- Japan

- /

- Capital Markets

- /

- TSE:8707

Undiscovered Gems in Japan for September 2024

Reviewed by Simply Wall St

As Japan's stock markets navigate a period of volatility, with the Nikkei 225 Index and TOPIX Index both experiencing notable declines, investors are increasingly on the lookout for resilient opportunities within the small-cap sector. Amidst this backdrop, identifying stocks with strong fundamentals and growth potential becomes crucial for navigating uncertain economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NCD | 11.89% | 8.95% | 25.43% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 0.86% | 4.40% | ★★★★★★ |

| QuickLtd | 0.73% | 9.61% | 14.56% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.80% | 6.26% | 4.41% | ★★★★★★ |

| Ad-Sol Nissin | NA | 4.02% | 7.90% | ★★★★★★ |

| HeadwatersLtd | NA | 19.26% | 23.89% | ★★★★★★ |

| NPR-Riken | 15.31% | 10.00% | 44.55% | ★★★★★☆ |

| Toho | 82.16% | 1.83% | 47.38% | ★★★★★☆ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

We'll examine a selection from our screener results.

Showa Sangyo (TSE:2004)

Simply Wall St Value Rating: ★★★★★☆

Overview: Showa Sangyo Co., Ltd. manufactures, processes, and sells food products in Japan with a market cap of ¥95.60 billion.

Operations: Showa Sangyo generates revenue primarily from its Food Business segment, which contributed ¥283.80 billion, and its Feed Business segment, which added ¥57.95 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

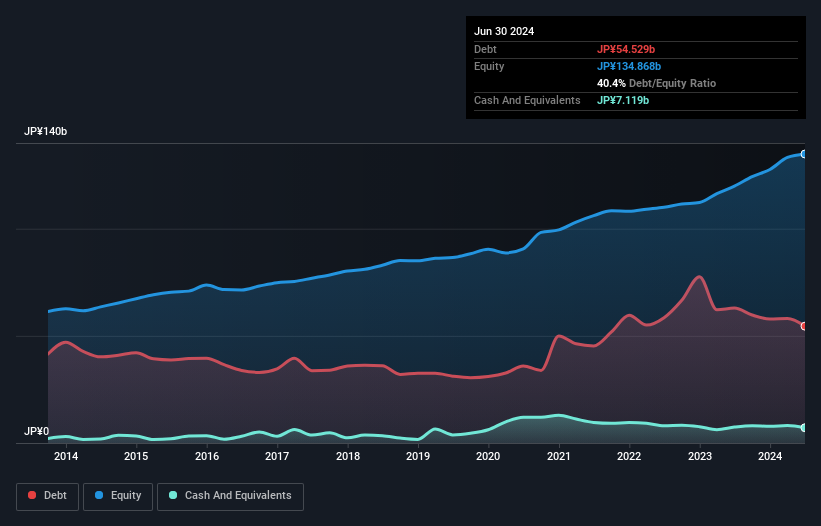

Showa Sangyo, trading at 52.7% below its estimated fair value, has shown impressive earnings growth of 63.1% over the past year, outpacing the Food industry’s 27.5%. The company expects net sales of ¥346 billion and operating profit of ¥12 billion for fiscal year ending March 2025. With a satisfactory net debt to equity ratio of 35.2%, Showa Sangyo's financial health appears robust despite forecasts suggesting an average annual earnings decline of 8.3% over the next three years.

- Unlock comprehensive insights into our analysis of Showa Sangyo stock in this health report.

Gain insights into Showa Sangyo's historical performance by reviewing our past performance report.

Espec (TSE:6859)

Simply Wall St Value Rating: ★★★★★☆

Overview: Espec Corp. manufactures and sells environmental test chambers worldwide, with a market cap of ¥52.66 billion.

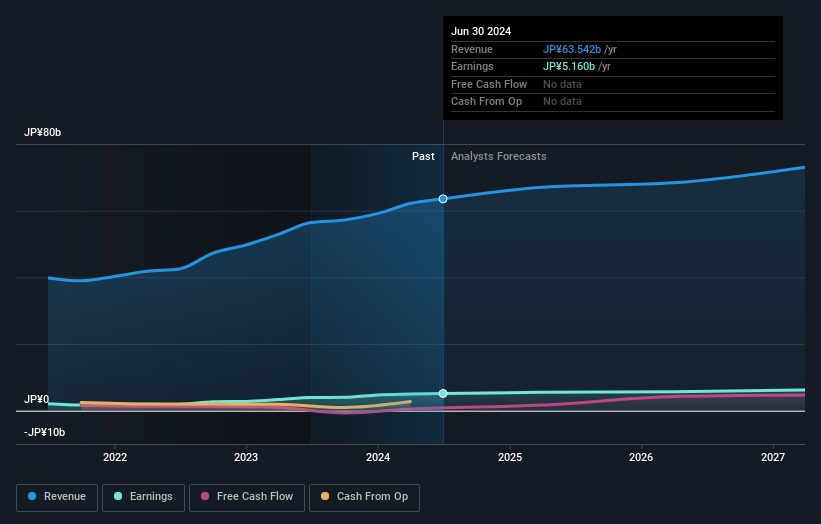

Operations: The primary revenue streams for Espec Corp. include the Equipment Business generating ¥54.77 billion and the Service Business contributing ¥7.71 billion, with minimal input from Other Businesses at ¥1.46 billion.

Espec, a small-cap player in the electronics sector, has shown impressive performance with earnings growth of 30.4% over the past year, outpacing the industry average of 8.3%. Trading at 49.2% below its fair value estimate, it offers potential for value investors. The company’s debt-to-equity ratio rose from 0% to 2.3% over five years but remains manageable as Espec has more cash than total debt and is free cash flow positive.

- Navigate through the intricacies of Espec with our comprehensive health report here.

Gain insights into Espec's past trends and performance with our Past report.

IwaiCosmo Holdings (TSE:8707)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IwaiCosmo Holdings, Inc., with a market cap of ¥47.12 billion, provides financial services using information technology in Japan through its subsidiaries.

Operations: The company generates revenue primarily through its financial services operations in Japan. The net profit margin for the most recent fiscal year was 12.34%. Operating expenses include personnel costs, technology infrastructure, and administrative expenses.

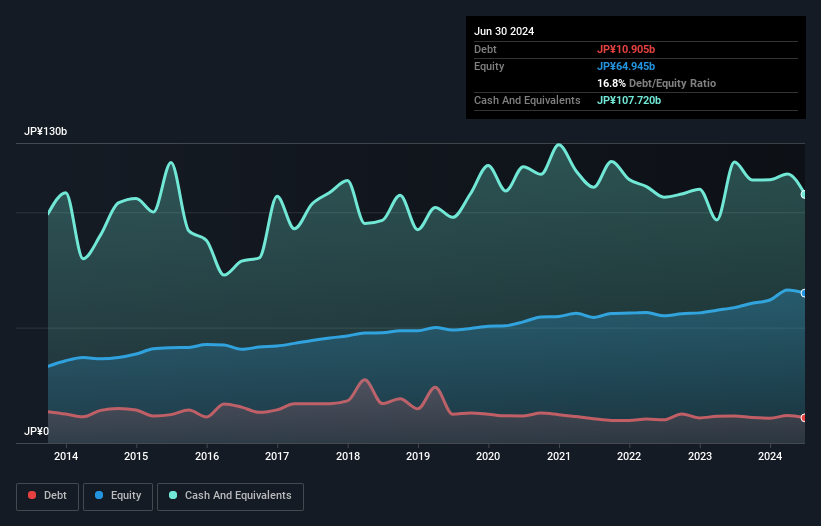

IwaiCosmo Holdings has shown impressive earnings growth of 49.1% over the past year, outpacing the Capital Markets industry average of 36.1%. The debt to equity ratio improved from 25.5% to 16.8% in five years, indicating better financial health. Trading at a significant discount of 27.8% below its estimated fair value, IwaiCosmo appears undervalued compared to peers and industry standards, positioning it as an attractive investment opportunity in Japan's market landscape.

Make It Happen

- Unlock our comprehensive list of 751 Japanese Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8707

IwaiCosmo Holdings

Provides financial services using information technology in Japan.

Solid track record, good value and pays a dividend.