Will Broadcom and VMware Partnership Shift NEC's (TSE:6701) Private Cloud Growth Narrative?

Reviewed by Sasha Jovanovic

- On November 18, 2025, Broadcom announced an expanded partnership with NEC Corporation to adopt and deliver modern private cloud services based on VMware Cloud Foundation, which NEC will integrate into its own systems and offer as managed cloud solutions for clients.

- NEC's use of VMware Cloud Foundation not only updates its internal IT architecture but also positions the company to accelerate private cloud adoption for customers through its BluStellar Scenario offerings.

- We'll examine how NEC's advancement in private cloud solutions with Broadcom could influence its growth outlook and service differentiation.

Find companies with promising cash flow potential yet trading below their fair value.

NEC Investment Narrative Recap

To be a shareholder in NEC, you need to believe in the company’s ability to drive digital transformation through cloud and managed service innovation, particularly its BluStellar portfolio, while weathering declines in domestic IT and telecom hardware revenue. The recent Broadcom partnership positions NEC to refresh its offerings and capitalize on private cloud demand, but does not fundamentally shift the most prominent near-term catalyst: sustained order growth in high-margin IT and digital services, nor does it fully offset the ongoing risk of shrinking legacy business lines.

The November 18 KDDI announcement stands out for its relevance, as NEC’s role in deploying Netcracker’s platform demonstrates ongoing progress in providing advanced IT infrastructure and integration services, directly linking to investor expectations for order momentum in NEC’s digital transformation segments.

However, investors should keep in mind that while NEC is shifting to growth areas, the pace of legacy business contraction remains a risk that could ...

Read the full narrative on NEC (it's free!)

NEC's narrative projects ¥3,787.0 billion in revenue and ¥291.3 billion in earnings by 2028. This requires 3.2% yearly revenue growth and a ¥91.0 billion increase in earnings from ¥200.3 billion today.

Uncover how NEC's forecasts yield a ¥5445 fair value, a 10% downside to its current price.

Exploring Other Perspectives

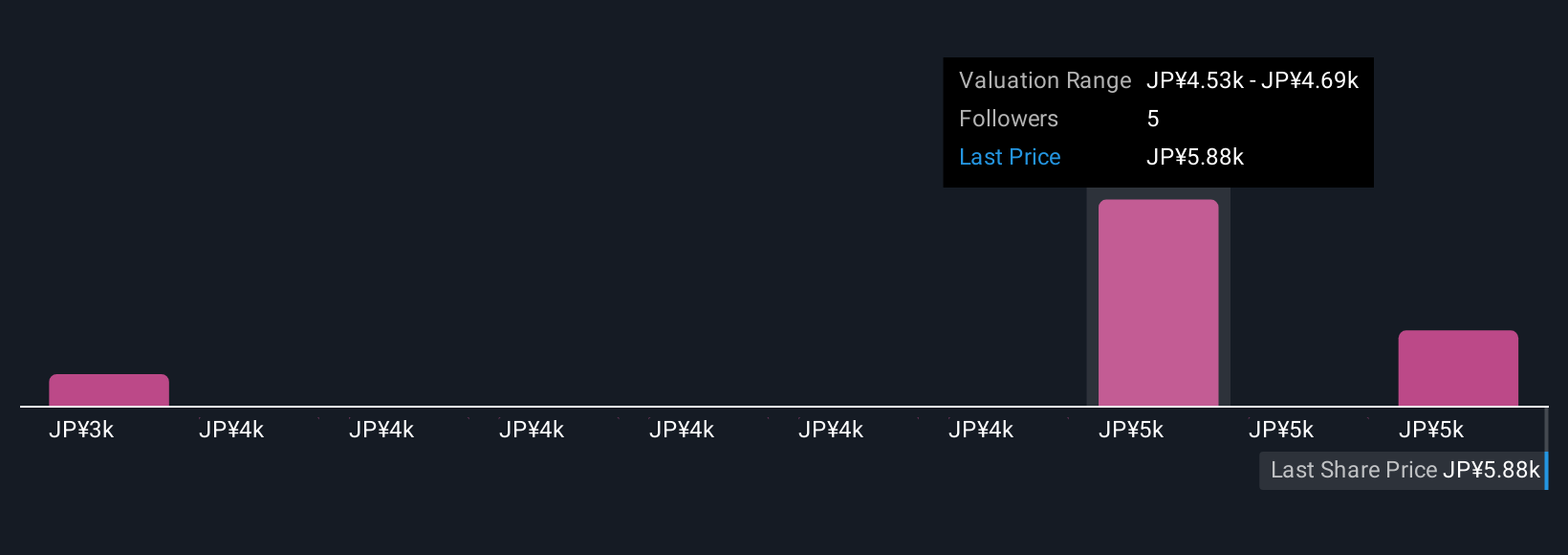

Three members of the Simply Wall St Community provided fair value estimates for NEC ranging from ¥3,436 to ¥5,445. This wide spread reflects different views among investors, even as expectations for digital services revenue growth continue to shape the overall outlook.

Explore 3 other fair value estimates on NEC - why the stock might be worth as much as ¥5445!

Build Your Own NEC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NEC research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NEC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NEC's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6701

NEC

Provides information technology services and social infrastructure in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives