Stock Analysis

Amidst a backdrop of modest declines in Japan's stock markets and heightened uncertainty about future monetary policy directions, investors may find solace in dividend-paying stocks that offer potential for steady income. In evaluating such stocks, it's crucial to consider the company's dividend yield, payout stability, and the broader economic environment that could influence these factors.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.44% | ★★★★★★ |

| Nihon Tokushu Toryo (TSE:4619) | 3.88% | ★★★★★★ |

| Globeride (TSE:7990) | 3.69% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.45% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.75% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.07% | ★★★★★★ |

| Japan Pulp and Paper (TSE:8032) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.11% | ★★★★★★ |

| Innotech (TSE:9880) | 3.92% | ★★★★★★ |

Click here to see the full list of 381 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Yahagi ConstructionLtd (TSE:1870)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Yahagi Construction Co., Ltd. specializes in building construction across Japan, with a market capitalization of approximately ¥71.72 billion.

Operations: Yahagi Construction Co., Ltd. primarily focuses on building construction throughout Japan.

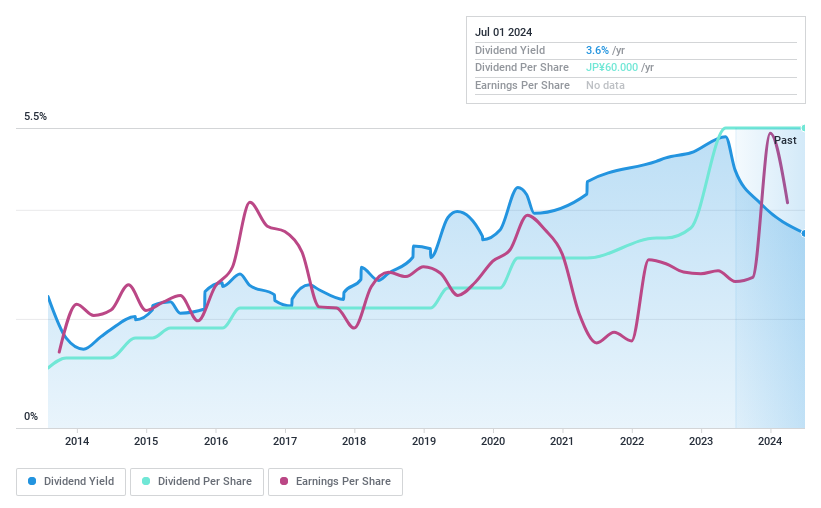

Dividend Yield: 3.6%

Yahagi Construction Co., Ltd. recently raised its annual dividend from JPY 24.00 to JPY 30.00 per share, with an expected increase to JPY 40.00 in the next fiscal year, reflecting a strong commitment to shareholder returns amidst solid financial performance. The company's dividends are well-supported by both earnings and cash flow, with a low payout ratio of 27.5% and a cash payout ratio of 33%, indicating sustainability. Additionally, Yahagi's dividends have shown stability over the past decade, growing consistently alongside earnings which surged by 43.3% last year alone, positioning it favorably in Japan’s competitive dividend market.

- Get an in-depth perspective on Yahagi ConstructionLtd's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Yahagi ConstructionLtd shares in the market.

SRA Holdings (TSE:3817)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SRA Holdings, Inc. operates in systems development, operation/administration, and product solutions marketing both domestically and internationally, with a market capitalization of approximately ¥54.12 billion.

Operations: SRA Holdings, Inc. generates revenue through systems development, operation/administration services, and product solutions marketing on a global scale.

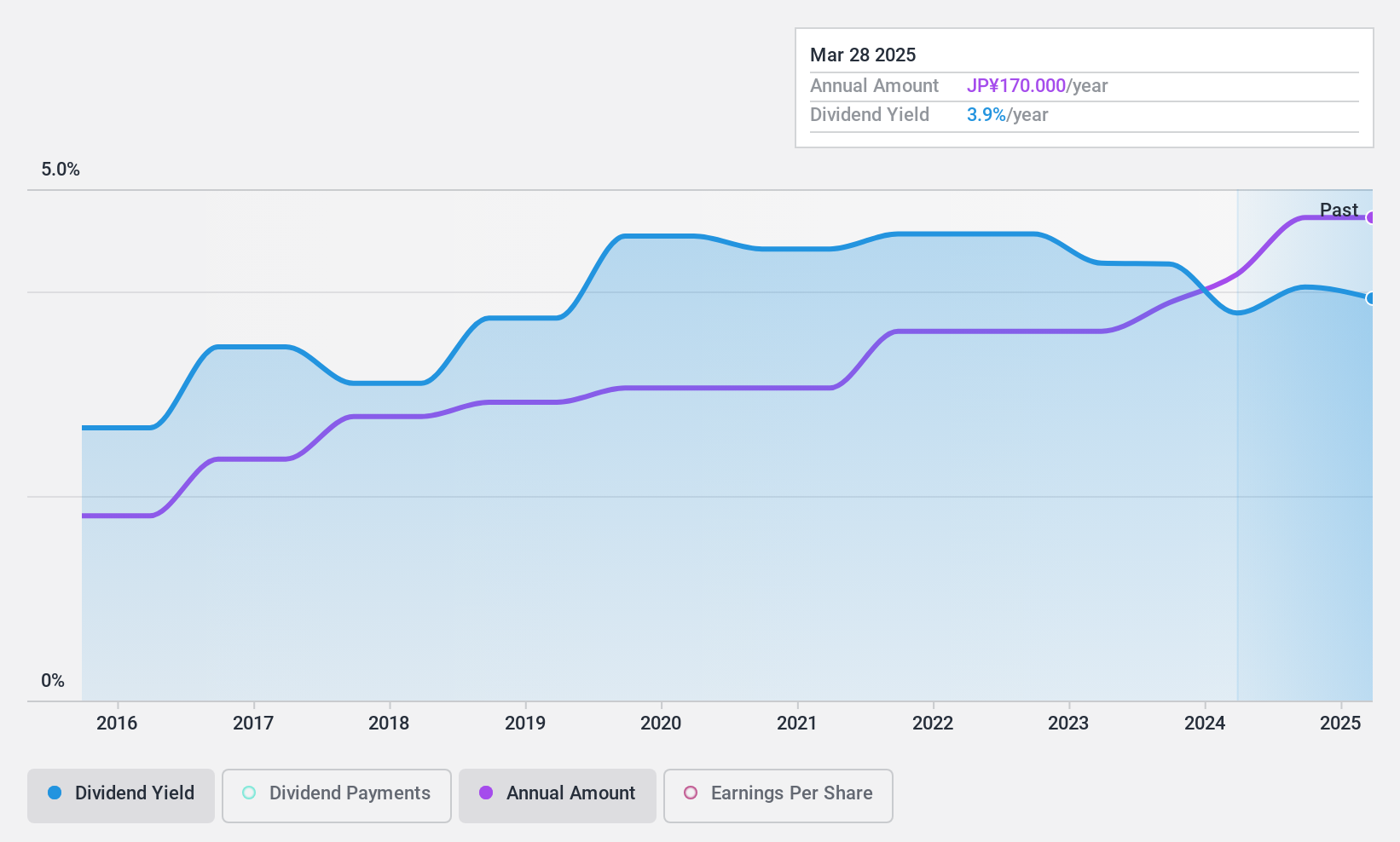

Dividend Yield: 3.2%

SRA Holdings maintains a dividend yield of 3.23%, slightly below the top quartile in Japan's market, despite a challenging coverage scenario where dividends are not well-supported by earnings, with a high payout ratio of 98.1%. However, the company benefits from stable dividend payments over the past decade and significant earnings growth of 421.5% last year. Its price-to-earnings ratio stands at 11.8x, favorable compared to the market average, reflecting potential value amidst its financial metrics challenges.

- Click here to discover the nuances of SRA Holdings with our detailed analytical dividend report.

- Our valuation report unveils the possibility SRA Holdings' shares may be trading at a premium.

Intelligent Wave (TSE:4847)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Intelligent Wave Inc. operates in system development services and offers system products both domestically in Japan and internationally, with a market capitalization of ¥29.30 billion.

Operations: Intelligent Wave Inc. generates ¥14.23 billion in revenue from its software and programming segment.

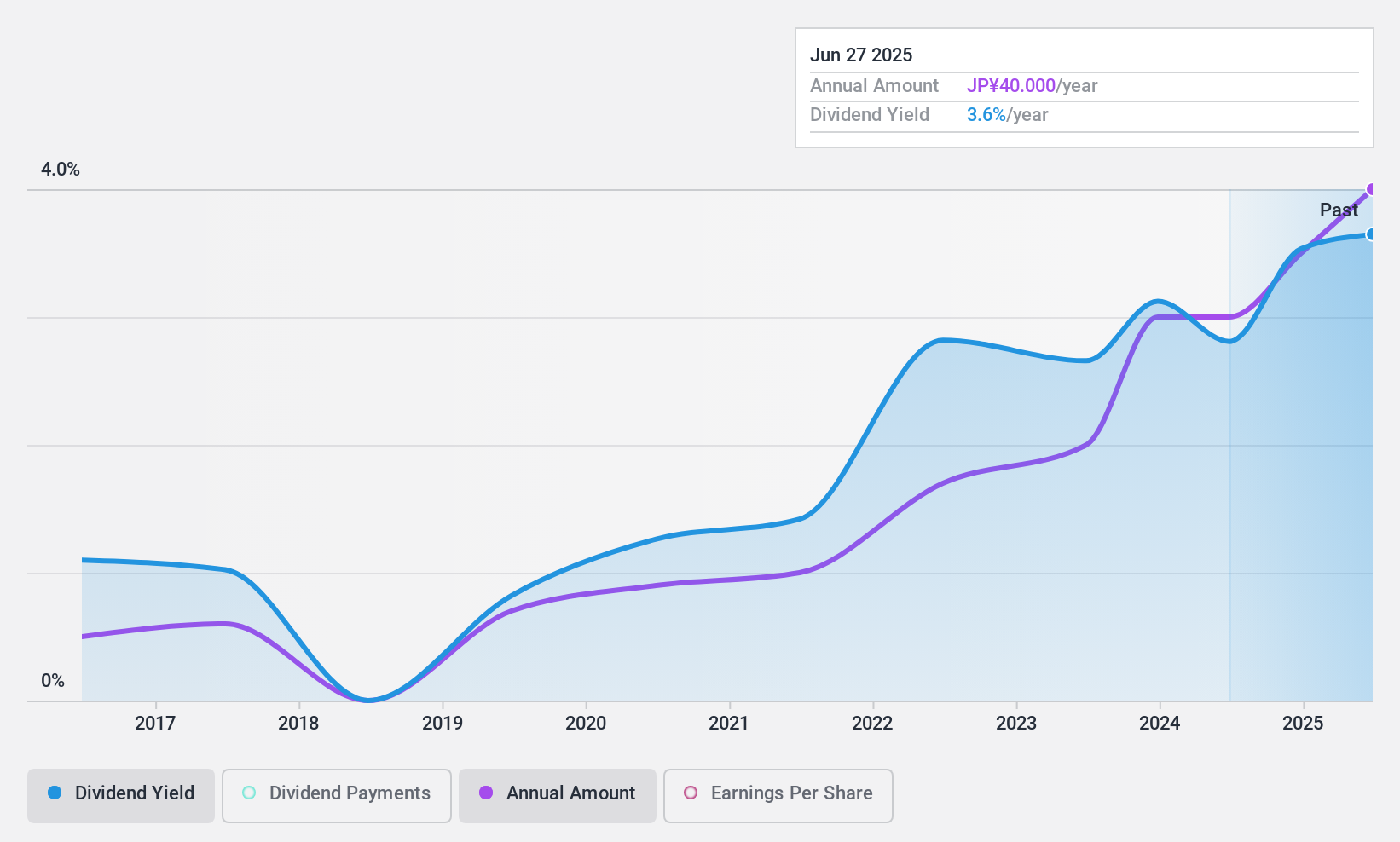

Dividend Yield: 4.5%

Intelligent Wave offers a dividend yield of 4.47%, ranking it in the upper quartile of Japanese dividend stocks. The company has demonstrated a decade-long consistency in its dividend payments, with an increasing trend over this period. Despite this, the dividends are not fully supported by cash flows, presenting potential sustainability concerns. Additionally, while the price-to-earnings ratio at 20.8x is favorable against the industry average of 22.3x, and earnings have grown by 19.9% last year, the lack of free cash flow could challenge future dividend reliability.

- Take a closer look at Intelligent Wave's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Intelligent Wave is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 378 Top Dividend Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Intelligent Wave is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4847

Intelligent Wave

Provides system development services and system products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.