3 Asian Growth Companies With High Insider Ownership Expecting 36% Revenue Growth

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, Asian equities have also felt the pressure, reflecting broader investor caution. However, within this challenging landscape, growth companies with high insider ownership can offer a unique advantage as they often signal confidence in the company's potential and align management interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 110.4% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 32.6% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Bora Pharmaceuticals (TWSE:6472) | 11.9% | 20.3% |

We're going to check out a few of the best picks from our screener tool.

Olympic Circuit Technology (SHSE:603920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Olympic Circuit Technology Co., Ltd specializes in the research, development, manufacture, and sales of printed circuit boards (PCBs) both in China and internationally, with a market cap of CN¥28.66 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, which generated CN¥5.42 billion.

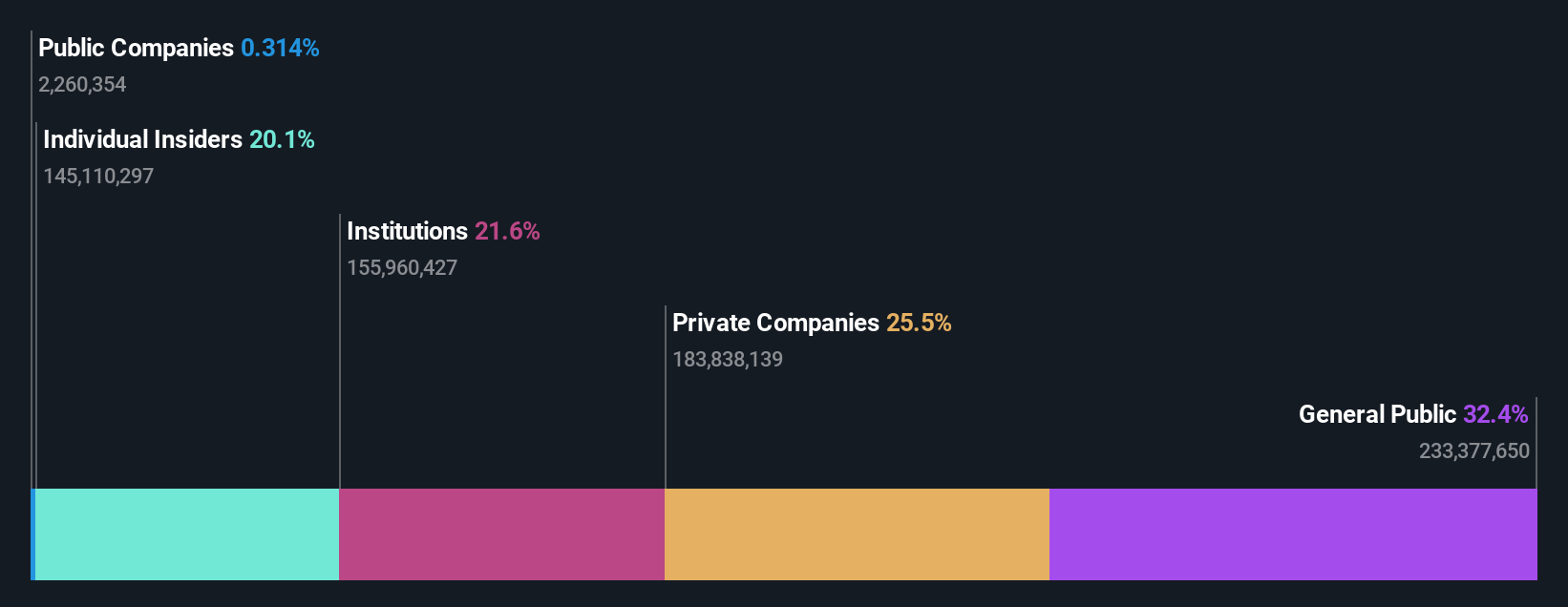

Insider Ownership: 20.1%

Revenue Growth Forecast: 25.9% p.a.

Olympic Circuit Technology has shown robust growth, with earnings rising by 35.3% over the past year and revenue reaching CNY 4.08 billion for the nine months ending September 2025. Despite a volatile share price, the company maintains a lower P/E ratio of 35.1x compared to the market's 43.1x, indicating potential value. Insider ownership is high, though recent trading activity shows no significant insider buying or selling in the last three months.

- Unlock comprehensive insights into our analysis of Olympic Circuit Technology stock in this growth report.

- Our expertly prepared valuation report Olympic Circuit Technology implies its share price may be too high.

Espressif Systems (Shanghai) (SHSE:688018)

Simply Wall St Growth Rating: ★★★★★★

Overview: Espressif Systems (Shanghai) Co., Ltd. is a fabless semiconductor company that develops and sells advanced low-power wireless communication chipsets both in China and internationally, with a market cap of CN¥27.21 billion.

Operations: Espressif Systems generates its revenue primarily from the sale of semiconductors, totaling CN¥2.46 billion.

Insider Ownership: 37.4%

Revenue Growth Forecast: 22.1% p.a.

Espressif Systems (Shanghai) has demonstrated strong growth, with earnings increasing by 54.9% over the past year and revenue reaching CNY 1.91 billion for the nine months ending September 2025. The company trades at a P/E ratio of 58.5x, below the semiconductor industry average of 76.2x, suggesting relative value despite recent share price volatility. Revenue is forecast to grow over 20% annually, outpacing market averages, while insider trading activity remains minimal in recent months.

- Dive into the specifics of Espressif Systems (Shanghai) here with our thorough growth forecast report.

- The analysis detailed in our Espressif Systems (Shanghai) valuation report hints at an deflated share price compared to its estimated value.

Northsand (TSE:446A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Northsand, Inc. offers IT consulting, business consulting, and new business launch services to companies in Japan and has a market cap of ¥96.32 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which amounts to ¥9.19 billion.

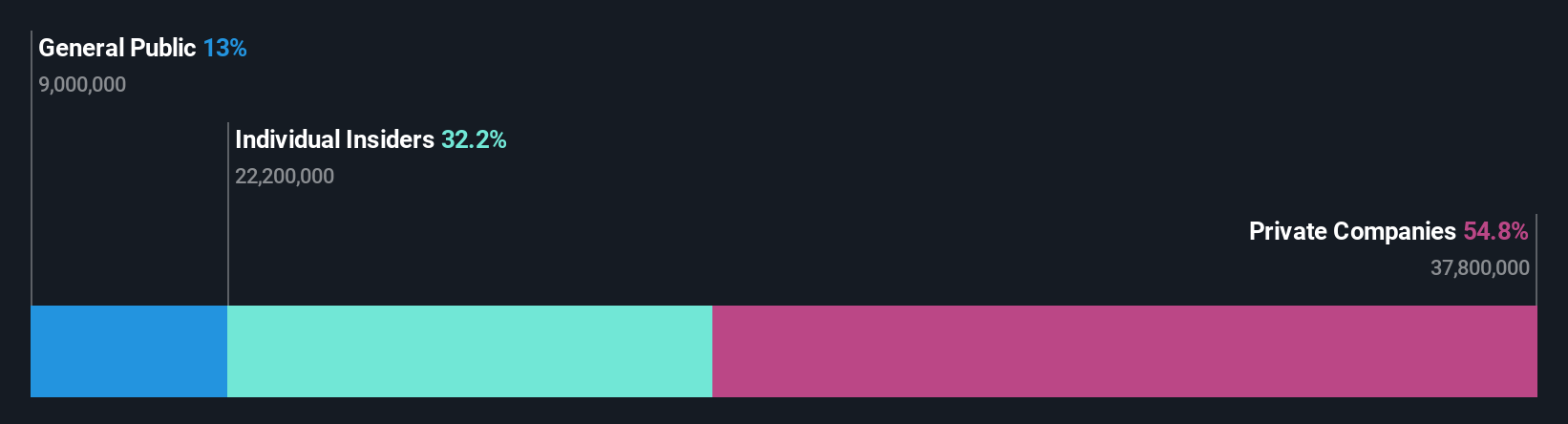

Insider Ownership: 32.2%

Revenue Growth Forecast: 36.3% p.a.

Northsand recently completed a ¥19.29 billion IPO, with shares offered at a discount, reflecting strong insider involvement through an ESOP-related offering. Despite the absence of reported financial data, Northsand's earnings are projected to grow significantly at 47.9% annually over the next three years, outpacing the Japanese market average of 8.2%. Revenue is also expected to increase by 36.3% per year, although shares remain highly illiquid with no recent insider trading activity noted.

- Click here and access our complete growth analysis report to understand the dynamics of Northsand.

- The valuation report we've compiled suggests that Northsand's current price could be inflated.

Where To Now?

- Take a closer look at our Fast Growing Asian Companies With High Insider Ownership list of 637 companies by clicking here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Northsand might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:446A

Northsand

Provides IT consulting, business consulting, and new business launch services for companies in Japan.

High growth potential with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success