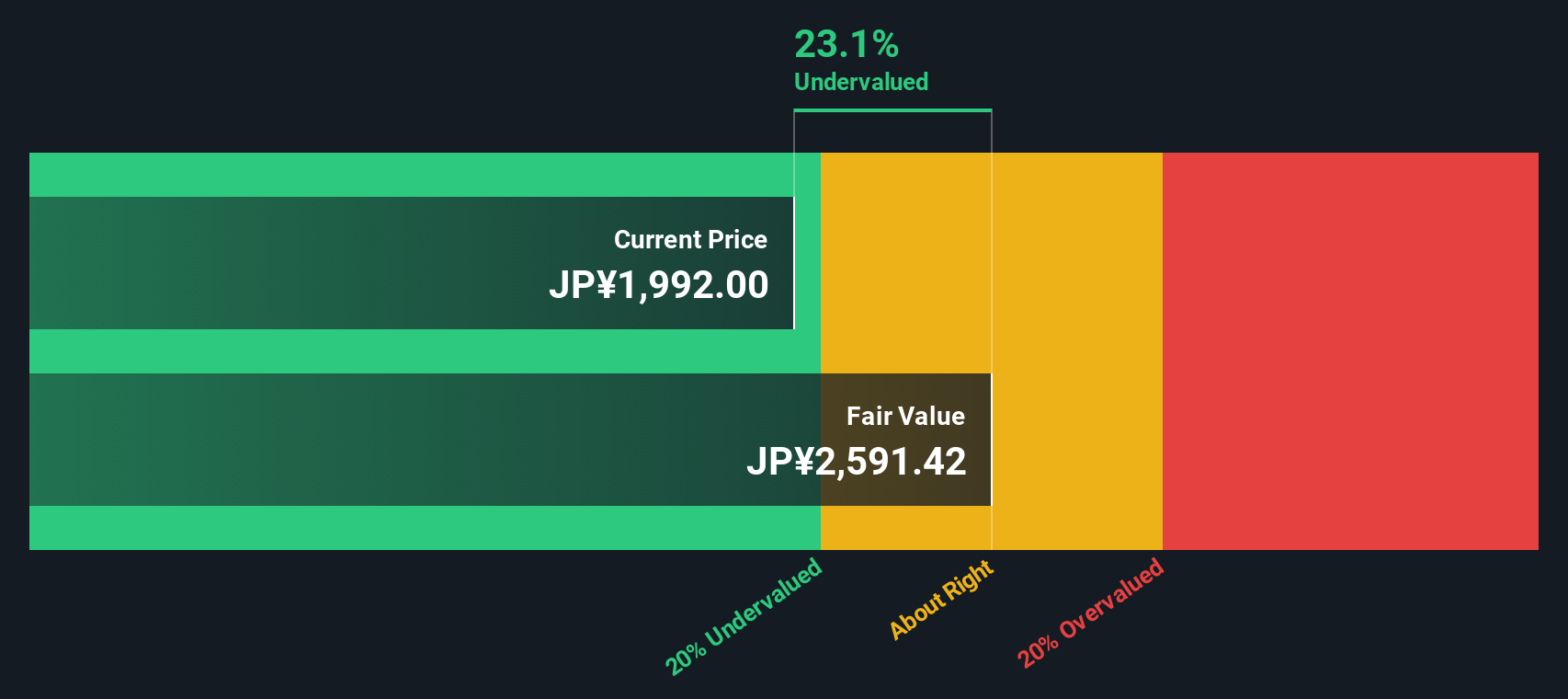

Another View: SWS DCF Model Points to Undervaluation

While Kyocera’s share price looks expensive using the price-to-earnings ratio, our DCF model presents a different story. The SWS DCF model estimates fair value at ¥2,587.67, which is about 21% above the current price. This model suggests Kyocera may actually be undervalued. But can the underlying cash flows justify this optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kyocera for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 831 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kyocera Narrative

If you want to take a different approach or would rather shape the story yourself, it’s quick and easy to build your own view in just a few minutes. Do it your way

A great starting point for your Kyocera research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors keep their options open. Don’t miss the stocks making waves beyond Kyocera; your next winning idea may be just a click away.

- Maximize income potential and see which companies are offering impressive yields with these 24 dividend stocks with yields > 3%.

- Power up your portfolio by tapping into the innovators at the forefront of artificial intelligence through these 26 AI penny stocks.

- Stay ahead of the crowd and spot hidden bargains among these 831 undervalued stocks based on cash flows currently flying under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyocera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6971

Kyocera

Develops and sells products based on fine ceramic technologies in Japan, China, rest of Asia, Europe, the United States, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives