- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6744

Nohmi Bosai (TSE:6744) Valuation in Focus After New Earnings and Dividend Guidance

Reviewed by Simply Wall St

Nohmi Bosai (TSE:6744) drew investor attention after releasing full-year earnings guidance along with an increased interim dividend. The company projects continued profitability and has raised its dividend payout compared to the previous year.

See our latest analysis for Nohmi Bosai.

After Nohmi Bosai unveiled its latest guidance and stepped up its dividend, the stock’s momentum has cooled slightly. After a strong year-to-date share price return of 7.7%, recent weeks have seen a pullback. Still, shareholders holding on over the past year enjoyed an 18.7% total return, and those with a longer view have seen triple-digit gains over three years, confirming that the company’s longer-term performance remains firmly intact.

If you’re looking to spot the next wave of high performers, this is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the latest results priced in and shares still below analyst targets, is this a window to buy Nohmi Bosai at attractive value, or has the market already accounted for its future earnings growth?

Price-to-Earnings of 18.9x: Is it justified?

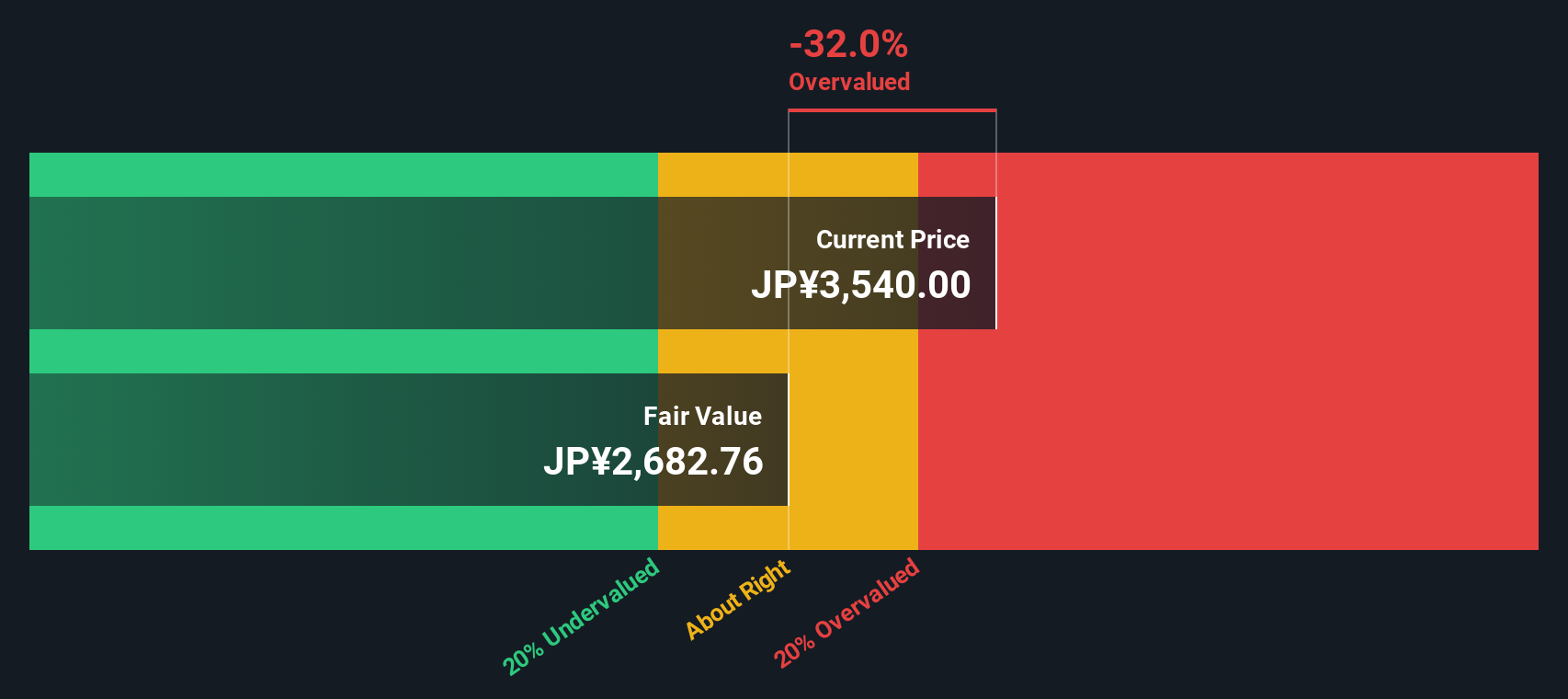

Nohmi Bosai’s shares trade at a price-to-earnings (P/E) ratio of 18.9x, noticeably above both its industry peers and broader averages. Based on this multiple, the stock appears overvalued relative to its competitors and its own estimated fair value.

The price-to-earnings ratio measures how much investors are willing to pay for each unit of the company’s earnings. Higher P/E ratios can signal strong growth expectations or, alternatively, a premium price with limited upside.

At 18.9x earnings, Nohmi Bosai is priced higher than the average for both its peer group (16.5x) and the wider JP Electronic industry (14x). This elevated valuation implies the market anticipates faster profit growth than the average peer. However, the company’s fair price-to-earnings ratio is estimated at 16.9x. This suggests there is room for the premium to narrow if growth does not outpace expectations.

Explore the SWS fair ratio for Nohmi Bosai

Result: Price-to-Earnings of 18.9x (OVERVALUED)

However, slower earnings growth or unexpected industry setbacks could challenge the current bullish view and place additional pressure on the company’s elevated valuation.

Find out about the key risks to this Nohmi Bosai narrative.

Another View: Discounted Cash Flow Comparison

While the price-to-earnings analysis suggests Nohmi Bosai is overvalued, our DCF model puts the company’s intrinsic value at ¥2,678 a share, well below the current price of ¥3,420. This signals an even bigger premium is baked in by the market. Does this point to overconfidence or something the numbers miss?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nohmi Bosai for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nohmi Bosai Narrative

If you see things differently or want to review the details firsthand, you can shape your own view of the numbers in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Nohmi Bosai.

Looking for More Smart Investment Ideas?

Don’t watch great opportunities pass you by. Put your curiosity to work and act on powerful trends shaping global markets with these tailored picks:

- Uncover growth potential by targeting these 897 undervalued stocks based on cash flows, which offer compelling value based on robust cash flows and overlooked fundamentals.

- Tap into future healthcare innovation through these 30 healthcare AI stocks, poised to profit from breakthroughs in artificial intelligence and medical technology.

- Boost your portfolio’s income and stability by selecting these 15 dividend stocks with yields > 3%, offering reliable yields that stand above the competition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nohmi Bosai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6744

Nohmi Bosai

Engages in the development, marketing, installation, and maintenance of various fire protection systems in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives