- Japan

- /

- Professional Services

- /

- TSE:9743

Uncovering Japan System Techniques And 2 Other Hidden Small Caps For Your Portfolio

Reviewed by Simply Wall St

Amid recent turbulence in global markets, Japan's stock indices have faced significant declines, with the Nikkei 225 Index falling 4.7% and the broader TOPIX Index down 6.0%. However, this challenging environment can often reveal hidden opportunities within small-cap stocks that may be overlooked by mainstream investors. Identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals, innovative business models, and growth potential despite broader market volatility. In this article, we explore three such undiscovered gems in Japan: Japan System Techniques and two other compelling small caps that could add value to your portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| QuickLtd | 0.73% | 9.61% | 14.56% | ★★★★★★ |

| Central Forest Group | NA | 5.16% | 12.45% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| Nihon Parkerizing | 0.32% | -0.14% | 1.92% | ★★★★★★ |

| Icom | NA | 4.02% | 13.06% | ★★★★★★ |

| Yashima Denki | 2.93% | -2.38% | 13.99% | ★★★★★★ |

| Toho | 82.16% | 1.83% | 47.38% | ★★★★★☆ |

| Pharma Foods International | 191.14% | 33.83% | 23.46% | ★★★★★☆ |

| GakkyushaLtd | 22.47% | 5.11% | 19.19% | ★★★★★☆ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Japan System Techniques (TSE:4323)

Simply Wall St Value Rating: ★★★★★★

Overview: Japan System Techniques Co., Ltd. engages in the software business in Japan and internationally, with a market cap of ¥37.95 billion.

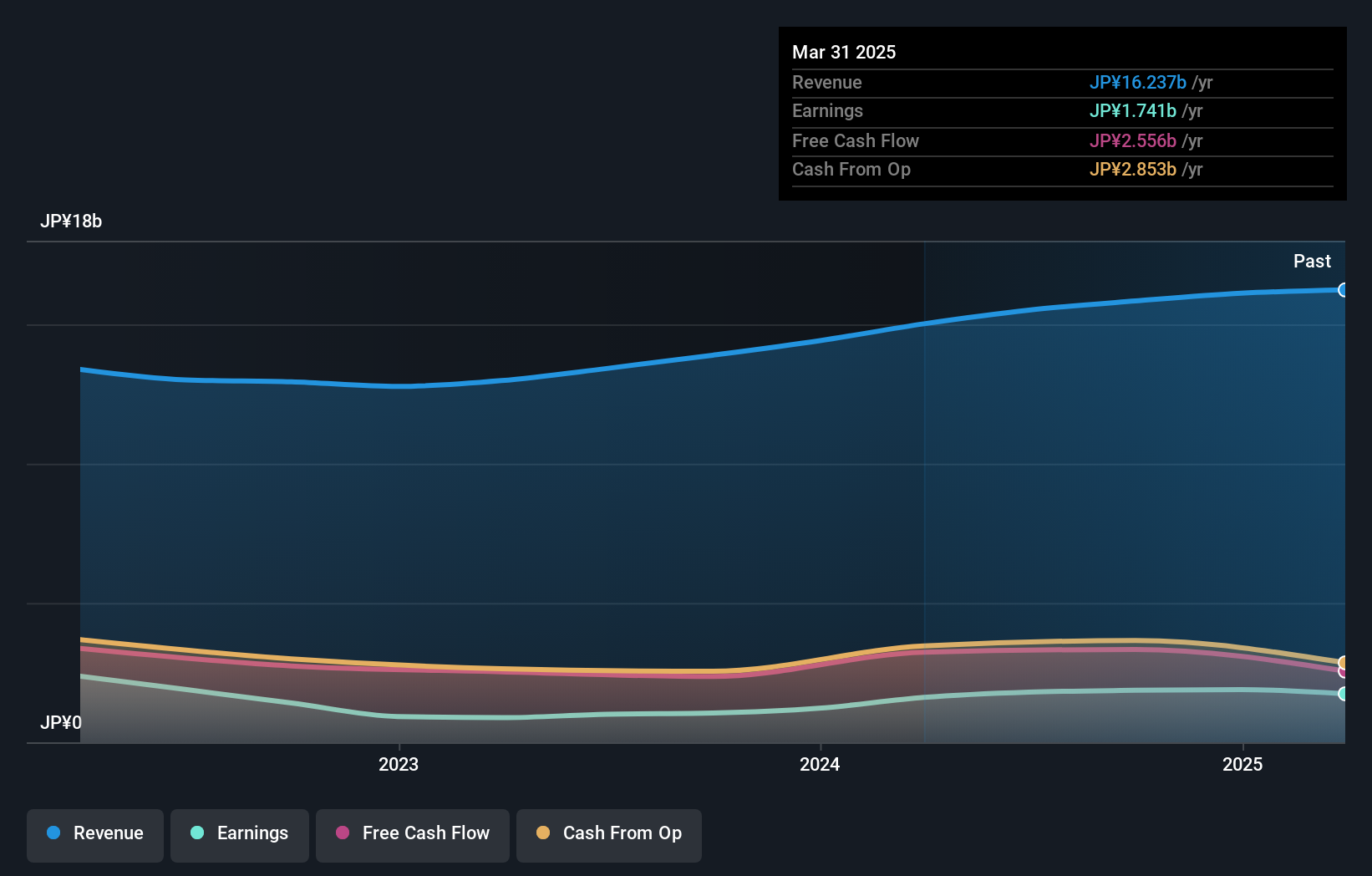

Operations: The company generates revenue primarily from four segments: Global Business (¥3.42 billion), DX & SI Business (¥15.38 billion), Packaging Business (¥4.94 billion), and Medical Big Data Business (¥2.65 billion).

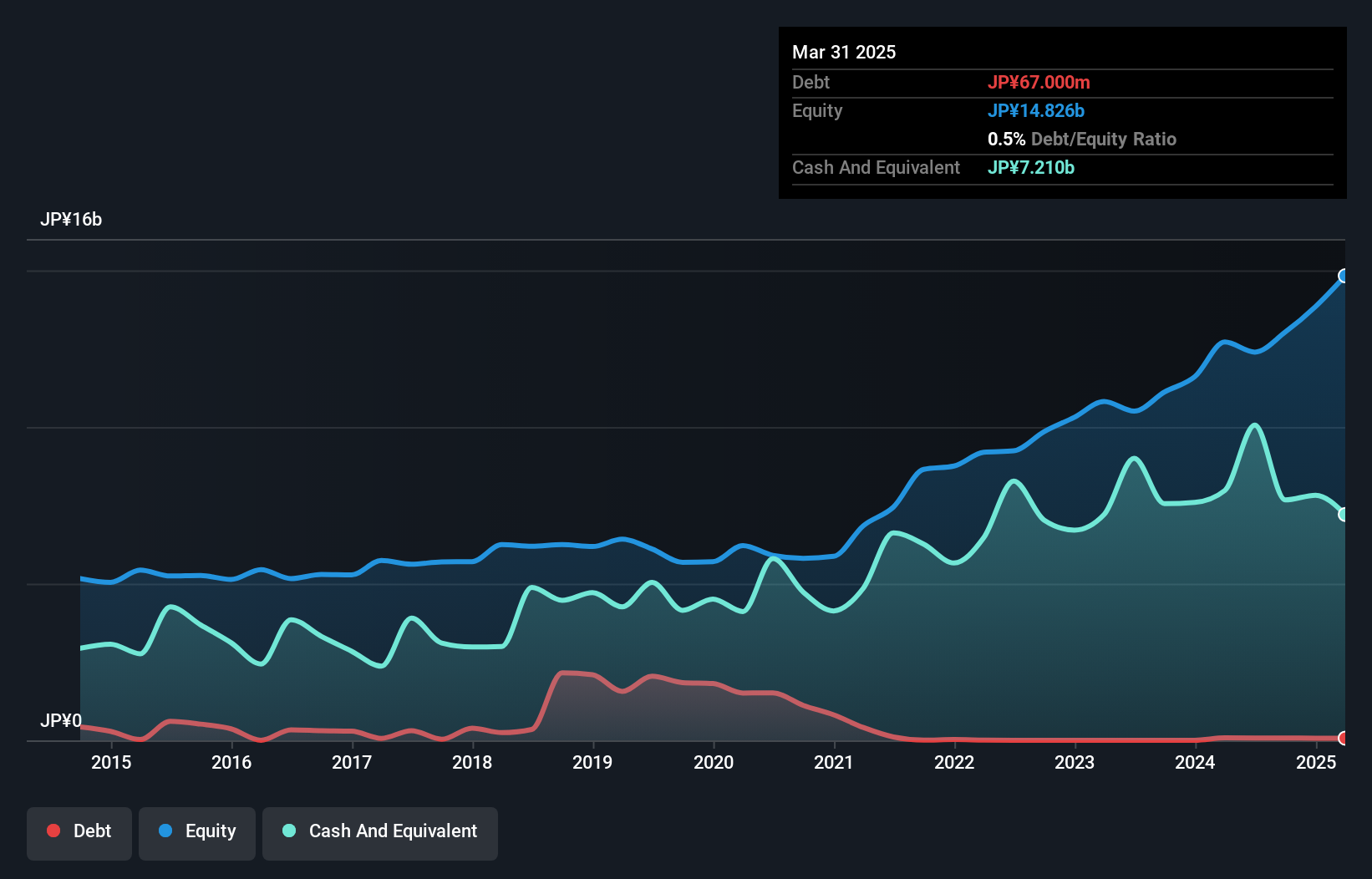

Japan System Techniques (JAST) has demonstrated robust performance with earnings growing by 17.7% over the past year, outpacing the software industry’s 13%. The company’s debt-to-equity ratio has impressively decreased from 24.3% to 0.6% over five years, and it trades at a notable discount of 35.9% below its estimated fair value. Recently, JAST raised its fiscal year guidance, expecting net sales of ¥26.15 billion (US$180 million) and operating income of ¥2.78 billion (US$19 million).

PCA (TSE:9629)

Simply Wall St Value Rating: ★★★★★★

Overview: PCA Corporation develops and sells computer software in Japan with a market cap of ¥38.54 billion.

Operations: PCA generates revenue primarily through the sale of computer software. The company incurs costs related to software development, marketing, and administrative expenses. Net profit margin stands at 9.5%.

PCA Corporation, a smaller player in Japan's software industry, has shown impressive growth with earnings increasing by 78.7% over the past year, outpacing the sector's 13%. Despite a 5.8% annual decline in earnings over five years, PCA remains debt-free and trades at 53.1% below its estimated fair value. The company also boasts high-quality past earnings and positive free cash flow, indicating strong financial health without debt concerns.

- Get an in-depth perspective on PCA's performance by reading our health report here.

Assess PCA's past performance with our detailed historical performance reports.

Tanseisha (TSE:9743)

Simply Wall St Value Rating: ★★★★★☆

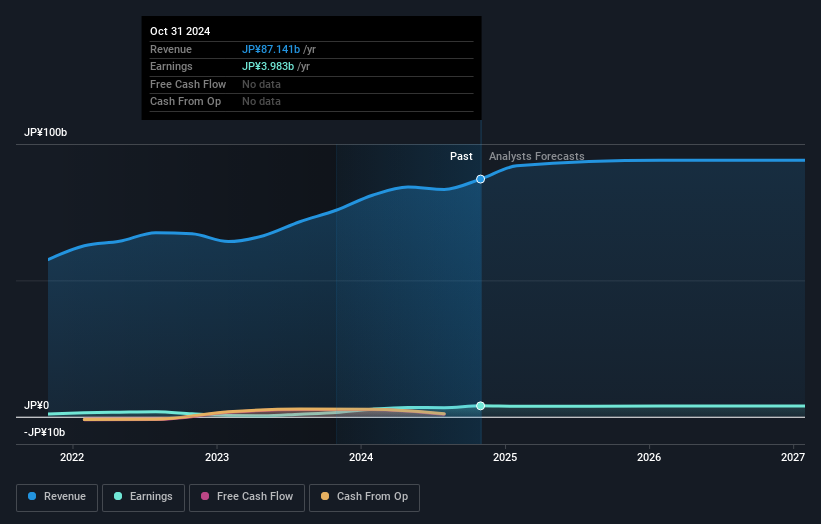

Overview: Tanseisha Co., Ltd. engages in the research, planning, design, layout, production, construction, and operation of commercial, public, hospitality, event, and business and cultural spaces in Japan and internationally with a market cap of ¥41.19 billion.

Operations: Tanseisha generates revenue primarily through its services in commercial, public, hospitality, event, and cultural spaces. The company’s net profit margin has shown variability over recent periods.

Tanseisha, a small cap player in Japan's design and construction sector, has shown impressive financial performance. Earnings surged by 866% over the past year, significantly outpacing the industry average of 10.1%. Trading at 38.2% below its estimated fair value, it offers good relative value compared to peers. The debt-to-equity ratio increased from 1.1% to 2.7% over five years, but with more cash than total debt and positive free cash flow, financial stability remains strong.

- Unlock comprehensive insights into our analysis of Tanseisha stock in this health report.

Understand Tanseisha's track record by examining our Past report.

Key Takeaways

- Get an in-depth perspective on all 708 Japanese Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tanseisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9743

Tanseisha

Engages in the research, planning, design, layout, production, construction, and operation of commercial, public, hospitality, event, and business and cultural spaces in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives