- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6946

Subdued Growth No Barrier To Nippon Avionics Co., Ltd. (TSE:6946) With Shares Advancing 29%

Nippon Avionics Co., Ltd. (TSE:6946) shareholders have had their patience rewarded with a 29% share price jump in the last month. The last month tops off a massive increase of 145% in the last year.

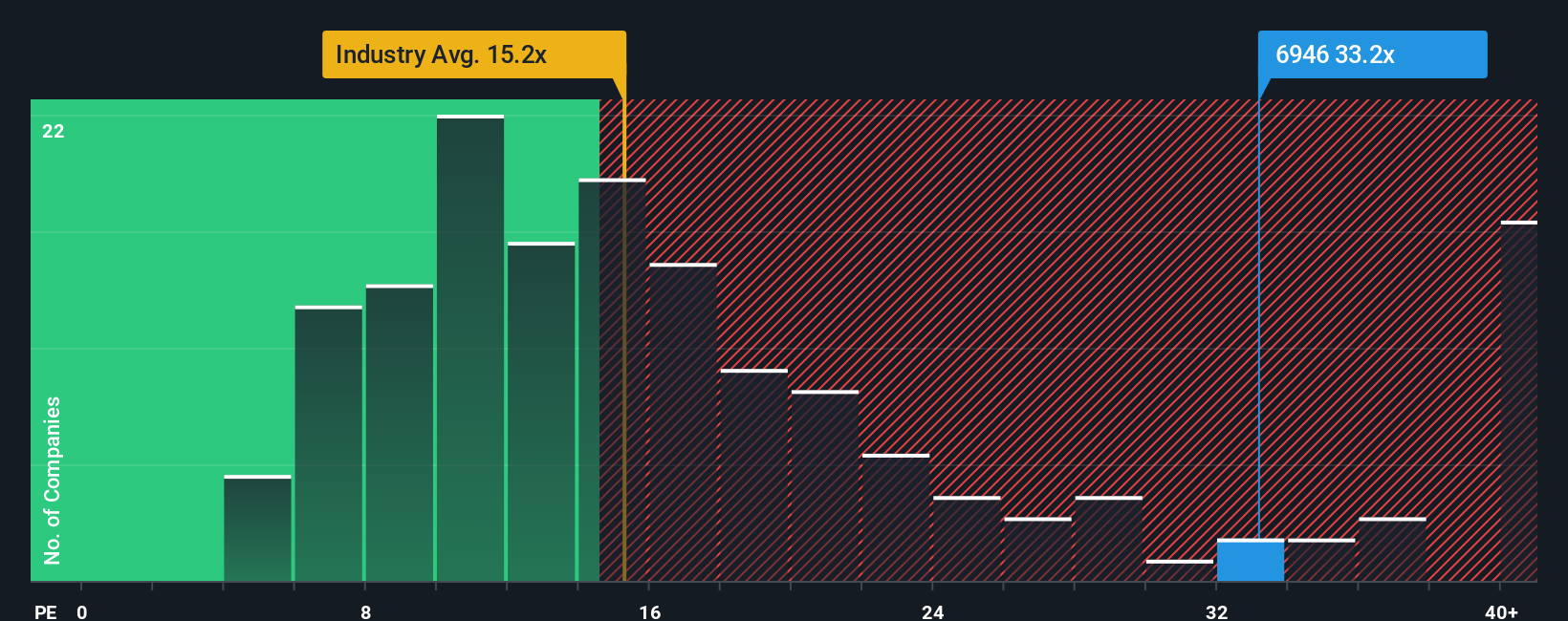

Following the firm bounce in price, given close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 14x, you may consider Nippon Avionics as a stock to avoid entirely with its 33.2x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Nippon Avionics has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Nippon Avionics

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Nippon Avionics' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 26% last year. The strong recent performance means it was also able to grow EPS by 82% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 11% each year during the coming three years according to the two analysts following the company. With the market predicted to deliver 9.6% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's curious that Nippon Avionics' P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Nippon Avionics' P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Nippon Avionics currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Nippon Avionics (1 doesn't sit too well with us!) that you need to be mindful of.

You might be able to find a better investment than Nippon Avionics. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nippon Avionics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6946

Nippon Avionics

Designs, develops, manufactures and sells data processing systems and related electric equipment in Japan.

Proven track record with moderate growth potential.

Market Insights

Community Narratives