- Japan

- /

- Tech Hardware

- /

- TSE:6736

A Fresh Look at Sun (TSE:6736) Valuation After Interim Dividend Decision

Reviewed by Simply Wall St

Sun (TSE:6736) caught investor attention following its recent board meeting, where the company decided against paying interim dividends for the period ending September 30, 2025. This shift in dividend policy raises questions around management’s outlook and priorities.

See our latest analysis for Sun.

Even with the recent dividend pause raising questions, Sun’s 90-day share price return of 36.78% signals robust momentum. This builds on a one-year total shareholder return of 13.84% and a remarkable three-year total return of 339.77%. Despite short-term volatility, long-term holders have seen strong gains.

If this shift in strategy has you thinking bigger, now is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Sun’s share price on a winning streak, the question is whether this rally reflects genuine undervaluation, or if the market is already anticipating stronger future performance. Is there still value left for new investors, or has the growth story been fully priced in?

Price-to-Earnings of 9.1x: Is it justified?

Sun is trading at a price-to-earnings (P/E) ratio of 9.1x, making it look attractively priced compared to both the Japanese tech sector and its closest peers. With a last close of ¥9,000, this multiple suggests the market may be overlooking recent performance.

The price-to-earnings ratio compares a company's current share price to its per-share earnings, offering a simple way to gauge if investors are paying a high or low price given recent profitability. For a tech company showing strong profit growth, a lower P/E can often point to undervaluation or skepticism about sustainability.

Sun’s P/E ratio of 9.1x is well below the Japanese tech industry average of 12.6x and the peer average of 15.1x. This emphasizes that the stock may be overlooked or the market is underestimating what comes next for the company.

Sun’s low pricing relative to sector averages could signal a potential opportunity if the firm’s rapid earnings growth is viewed as repeatable. There is no available fair ratio, but this multiple stands out among peers and sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 9.1x (UNDERVALUED)

However, short-term price declines and a negative year-to-date return highlight lingering volatility. These factors suggest that sentiment shifts could challenge the current valuation narrative.

Find out about the key risks to this Sun narrative.

Another View: Discounted Cash Flow Tells a Different Story

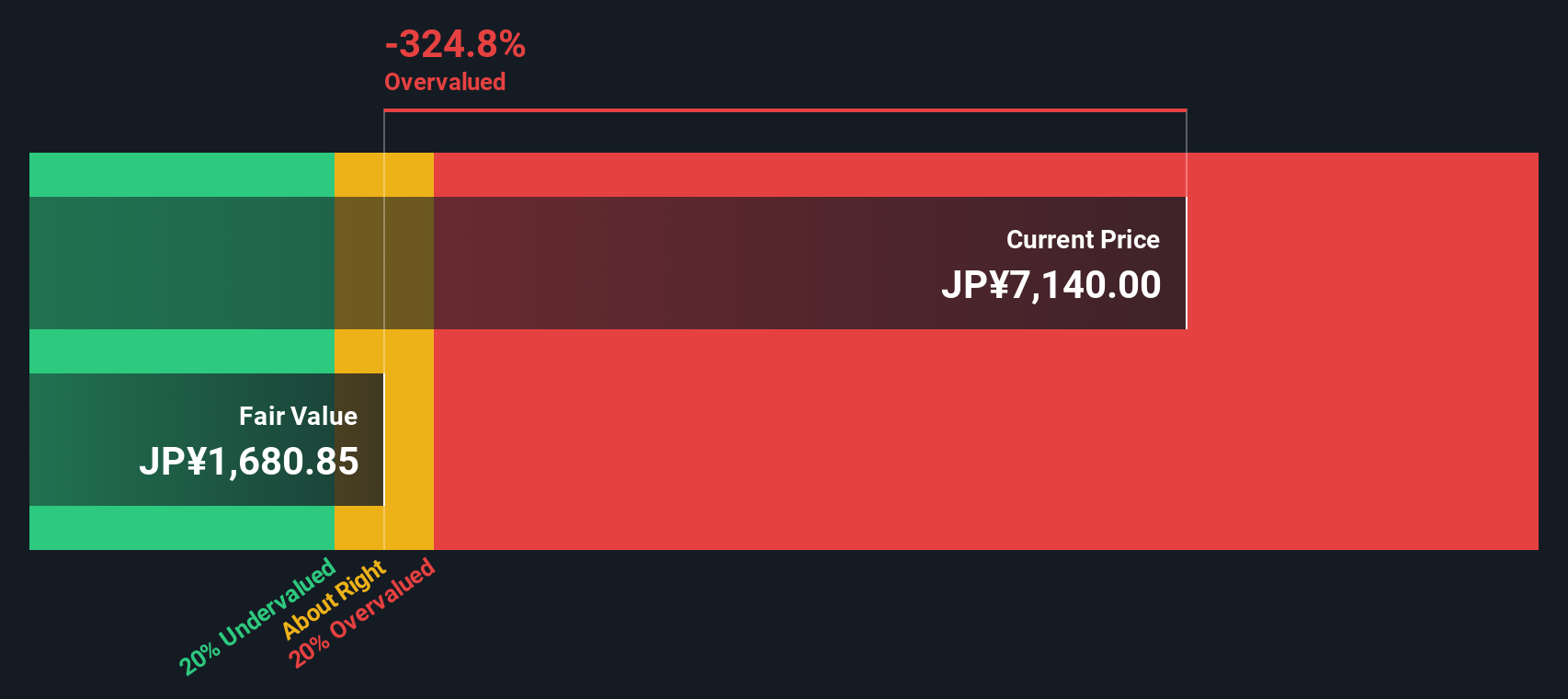

While the price-to-earnings ratio paints Sun as undervalued, our SWS DCF model looks at future cash flows and challenges this view. According to this method, Sun’s shares are trading well above their estimated fair value, which could signal possible overvaluation if expected growth falls short. Which approach better reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sun for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 896 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sun Narrative

If you see the data differently or want to chart your own course, you can build a personal perspective using our tools in just minutes. Do it your way

A great starting point for your Sun research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more smart investment opportunities?

Don’t limit yourself to just one great stock. Find your next winning idea. These picks could power your portfolio with fresh growth potential and unique advantages.

- Uncover strong yield potential and lock in passive income by browsing these 15 dividend stocks with yields > 3% with above-average payouts and consistent performance.

- Jump on trends reshaping industries when you check out these 27 AI penny stocks leading innovation through artificial intelligence and automation breakthroughs.

- Target overlooked value with these 896 undervalued stocks based on cash flows that show solid fundamentals and attractive price-to-cash flow profiles most investors have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6736

Sun

Engages in the global data intelligence, entertainment, information technology, and other businesses in Japan.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives