Digital Garage, Inc. (TSE:4819) will increase its dividend from last year's comparable payment on the 24th of June to ¥53.00. This takes the annual payment to 1.1% of the current stock price, which unfortunately is below what the industry is paying.

See our latest analysis for Digital Garage

Digital Garage Might Find It Hard To Continue The Dividend

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Digital Garage is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Analysts are expecting EPS to grow by 82.7% over the next 12 months. We like to see the company moving towards profitability, but this probably won't be enough for it to post positive net income this year. The healthy cash flows are definitely a good sign though, so we wouldn't panic just yet, especially with the earnings growing.

Digital Garage Has A Solid Track Record

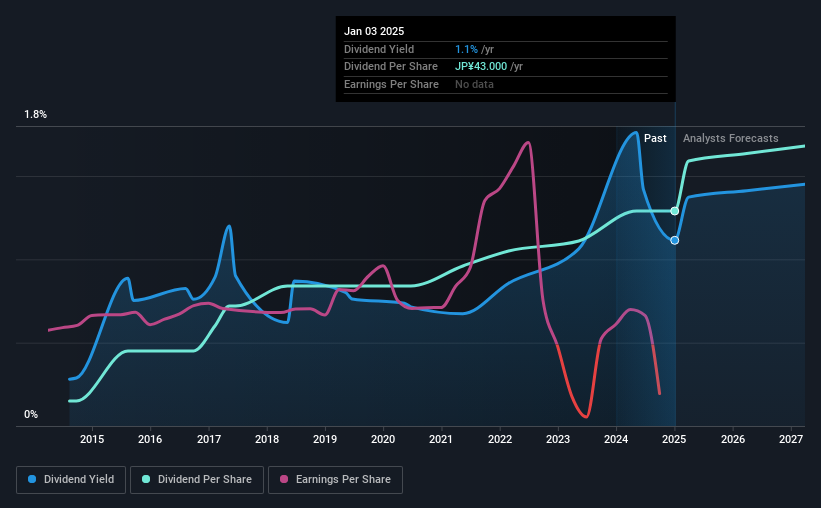

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2015, the annual payment back then was ¥5.00, compared to the most recent full-year payment of ¥43.00. This implies that the company grew its distributions at a yearly rate of about 24% over that duration. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, things aren't all that rosy. Digital Garage's EPS has fallen by approximately 26% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Our Thoughts On Digital Garage's Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 2 warning signs for Digital Garage that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4819

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives