- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6841

There's Reason For Concern Over Yokogawa Electric Corporation's (TSE:6841) Massive 28% Price Jump

Yokogawa Electric Corporation (TSE:6841) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. The last 30 days bring the annual gain to a very sharp 27%.

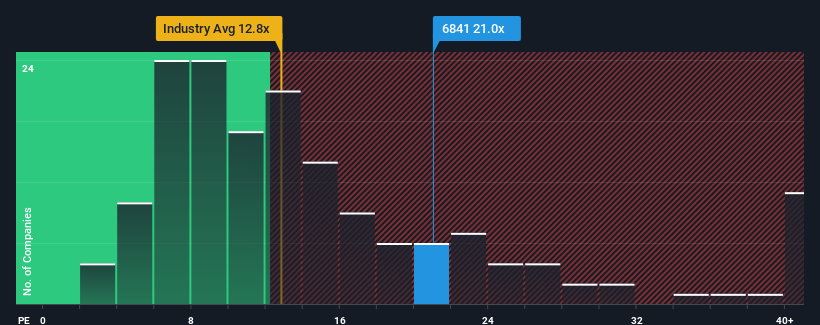

Since its price has surged higher, Yokogawa Electric's price-to-earnings (or "P/E") ratio of 21x might make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 13x and even P/E's below 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Yokogawa Electric's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Yokogawa Electric

Does Growth Match The High P/E?

In order to justify its P/E ratio, Yokogawa Electric would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 23%. Even so, admirably EPS has lifted 151% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 8.3% per year as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 9.4% per year, which is not materially different.

In light of this, it's curious that Yokogawa Electric's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

Shares in Yokogawa Electric have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Yokogawa Electric currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Yokogawa Electric is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Yokogawa Electric's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6841

Yokogawa Electric

Provides industrial automation, and test and measurement solutions in Japan, Southeast Asia, Far East, China, India, Russia, Europe, North America, the Middle East, Africa, and Middle and South America.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives