- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6856

Is Strong Earnings and a Higher Dividend Altering the Investment Case for HORIBA (TSE:6856)?

Reviewed by Sasha Jovanovic

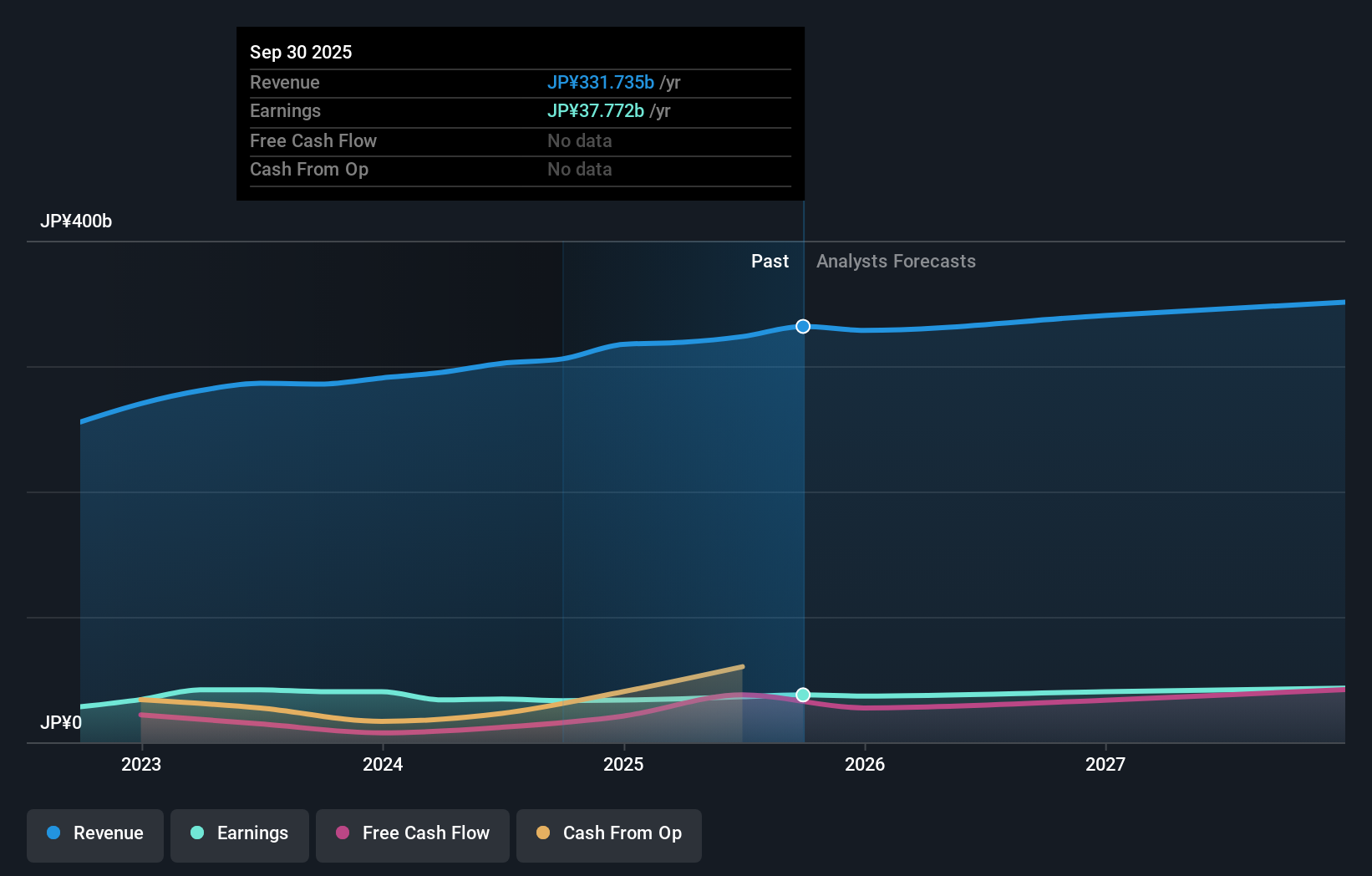

- HORIBA, Ltd. reported a 6.7% increase in net sales and a 21% rise in net income attributable to shareholders for the nine months ending September 30, 2025, while also forecasting a higher dividend payout for the full year.

- This combination of strong financial results and a raised dividend forecast highlights management’s confidence in the company’s ongoing performance and outlook.

- With net income and dividends on the rise, we’ll explore how these trends may shape HORIBA’s long-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is HORIBA's Investment Narrative?

To be a long-term shareholder in HORIBA, the big picture belief rests on continued earnings resilience, sustained demand for emission testing and analytical solutions, plus ongoing innovation. The latest results, with net sales up 6.7% and net income jumping 21%, may recalibrate some near-term expectations, adding weight to catalysts like regulatory wins and an increased dividend outlook. Prior analysis suggested modest growth and some valuation premium to peers, with risks concentrated around inconsistent dividends, lower board independence, and volatile share price movements. With this results surprise and higher dividend guidance, some risk factors, such as dividend instability, could look less acute in the near term. However, share price volatility and a board heavy with recent appointees still present important questions for investors going forward.

Yet, recent board turnover remains a concern investors should keep in mind. HORIBA's shares have been on the rise but are still potentially undervalued by 22%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on HORIBA - why the stock might be worth just ¥13750!

Build Your Own HORIBA Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HORIBA research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HORIBA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HORIBA's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HORIBA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6856

HORIBA

Provides analytical and measurement solutions in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives