- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6806

Hirose Electric (TSE:6806) Margin Miss Tests Quality-Growth Narrative as Profit Growth Accelerates

Reviewed by Simply Wall St

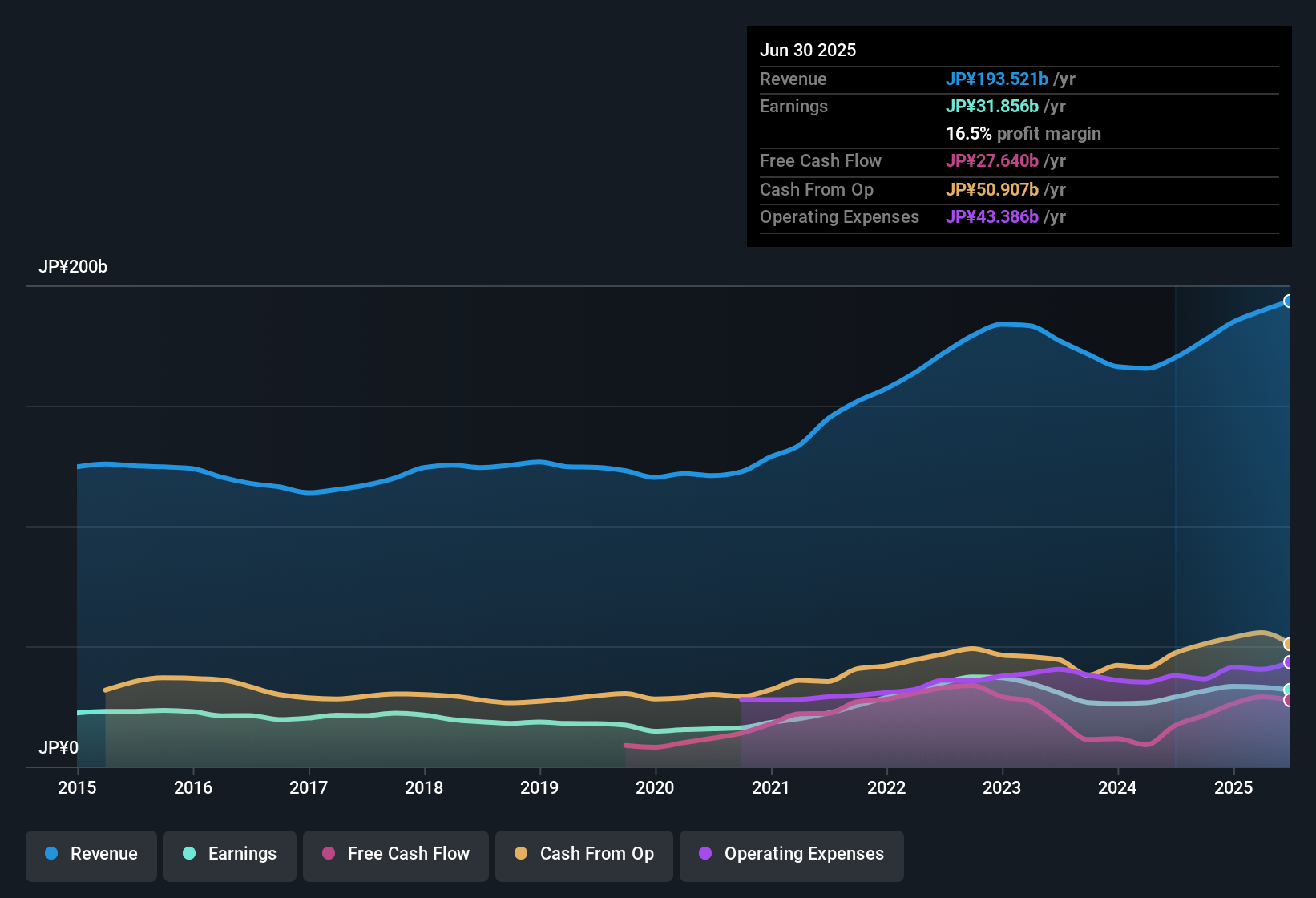

Hirose Electric (TSE:6806) posted a net profit margin of 16.5%, just below last year’s 17%, while annual earnings growth hit 10.4%. Over the past five years, the company has maintained an earnings growth rate of 8.3% per year. Looking ahead, earnings are forecast to climb 9.1% annually, outpacing the broader JP market’s 7.8% trajectory. With its net margin holding steady and profit growth picking up steam, investors appear focused on Hirose Electric’s ability to balance value and ongoing growth during this earnings cycle.

See our full analysis for Hirose ElectricLtd.Now it’s time to see how these numbers play out against the dominant narratives. Some may hold up, while others could be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Stays Above 16% Despite Tightening

- Net profit margin landed at 16.5%, slightly narrowing from last year’s 17%, yet still above most Japanese peers in the sector.

- Market commentary points out that even with this slight margin compression, Hirose Electric’s reputation for reliability and stable product lines keeps it positioned as a solid pick for investors seeking dependable growth.

- The company continues to benefit from demand in automotive and communications components, supporting steady operational performance.

- Investors should watch for new product launches or partnerships to reignite margin expansion, as sector competition remains fierce.

Five-Year Earnings Growth Outpaces Industry Norms

- Earnings have climbed by 8.3% per year over the last five years, topping the broader Japanese market’s 7.8% projected pace for the years ahead.

- Hirose Electric’s ongoing momentum signals the business is well placed to absorb sector volatility and capitalize on rising demand from high-growth industries.

- Consistent past performance and forecasted 9.1% profit growth illustrate durable fundamentals, even if revenue growth is seen trailing just below the sector average.

- Continued sector expansion in industrial automation and automotive electronics offers an underpinning for Hirose’s outlook, provided they can maintain their technology edge.

Shares Trading Below DCF Fair Value and Analyst Targets

- Current share price of ¥17,840 sits beneath both analyst price targets of ¥22,242.86 and the DCF fair value of ¥18,913.31, flagging a valuation disconnect that could attract value-focused buyers.

- This discount versus estimates and peer multiples supports a moderate value case, even as the broader electronic industry offers cheaper alternatives.

- The price-to-earnings ratio suggests Hirose Electric is better value than immediate sector peers, but its premium to the broader industry hints at a "quality premium" built into the price.

- Stability in share price and earnings growth may keep the floor beneath valuation, pending additional catalysts or broader market shifts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hirose ElectricLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Hirose Electric’s solid profit margins and earnings trend are positive, ongoing margin compression and sector competition threaten its ability to sustain outperformance.

If you’re seeking companies with sturdier fundamentals and reliable momentum, check out stable growth stocks screener (2080 results) to target businesses offering consistent growth and resilience across various market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hirose ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6806

Hirose ElectricLtd

Manufactures and sells connectors and other electronic components in Japan, China, South Korea, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives