- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6787

Assessing Meiko Electronics (TSE:6787) Valuation Following Updated Earnings Guidance for 2026

Reviewed by Simply Wall St

Meiko Electronics (TSE:6787) has released updated earnings guidance for the year ending March 2026, sharing its forecasts for net sales, operating profit, and profit attributable to owners. Investors often look to these figures as indicators of management’s outlook for the business.

See our latest analysis for Meiko Electronics.

Meiko Electronics’ latest earnings guidance lands after a year of notable gains, with the company delivering a 13.45% share price return year to date and an impressive 18.43% total shareholder return over the past twelve months. Momentum has remained strong, fueled by resilience in long-term growth and renewed confidence around updated forecasts, as investors monitor how management’s projections might reshape sentiment going forward.

If fresh outlooks like Meiko’s have caught your attention, this could be a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading below analyst price targets and robust profit growth forecasted, the question remains: Is Meiko Electronics undervalued at current levels, or has the market already factored in all the optimism?

Price-to-Earnings of 14.6x: Is it justified?

With Meiko Electronics trading at a price-to-earnings (P/E) ratio of 14.6x, the stock is priced far lower than peers, signaling a potential value opportunity at current levels.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings. It is a core metric for technology companies like Meiko Electronics, where growth and profitability drive valuations. A lower P/E can imply that the market expects slower growth, or it may signal undervaluation if earnings growth is expected to persist.

Compared to the peer group average of 33.5x, Meiko Electronics looks notably inexpensive. However, its P/E is above the average for the broader JP Electronic industry at 13.9x. This suggests the market recognizes some relative strength, but not enough to close the gap with direct competitors. The company’s ratio is also below the estimated fair P/E of 23x, indicating further headroom before valuations might normalize if fundamentals continue on track.

Explore the SWS fair ratio for Meiko Electronics

Result: Price-to-Earnings of 14.6x (UNDERVALUED)

However, slower revenue growth or a reversal in net income trends could quickly challenge the current optimism and prompt a reassessment of valuation assumptions.

Find out about the key risks to this Meiko Electronics narrative.

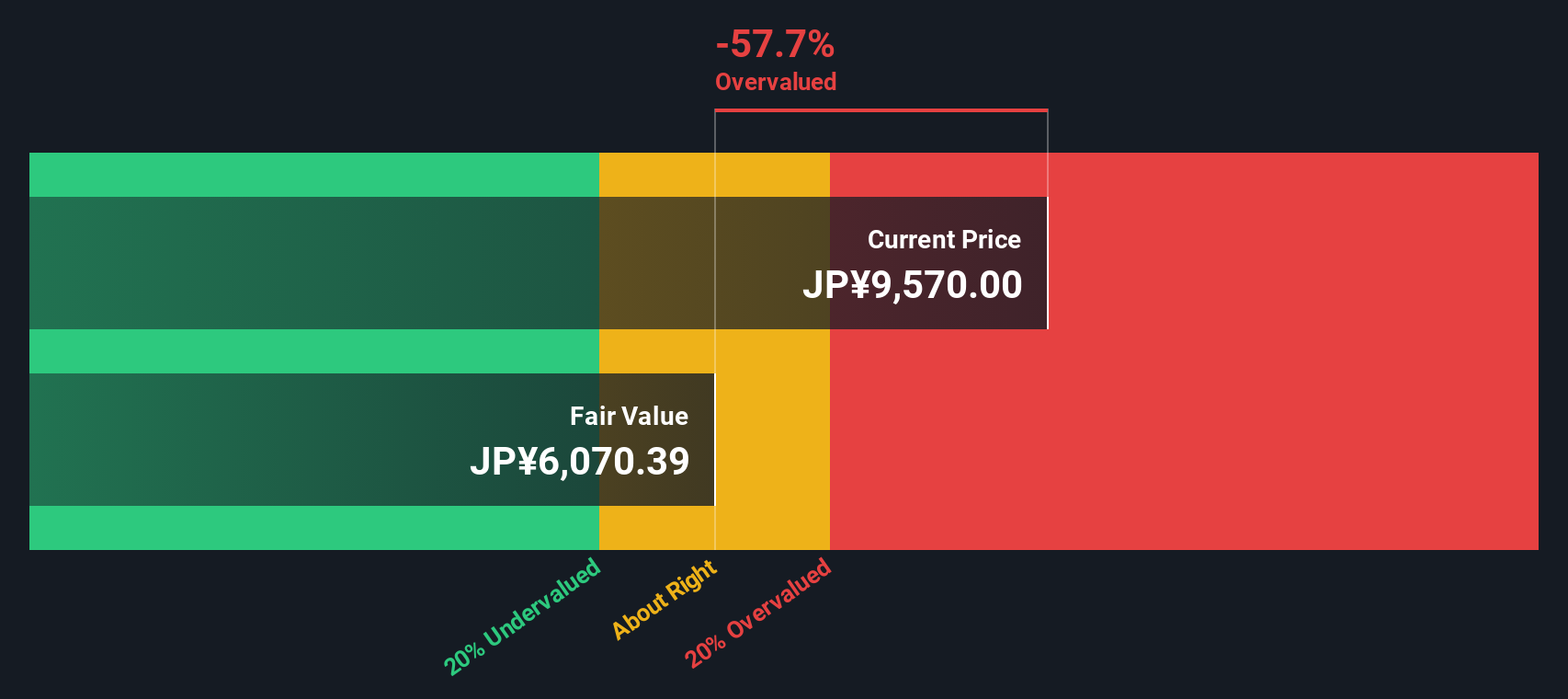

Another View: Discounted Cash Flow Signals Overvaluation

While price-to-earnings makes Meiko Electronics look undervalued, our SWS DCF model paints a much less optimistic picture. The stock currently trades well above the model’s fair value estimate of ¥6,074, which could imply it is overvalued. Does this highlight hidden risks, or is the market pricing in strengths the DCF model cannot identify?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Meiko Electronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Meiko Electronics Narrative

If you see the story differently or want to check the numbers yourself, you can build your own take on Meiko’s prospects in just a few minutes with Do it your way.

A great starting point for your Meiko Electronics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t stop at Meiko Electronics. Access unique opportunities that fit your investment style by using Simply Wall Street’s powerful Screener. You could easily miss out on the next big trend if you stay in your comfort zone.

- Capture the upside of tomorrow’s breakthroughs by checking out these 26 AI penny stocks leading innovation in artificial intelligence and automation.

- Strengthen your portfolio with reliable income streams by exploring these 15 dividend stocks with yields > 3% that consistently deliver above-average yields.

- Capitalize on shifting global finance by reviewing these 81 cryptocurrency and blockchain stocks making waves in blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6787

Meiko Electronics

Engages in the design, manufacture, and sale of printed circuit boards (PCBs) and auxiliary electronics in Japan, China, Vietnam, the rest of Asia, North America, Europe, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives