- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6807

Japan Aviation Electronics Industry (TSE:6807) Margin Decline Challenges Optimism on Growth-Led Recovery

Reviewed by Simply Wall St

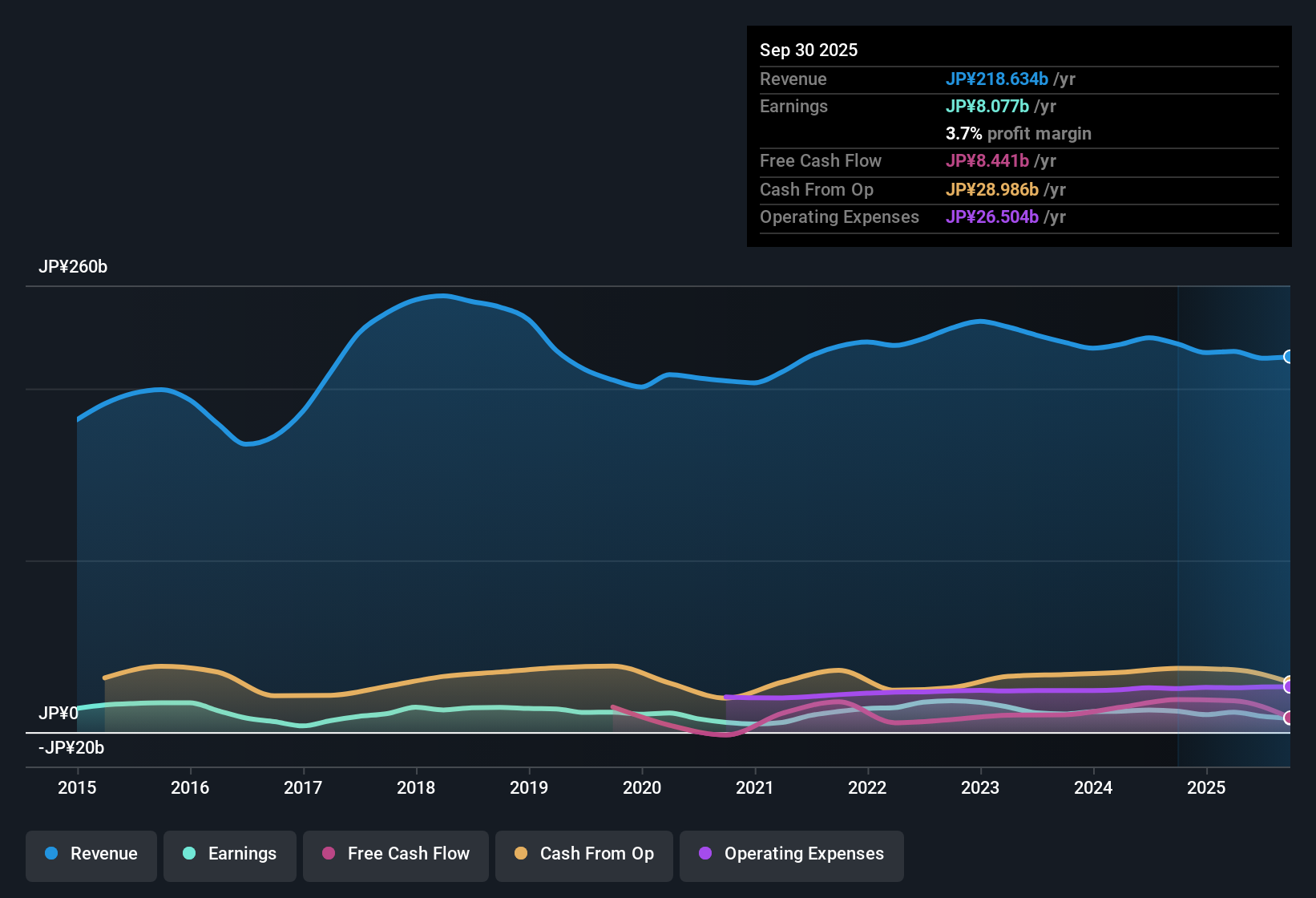

Japan Aviation Electronics Industry (TSE:6807) posted net profit margins of 4.3% for the current period, down from 5.6% last year. The stock trades at ¥2,307, notably below its estimated fair value of ¥3,363.81. Annual earnings have grown 5.2% over the past five years and are forecast to accelerate at a 12.8% pace, outpacing the wider Japanese market's 7.9% growth projection. With attractive valuation metrics, ongoing profit growth, and a positive reward profile including dividends and revenue expansion, investors are likely to view these results with cautious optimism.

See our full analysis for Japan Aviation Electronics Industry.Next, we will see how these updated earnings line up against the key narratives shaping market sentiment and expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Compression Offsets High-Quality Earnings

- Net profit margins slid from 5.6% to 4.3% this year, a significant drop even as the company’s earnings are described as high quality in filings.

- The prevailing market view highlights that, while Japan Aviation Electronics Industry remains respected for product quality and serves high-growth sectors such as automotive and telecom, investors notice that margin pressures, potentially from competition or cyclical demand, have started to show up in reported profitability figures.

- Despite robust end-market exposure, the recent margin contraction tempers optimism that JAE will easily capture sector momentum.

- Coverage suggests JAE’s innovation and role as a supplier to global electrification trends may support ongoing recovery in profitability if cost pressures ease.

Profit Growth Outpaces Broader Market Trends

- Five-year annual earnings growth averaged 5.2%, and forward projections call for 12.8% annual earnings growth, well ahead of the Japanese market’s 7.9% outlook.

- The prevailing market view points out that this above-market projected growth attracts optimistic investors who see JAE as a “quiet beneficiary” of global tech trends and automation.

- Forecast acceleration to 12.8% per year, even with limited revenue growth (4.4% projected, just under the 4.5% industry average), strengthens arguments that operational leverage or cost improvements are powering the bottom line.

- The steady long-run growth and ‘pick-and-shovel’ supplier narrative appeals to market watchers seeking durable EPS expansion rather than high volatility.

Valuation Discount versus Peers, Premium to Sector

- Shares trade at a Price-to-Earnings (P/E) ratio of 16.7x, making the stock cheaper than the peer average of 21.4x but at a slight premium to the Japanese electronic industry’s 15.2x. The current share price of ¥2,307 also sits below the DCF fair value of ¥3,363.81.

- The prevailing market analysis raises the question of how long this valuation gap persists, with bulls noting JAE’s growth and strong reward profile (including attractive dividends and revenue expansion), while others note competition and slower-than-market revenue forecasts could cap upside despite the apparent discount.

- JAE’s dual identity, trading below fair value yet above sector valuation, creates tension between value seekers and those watching for sector rotation or periods of slower end-market demand.

- The absence of notable risk factors in regulatory disclosures, combined with solid projected profit growth, may influence investors to view the current price as an opportunity, contingent on further performance materializing as forecast.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Japan Aviation Electronics Industry's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Japan Aviation Electronics Industry boasts strong growth forecasts, its thinning profit margins and lagging revenue growth signal risks to continued outperformance.

For investors looking to sidestep margin pressures and inconsistent growth, filter for companies consistently delivering steady results through cycles with stable growth stocks screener (2108 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6807

Japan Aviation Electronics Industry

Provides connectors, user interface solutions, and aerospace electronics in Japan.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives