- Philippines

- /

- Banks

- /

- PSE:PSB

Philippine Savings Bank Alongside 2 Other Top Dividend Stocks

Reviewed by Simply Wall St

As global markets experience broad-based gains, with U.S. indexes nearing record highs and smaller-cap indexes outperforming large-caps, investors are keeping a close eye on economic indicators such as jobless claims and home sales reports that are driving positive sentiment. In this environment of cautious optimism, dividend stocks like Philippine Savings Bank offer an attractive proposition for those seeking steady income streams amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.23% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.51% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.81% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.67% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.83% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Philippine Savings Bank (PSE:PSB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Philippine Savings Bank primarily operates in savings and mortgage banking activities in the Philippines, with a market cap of ₱25.61 billion.

Operations: Philippine Savings Bank generates revenue through its Treasury (₱2.25 billion), Branch Banking (₱7.58 billion), Consumer Banking (₱4.01 billion), and Corporate Banking (₱711.58 million) segments in the Philippines.

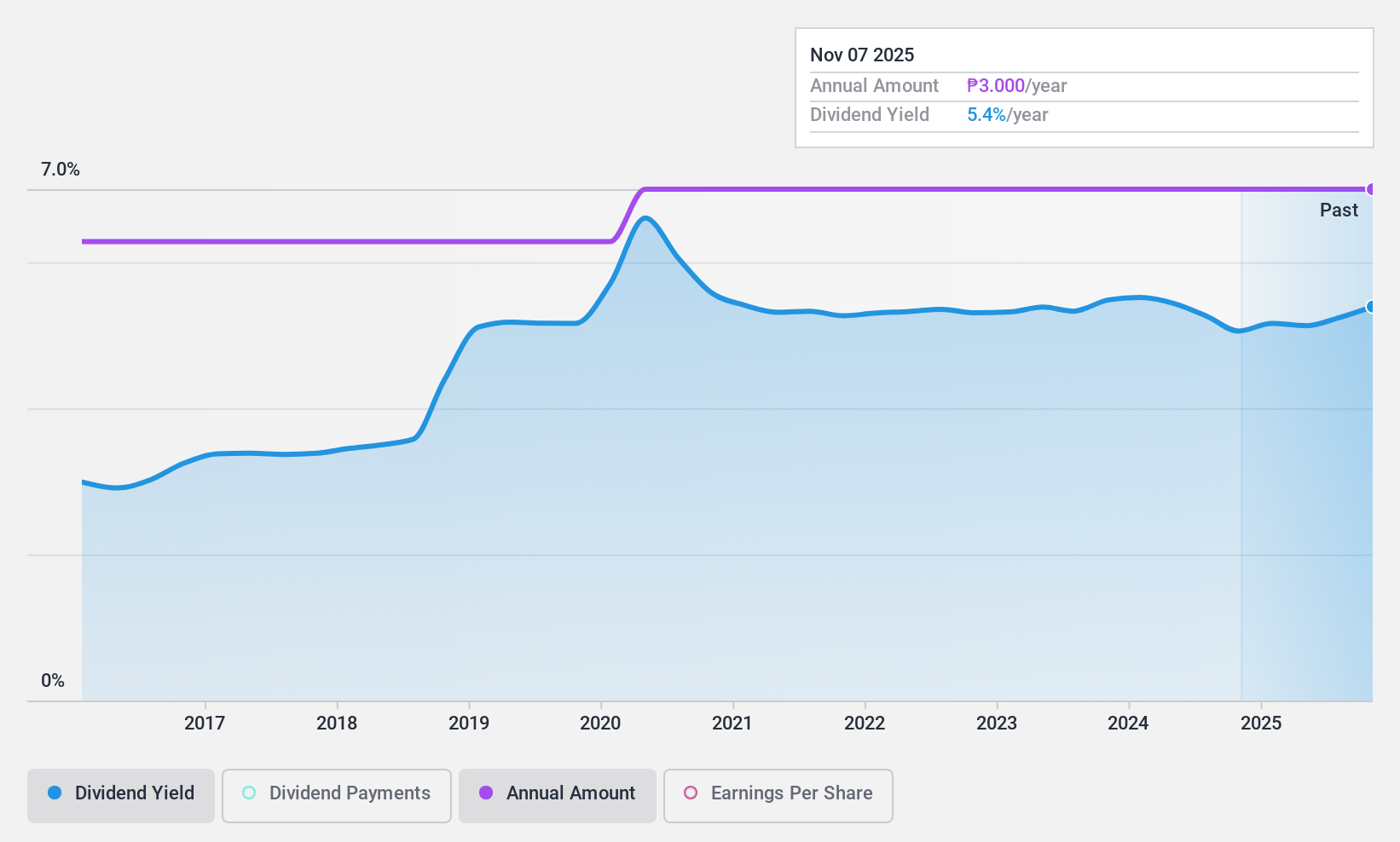

Dividend Yield: 5%

Philippine Savings Bank offers a stable dividend profile with a low payout ratio of 24.8%, indicating dividends are well covered by earnings. Recent earnings growth, up 23.1% year-over-year, supports its dividend sustainability. Despite a lower yield of 5% compared to top-tier payers in the Philippines, PSB has consistently increased and maintained stable dividends over the past decade. The price-to-earnings ratio at 5x suggests attractive valuation relative to the market average of 9.4x.

- Click to explore a detailed breakdown of our findings in Philippine Savings Bank's dividend report.

- Our expertly prepared valuation report Philippine Savings Bank implies its share price may be too high.

JFE Systems (TSE:4832)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JFE Systems, Inc. is a Japanese company involved in the planning, designing, developing, operating, and maintenance of information systems with a market cap of ¥47.98 billion.

Operations: JFE Systems, Inc. generates revenue primarily through its Information Services segment, which accounted for ¥61.12 billion.

Dividend Yield: 3.3%

JFE Systems trades significantly below its estimated fair value, offering potential valuation appeal. Although its dividend yield of 3.34% is below the top tier in Japan, dividends are well covered by both earnings and cash flow with low payout ratios of 19.7% and 26.4%, respectively. However, the dividend track record has been volatile over the past decade despite some growth, making reliability a concern for investors seeking stable income streams.

- Navigate through the intricacies of JFE Systems with our comprehensive dividend report here.

- According our valuation report, there's an indication that JFE Systems' share price might be on the cheaper side.

CHC Resources (TWSE:9930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CHC Resources Corporation manufactures and supplies construction materials in Taiwan with a market cap of NT$16.78 billion.

Operations: CHC Resources Corporation generates revenue primarily from Blast Furnace Cement, accounting for NT$7.44 billion, and Resource Regeneration, contributing NT$5.30 billion.

Dividend Yield: 4.4%

CHC Resources demonstrates solid earnings growth, with a 41.3% increase over the past year, supporting its dividend payments. The payout ratio of 69% indicates dividends are well-covered by earnings, while a cash payout ratio of 48.8% suggests strong cash flow coverage. However, the dividend track record has been volatile and unreliable over the past decade, raising concerns about stability despite a competitive yield in Taiwan's market at 4.44%.

- Dive into the specifics of CHC Resources here with our thorough dividend report.

- Our expertly prepared valuation report CHC Resources implies its share price may be lower than expected.

Key Takeaways

- Navigate through the entire inventory of 1960 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:PSB

Philippine Savings Bank

Primarily engages in savings and mortgage banking activities in the Philippines.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives