Stock Analysis

- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6800

High Growth Tech Stocks To Watch In Japan This September 2024

Reviewed by Simply Wall St

Japan’s stock markets have experienced significant gains recently, with the Nikkei 225 Index rising 5.6% and the broader TOPIX Index up 3.7%, buoyed by optimism surrounding China’s new stimulus measures and dovish commentary from the Bank of Japan. As we explore high-growth tech stocks in Japan this September, it's essential to consider companies that can leverage these favorable conditions, particularly those benefiting from strong export ties to China and robust domestic economic policies.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

| freee K.K | 18.18% | 74.08% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Arent (TSE:5254)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arent Inc. develops SaaS-based solutions for the construction industry in Japan and has a market cap of ¥46.29 billion.

Operations: Arent Inc. generates revenue primarily from Company Product sales (¥24.30 billion) and Product Co-Development (¥2.97 billion), with additional income from Co-Creation Product Sales (¥232.31 million). The company focuses on providing SaaS-based solutions tailored for the construction industry in Japan.

Arent Inc., amidst a competitive tech landscape in Japan, has demonstrated robust growth, with earnings surging by 107.6% over the past year, significantly outpacing the IT industry's average of 10.1%. This growth trajectory is supported by a projected annual earnings increase of 22.8% and revenue forecasts indicating an 18.4% rise per year, both metrics surpassing broader market expectations. Despite these strong financials, the company's Return on Equity is expected to moderate to 19.7%. With R&D expenses aligning closely with these ambitious targets—highlighting their commitment to innovation—the firm stands poised for sustained advancement in a rapidly evolving sector.

- Click here to discover the nuances of Arent with our detailed analytical health report.

Gain insights into Arent's historical performance by reviewing our past performance report.

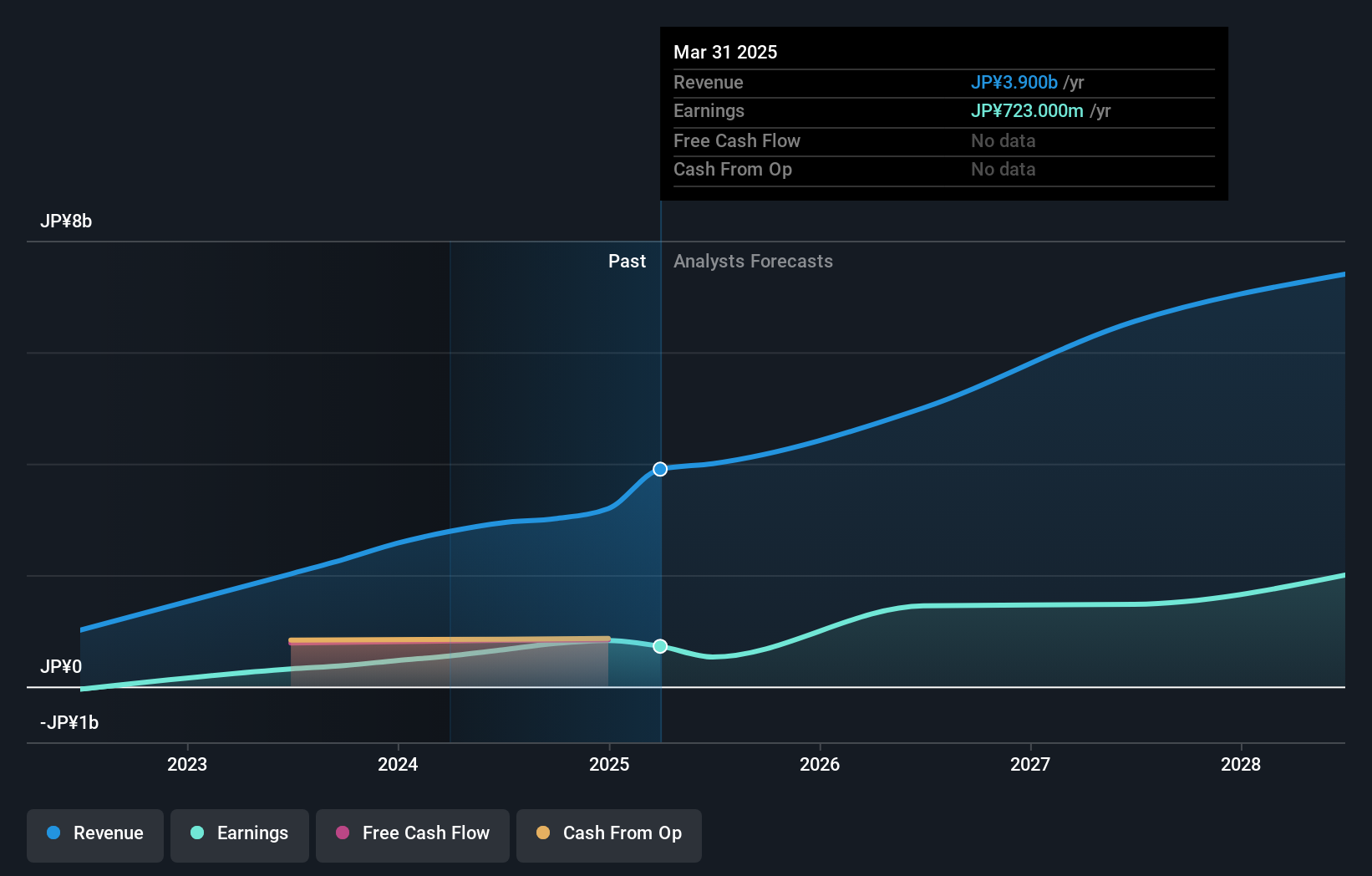

Yokowo (TSE:6800)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yokowo Co., Ltd. specializes in providing components and advanced devices for wireless communication and information transmission applications both in Japan and internationally, with a market cap of ¥36.34 billion.

Operations: Yokowo Co., Ltd. generates revenue primarily through three segments: VCCS (¥57.24 billion), CTC (¥12.78 billion), and FC/MD (¥9.25 billion). The VCCS segment is the largest contributor to the company's revenue stream, highlighting its significant role in their business operations.

Yokowo stands out in Japan's tech sector, not just for its solid performance but also for its strategic focus on R&D, which is evident from the recent guidance indicating robust future earnings and revenue projections. With a 23.5% forecasted annual growth in earnings, Yokowo is set to outpace the broader Japanese market significantly. This growth is underpinned by an aggressive R&D investment strategy that has seen expenses grow to support innovation and development in key tech areas. Moreover, the company's ability to exceed industry earnings growth by 24% last year showcases its potential to leverage these investments into tangible financial success. As Yokowo continues navigating through fiscal challenges with a projected net sales of ¥80 billion and operating profit of ¥4.1 billion for the upcoming year, it remains a critical player in shaping next-gen tech solutions within and possibly beyond Japan’s borders.

- Unlock comprehensive insights into our analysis of Yokowo stock in this health report.

Examine Yokowo's past performance report to understand how it has performed in the past.

Hagiwara Electric Holdings (TSE:7467)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hagiwara Electric Holdings Co., Ltd. sells electronic devices and equipment across Japan, North America, Europe, and Asia with a market cap of ¥35.67 billion.

Operations: Hagiwara Electric Holdings Co., Ltd. generates revenue primarily from two segments: Devices (¥207.88 billion) and Solutions (¥29.11 billion). The company's operations span Japan, North America, Europe, and Asia.

Hagiwara Electric Holdings is navigating a complex landscape with its recent dividend adjustments and robust earnings projections for the fiscal year ending March 2025, anticipating net sales of JPY 269 billion and an operating profit of JPY 7.9 billion. This financial outlook is bolstered by a significant R&D commitment, which has strategically positioned the company to capitalize on emerging tech trends. Despite a challenging past performance with a -30.2% earnings growth last year, Hagiwara's forward-looking strategy indicates an aggressive pursuit of innovation, underscored by expected annual earnings growth of 23.8%—outpacing the Japanese market average significantly. This focus on R&D not only drives future growth prospects but also aligns with industry shifts towards more sustainable and advanced technological solutions, positioning Hagiwara potentially as a resilient contender in high-growth sectors despite its recent hurdles.

- Take a closer look at Hagiwara Electric Holdings' potential here in our health report.

Understand Hagiwara Electric Holdings' track record by examining our Past report.

Where To Now?

- Take a closer look at our Japanese High Growth Tech and AI Stocks list of 124 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6800

Yokowo

Provides components and advanced devices for wireless communication and information transmission applications in Japan and internationally.