Aisan Technology Co.,Ltd. (TSE:4667) Stocks Pounded By 28% But Not Lagging Market On Growth Or Pricing

The Aisan Technology Co.,Ltd. (TSE:4667) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop has obliterated the annual return, with the share price now down 5.5% over that longer period.

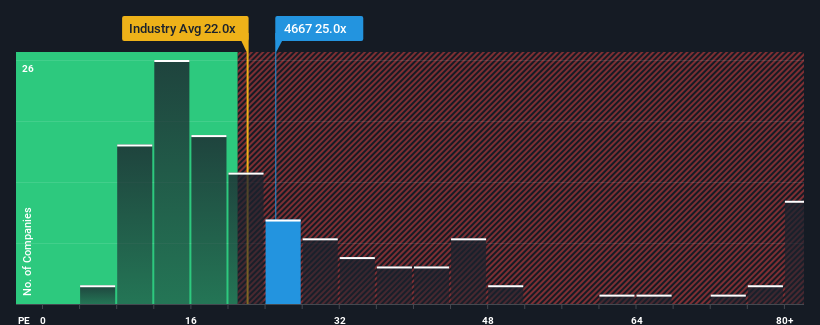

Even after such a large drop in price, Aisan TechnologyLtd's price-to-earnings (or "P/E") ratio of 25x might still make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 13x and even P/E's below 9x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

The earnings growth achieved at Aisan TechnologyLtd over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Aisan TechnologyLtd

How Is Aisan TechnologyLtd's Growth Trending?

Aisan TechnologyLtd's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 21%. The latest three year period has also seen an excellent 66% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 13% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that Aisan TechnologyLtd's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

A significant share price dive has done very little to deflate Aisan TechnologyLtd's very lofty P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Aisan TechnologyLtd revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Aisan TechnologyLtd (1 is significant!) that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4667

Aisan TechnologyLtd

Designs, develops, distributes, and maintains CAD systems for the public survey, registration surveying, civil engineering, and construction industries in Japan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives