- Taiwan

- /

- Communications

- /

- TWSE:2345

Asian Market: 3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the Asian markets navigate a complex landscape marked by ongoing U.S.-China trade negotiations and mixed economic signals, investors are increasingly focused on identifying opportunities that may be undervalued. In this environment, stocks trading below their estimated value can present potential for growth, making them an attractive consideration for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥18.67 | CN¥37.01 | 49.6% |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.78 | CN¥9.37 | 49% |

| Visional (TSE:4194) | ¥10100.00 | ¥19720.69 | 48.8% |

| Meitu (SEHK:1357) | HK$8.75 | HK$17.27 | 49.3% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.04 | CN¥19.94 | 49.6% |

| King Yuan Electronics (TWSE:2449) | NT$214.00 | NT$425.15 | 49.7% |

| freee K.K (TSE:4478) | ¥3345.00 | ¥6674.74 | 49.9% |

| Daiichi Sankyo Company (TSE:4568) | ¥3370.00 | ¥6631.69 | 49.2% |

| COVER (TSE:5253) | ¥1857.00 | ¥3670.33 | 49.4% |

| Alibaba Health Information Technology (SEHK:241) | HK$5.73 | HK$11.29 | 49.3% |

Let's dive into some prime choices out of the screener.

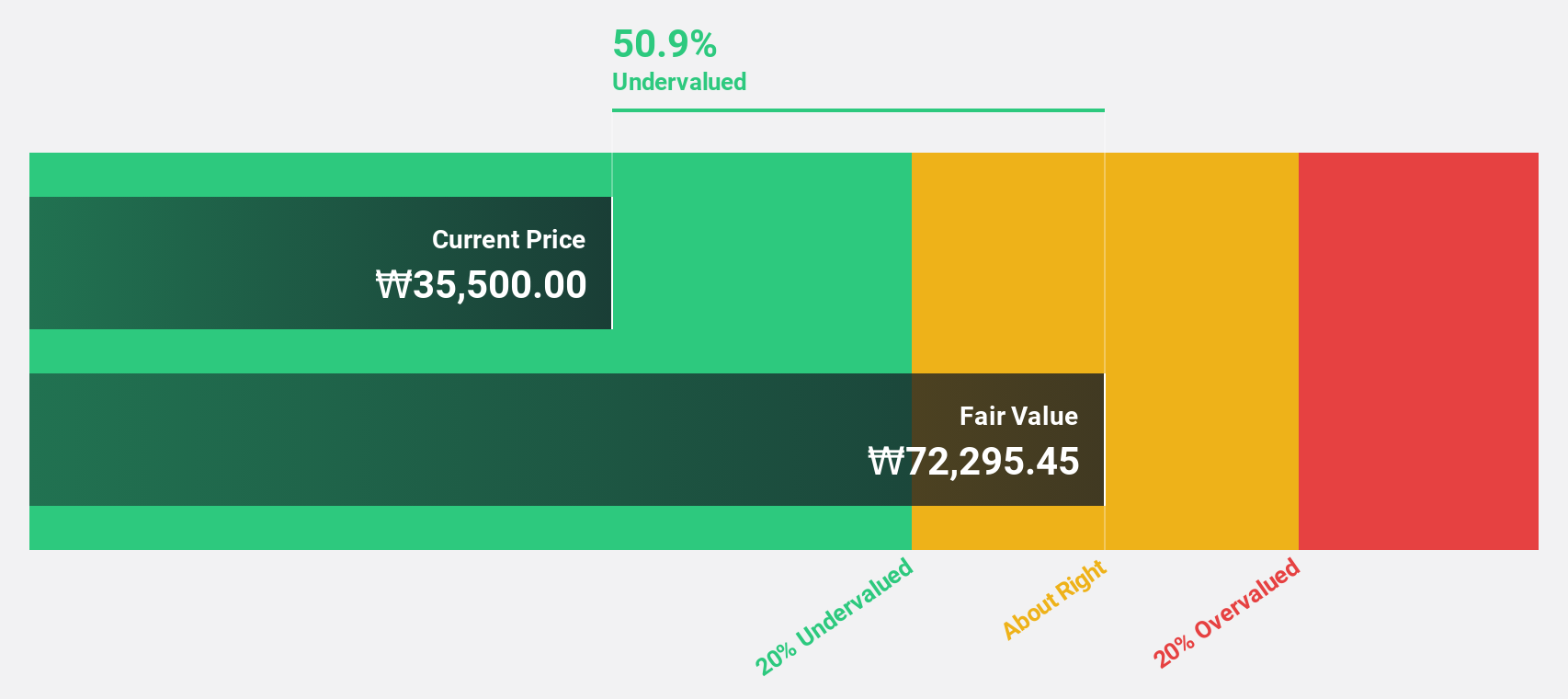

CHEMTRONICS.Co.Ltd (KOSDAQ:A089010)

Overview: CHEMTRONICS.Co.,Ltd. manufactures and sells electronic parts and chemicals both in South Korea and internationally, with a market cap of ₩676.19 billion.

Operations: The company's revenue segments are comprised of the Electronic Business Division at ₩350.81 billion, Distribution / Others at ₩150.77 billion, the Battlefield Business at ₩32.41 billion, and the Semiconductor Business at ₩30.72 billion.

Estimated Discount To Fair Value: 43.9%

CHEMTRONICS.Co.Ltd. is trading at ₩42,500, significantly below its estimated fair value of ₩75,766.89, indicating it may be undervalued based on cash flows. Despite a volatile share price and recent declines in both sales and net income compared to the previous year, earnings are forecast to grow significantly at 50.25% per year over the next three years, surpassing market expectations and highlighting potential long-term growth prospects amidst current financial challenges.

- In light of our recent growth report, it seems possible that CHEMTRONICS.Co.Ltd's financial performance will exceed current levels.

- Navigate through the intricacies of CHEMTRONICS.Co.Ltd with our comprehensive financial health report here.

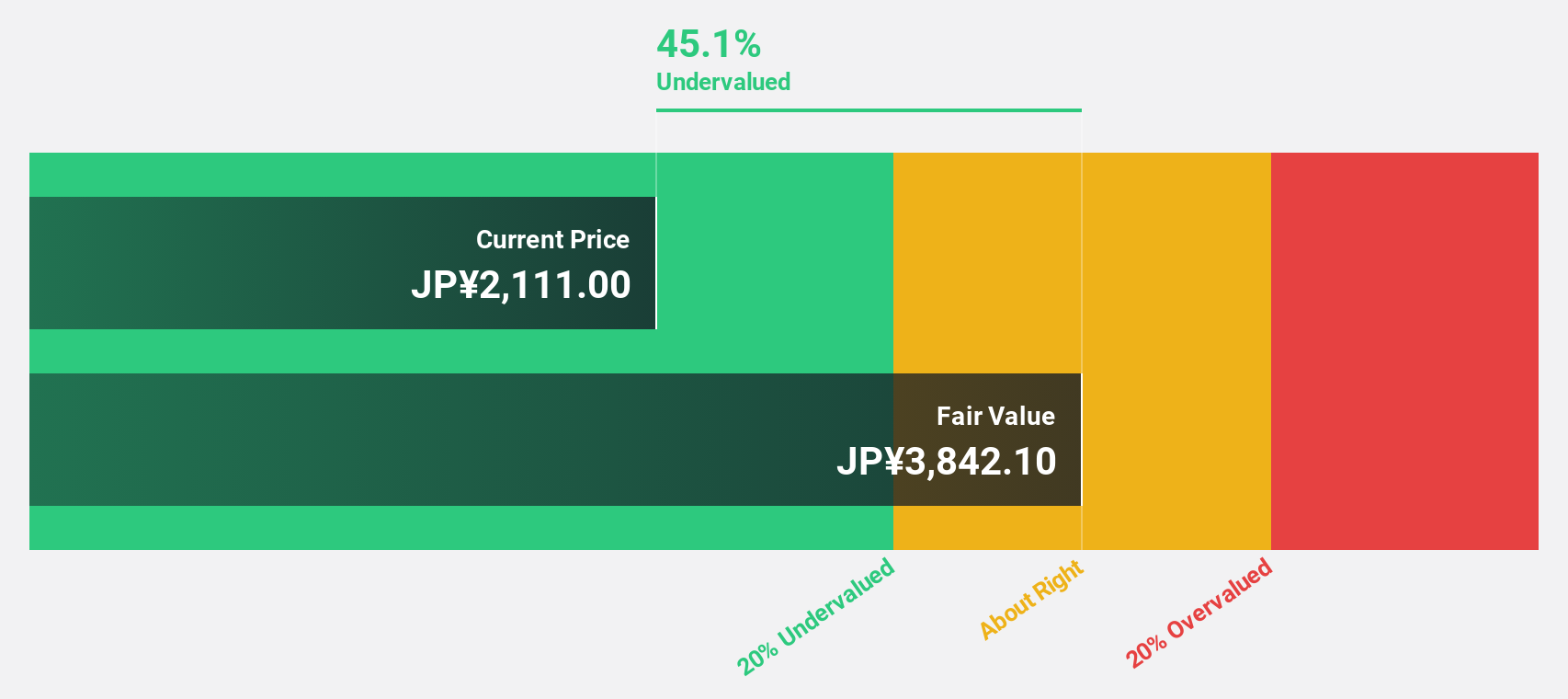

Yokowo (TSE:6800)

Overview: Yokowo Co., Ltd. specializes in components and advanced devices for wireless communication and information transmission across Japan, Europe, Asia, and the United States with a market cap of ¥48.18 billion.

Operations: The company's revenue segments include CTC at ¥16.38 billion, VCCS at ¥55.14 billion, and FC/MD at ¥10.95 billion.

Estimated Discount To Fair Value: 46.4%

Yokowo Co., Ltd. is trading at ¥2,067, substantially below its estimated fair value of ¥3,853.59, suggesting undervaluation based on cash flows. Despite a volatile share price and reduced profit margins from 3% to 1%, earnings are forecast to grow significantly at 40.87% annually over the next three years, outpacing the Japanese market's growth rate. Recent strategic alliances and private placements aim to strengthen business operations and explore new market opportunities in semiconductor testing segments.

- The analysis detailed in our Yokowo growth report hints at robust future financial performance.

- Click here to discover the nuances of Yokowo with our detailed financial health report.

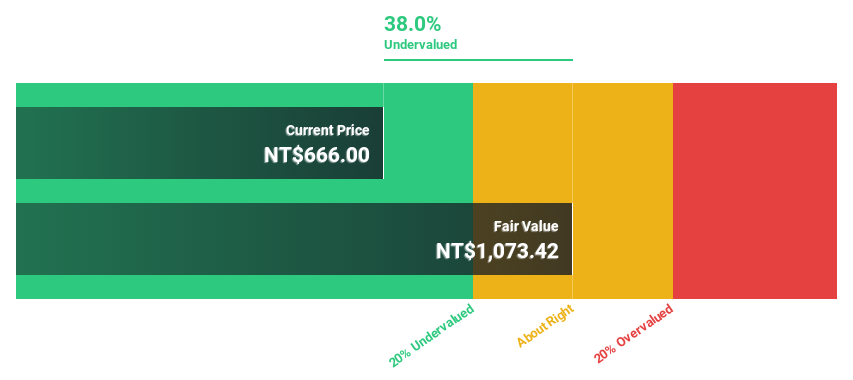

Accton Technology (TWSE:2345)

Overview: Accton Technology Corporation develops, manufactures, and sells computer network systems and wireless LAN hardware and software products globally, with a market cap of NT$642.74 billion.

Operations: The company's revenue is primarily derived from its computer networks segment, amounting to NT$170.52 billion.

Estimated Discount To Fair Value: 17.8%

Accton Technology's recent earnings report highlights robust growth, with net income reaching TWD 5.03 billion in Q2 2025, up from TWD 2.58 billion a year ago. Trading at NT$1,150, it is undervalued based on cash flows compared to its fair value estimate of NT$1,398.38. Despite share price volatility and high non-cash earnings levels, forecasted annual profit growth of 28.5% positions Accton to outperform Taiwan's market expansion rate significantly.

- The growth report we've compiled suggests that Accton Technology's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Accton Technology.

Summing It All Up

- Investigate our full lineup of 270 Undervalued Asian Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2345

Accton Technology

Develops, manufactures, and sells computer network systems and wireless land area network (LAN) hardware and software products in Taiwan, the United States, the Asian-Pacific, Europe, and internationally.

Exceptional growth potential with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives