Stock Analysis

Exploring High Growth Tech Stocks This November 2024

Reviewed by Simply Wall St

As global markets show resilience with major U.S. indexes approaching record highs and smaller-cap indexes outperforming, investor sentiment remains cautiously optimistic amid geopolitical tensions and economic uncertainties. In this environment, identifying high-growth tech stocks requires a focus on companies that demonstrate strong fundamentals, innovative capabilities, and adaptability to evolving market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.46% | 109.25% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1300 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

BioInvent International (OM:BINV)

Simply Wall St Growth Rating: ★★★★★☆

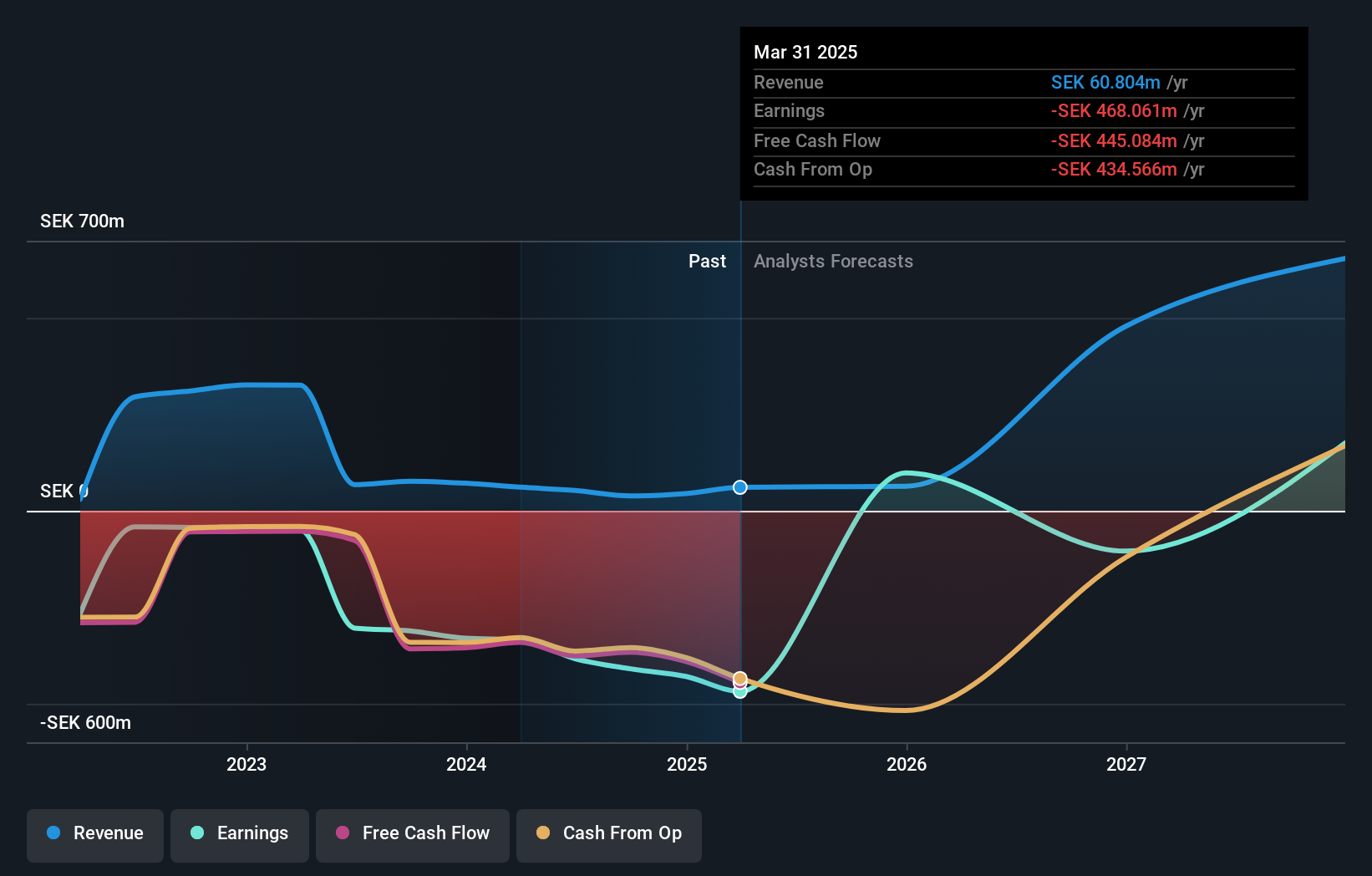

Overview: BioInvent International AB (publ) is a clinical-stage company focused on discovering, researching, and developing novel immuno-modulatory antibodies for cancer treatment across Sweden, Europe, the United States, and internationally, with a market cap of approximately SEK2.93 billion.

Operations: BioInvent generates revenue primarily from the development of antibody-based drugs, amounting to SEK38.64 million. The company operates in the biotechnology sector, focusing on innovative cancer treatments through immuno-modulatory antibodies.

BioInvent International, despite its current unprofitability and a challenging revenue base of SEK 39M, is navigating through a transformative phase with significant R&D investments. The company's commitment to innovation is evident as it reported an impressive forecasted annual revenue growth rate of 90.4%, outpacing the Swedish market's stagnant growth. Additionally, earnings are expected to surge by 108.6% annually. Recent clinical trials, such as the promising results from the Phase 2/2a study of BT-001 showing tumor regression in refractory solid tumors, underscore BioInvent's potential in pioneering oncological treatments. These developments could position BioInvent favorably if these early positive trends continue into future profitability and market capture.

Sensirion Holding (SWX:SENS)

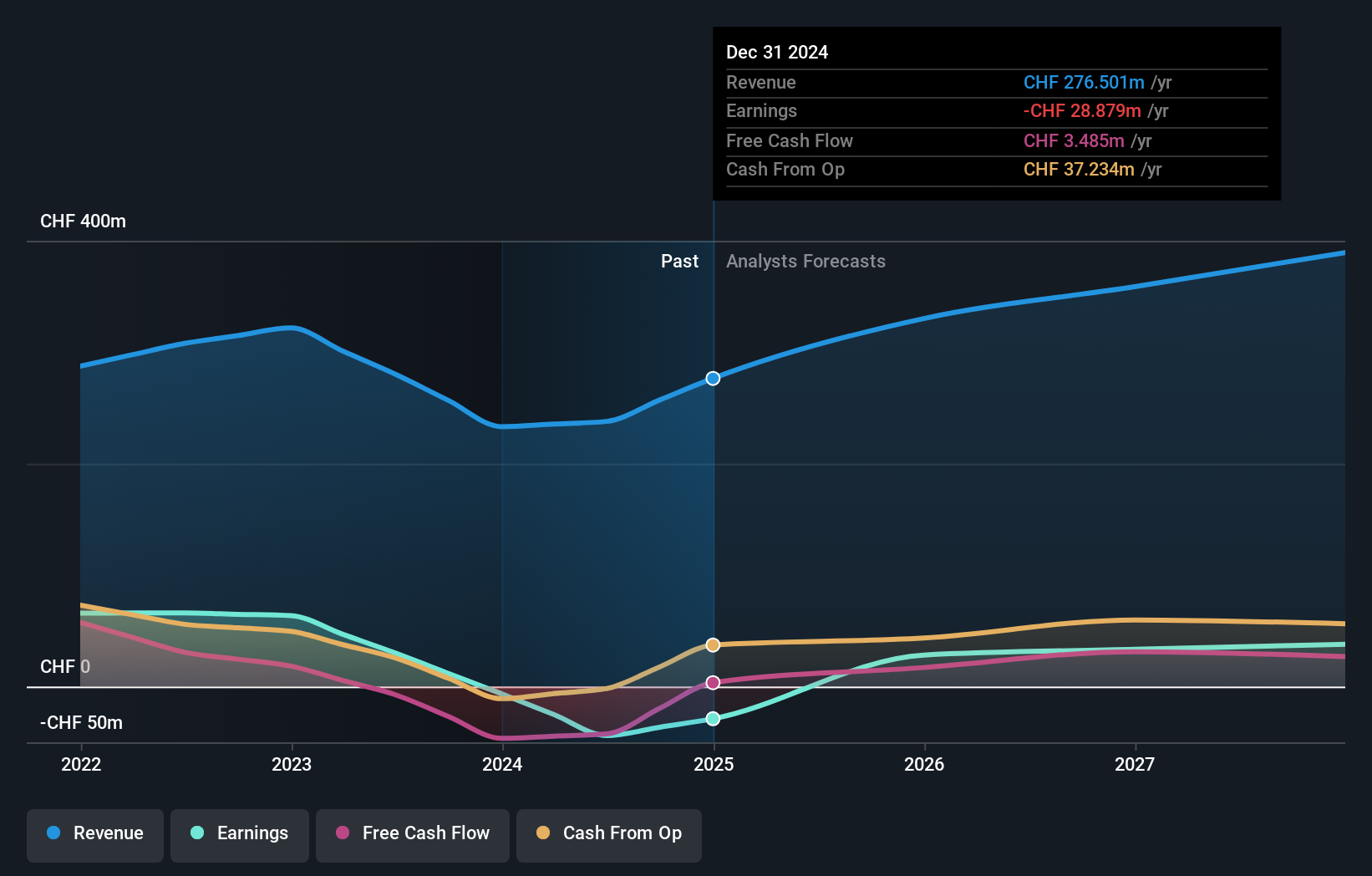

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG is a global company that develops, produces, sells, and services sensor systems, modules, and components with a market capitalization of CHF813.54 million.

Operations: Sensirion Holding AG generates revenue through its global operations in sensor systems, modules, and components, amounting to CHF237.91 million.

Sensirion Holding AG, amidst a volatile market, stands out with its robust commitment to growth and innovation. The company's revenue is set to expand by 13.9% annually, significantly outpacing the Swiss market's growth of 4.2%. This surge is underpinned by substantial R&D investments, which are crucial as Sensirion transitions towards profitability with an anticipated earnings increase of 102.8% per year. Notably, during their recent Analyst/Investor Day on September 19, 2024, Sensirion highlighted these financial trajectories alongside strategic initiatives aimed at enhancing their technological offerings in environmental and flow sensors for diverse industries such as automotive and medical technology. These developments suggest promising prospects for Sensirion in becoming a key contributor to tech innovation while navigating toward fiscal health.

- Unlock comprehensive insights into our analysis of Sensirion Holding stock in this health report.

Examine Sensirion Holding's past performance report to understand how it has performed in the past.

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. is a Japanese company that specializes in the planning, development, and sale of cloud-based solutions with a market capitalization of ¥253.95 billion.

Operations: Sansan generates revenue primarily from its Sansan/Bill One Business, contributing ¥31.79 billion, and the Eight Business, which adds ¥3.80 billion. The company's focus on cloud-based solutions is central to its operations in Japan.

Sansan, Inc. is navigating a promising trajectory in the tech sector, underscored by a robust 39.8% forecasted annual earnings growth which outstrips the Japanese market's average of 7.9%. This growth is bolstered by significant R&D investments, aligning with an impressive revenue increase expectation of 16.3% annually, surpassing the domestic market pace of 4.2%. Despite facing challenges from highly volatile share prices and a substantial one-off loss of ¥401 million affecting recent financial results, Sansan's strategic focus during its latest board meeting suggests readiness to enhance its offerings and address issuance purposes effectively. These elements collectively frame Sansan as an evolving entity within high-growth tech spheres, poised for impactful developments in software solutions amidst competitive pressures and market dynamics.

- Click to explore a detailed breakdown of our findings in Sansan's health report.

Evaluate Sansan's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Embark on your investment journey to our 1300 High Growth Tech and AI Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4443

Sansan

Engages in the planning, development, and selling of cloud- based solutions in Japan.