Stock Analysis

Japan’s stock markets have experienced a decline, with the Nikkei 225 Index down 1.58% and the TOPIX Index losing 0.64%, amid easing domestic inflation and speculation about future interest rate decisions by the Bank of Japan. In this environment, identifying high growth tech stocks requires attention to companies that can navigate economic uncertainties while capitalizing on technological advancements and market opportunities.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| GMO AD Partners | 69.79% | 97.87% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 21.22% | 71.29% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Infomart (TSE:2492)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Infomart Corporation operates an online BtoB EC trading platform for the food industry in Japan, with a market cap of ¥81.02 billion.

Operations: The company generates revenue primarily from its B2B-PF FOOD segment, contributing ¥8.79 billion, followed by the B2B-PFES segment at ¥5.52 billion. The business focuses on providing an electronic commerce platform tailored for the food industry in Japan.

Infomart, amid a volatile market, stands out with its robust earnings growth of 36.7% last year, significantly surpassing the Professional Services industry's average of 6.7%. This performance is poised to continue with an anticipated profit surge of 39.1% annually, far outpacing the broader Japanese market's forecast of 8.8%. Notably, Infomart's commitment to innovation is evident in its R&D investments which have strategically fueled these gains and are expected to sustain future growth trajectories. Additionally, while the company’s revenue growth projection at 11.2% yearly exceeds the national average (4.2%), it underscores a strategic focus on expanding its market footprint effectively amidst competitive pressures. Despite not maintaining free cash flow positivity currently, Infomart’s financial health is bolstered by high-quality earnings and a promising return on equity forecast at 20.7% in three years' time—reflective of efficient capital utilization and strong managerial acumen that could drive long-term shareholder value in Japan's tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Infomart.

Assess Infomart's past performance with our detailed historical performance reports.

PKSHA Technology (TSE:3993)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PKSHA Technology Inc. develops algorithmic solutions in Japan and has a market capitalization of ¥112.15 billion.

Operations: PKSHA Technology Inc. specializes in creating algorithmic solutions with a focus on the Japanese market. The company generates revenue through its innovative software offerings, which cater to various industries requiring advanced data analysis and automation tools.

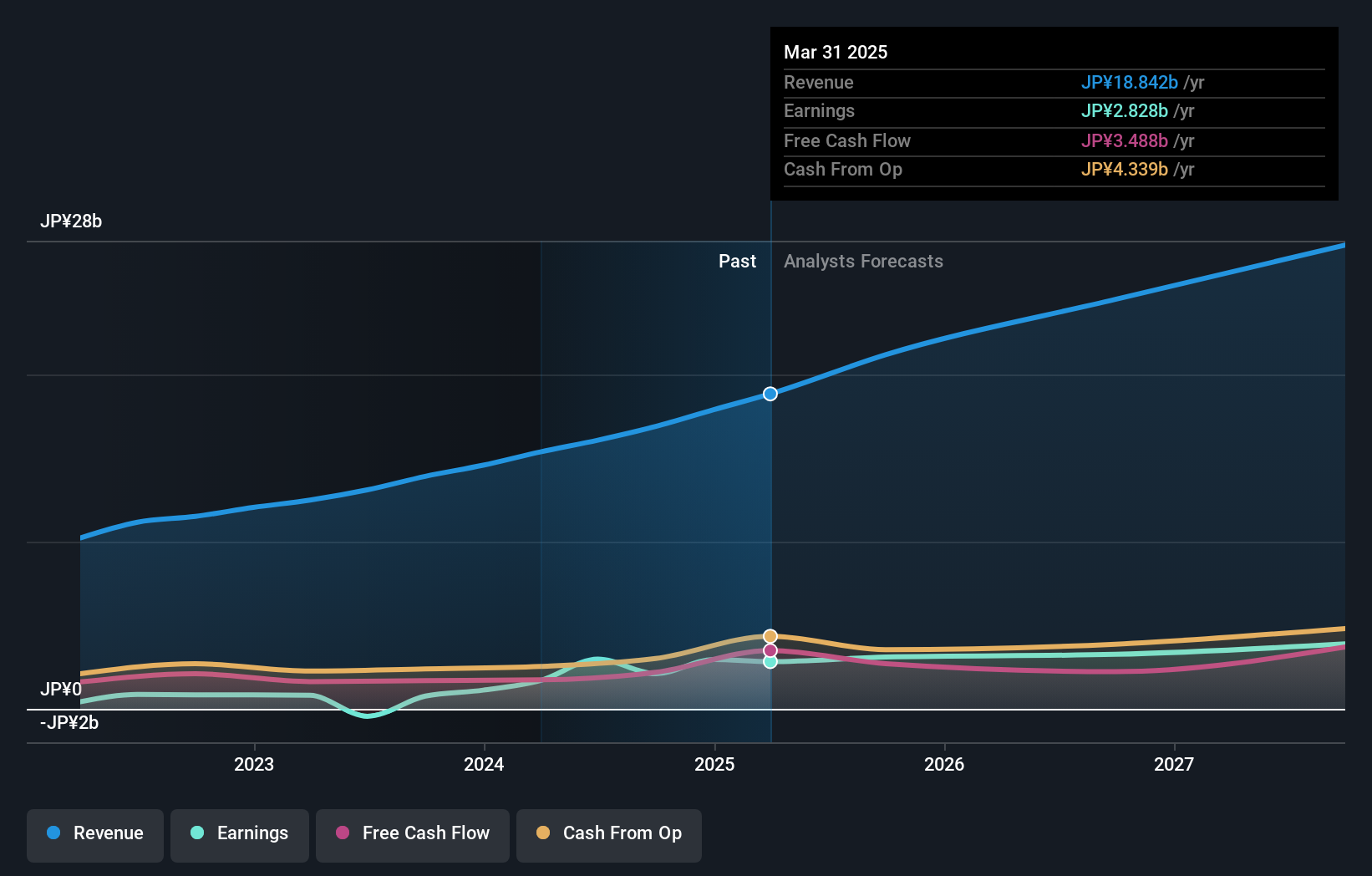

PKSHA Technology, amidst a competitive tech landscape in Japan, is navigating with promising financial forecasts and strategic investments. The company's revenue is expected to grow by 20.2% annually, outpacing the broader Japanese market growth of 4.2%. This growth trajectory is bolstered by a significant focus on R&D, with expenses aimed at fostering innovation and securing a competitive edge in software development—critical as firms globally shift towards SaaS models. Moreover, PKSHA's earnings are projected to surge by 23.8% per year, reflecting robust operational efficiency and potential market share expansion. These projections are set against the backdrop of their recent corporate guidance anticipating net sales reaching JPY 16.8 billion and profits at JPY 2 billion for the fiscal year ending September 2024, underscoring their proactive approach in scaling operations amidst evolving technological demands.

- Dive into the specifics of PKSHA Technology here with our thorough health report.

Evaluate PKSHA Technology's historical performance by accessing our past performance report.

Japan Business Systems (TSE:5036)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Japan Business Systems, Inc. specializes in cloud integration and related services with a market capitalization of ¥44.95 billion.

Operations: The company focuses on cloud integration and related services, leveraging its expertise to generate revenue. Its business model emphasizes providing specialized IT solutions, which likely involves significant investment in technology and skilled personnel to support these services.

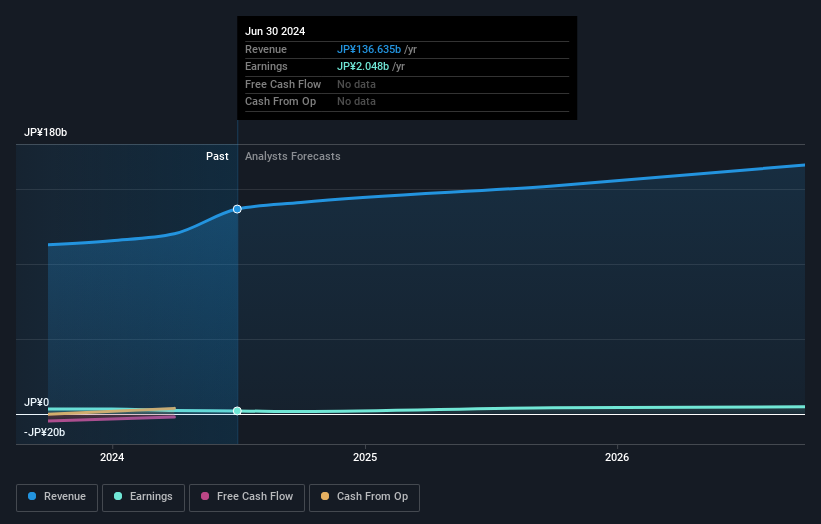

Amidst Japan's evolving tech scene, Japan Business Systems (JBS) is making notable strides. With an anticipated revenue growth of 8.5% per year, JBS is outpacing the broader Japanese market's average of 4.2%. This growth is underpinned by robust R&D investments, which have been crucial for JBS to maintain its competitive edge in software solutions. Particularly impressive is the company’s forecasted earnings surge at a rate of 45.8% annually, signaling strong operational efficiencies and market adaptation capabilities. Despite facing challenges like a one-off loss of ¥1.7 billion last fiscal year, these financial dynamics position JBS as a resilient contender in high-growth tech sectors within Japan.

- Take a closer look at Japan Business Systems' potential here in our health report.

Explore historical data to track Japan Business Systems' performance over time in our Past section.

Turning Ideas Into Actions

- Reveal the 118 hidden gems among our Japanese High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3993

PKSHA Technology

Engages in the development of algorithmic solutions in Japan.