High Growth Tech Stocks in Japan To Watch This September 2024

Reviewed by Simply Wall St

Japan’s stock market has shown mixed performance recently, with the Nikkei 225 Index gaining 0.5% while the broader TOPIX Index declined by 1.0%, amid a strengthening yen and expectations of further interest rate hikes from the Bank of Japan. In this fluctuating environment, identifying high-growth tech stocks becomes crucial as they can offer potential resilience and growth opportunities despite broader market volatility.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| GMO AD Partners | 69.79% | 97.87% | ★★★★★☆ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

I'LL (TSE:3854)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: I'LL Inc. operates a system solution business in Japan with a market cap of ¥72.72 billion.

Operations: The company generates revenue primarily from its computer services segment, which contributed ¥17.51 billion. Gross profit margin for the latest period was 45%.

I'LL Inc., a contender in Japan's tech scene, has demonstrated robust financial health with earnings growing by 16.8% over the past year, outpacing the software industry's growth of 11.1%. This growth is set to continue, with projections showing a 14.5% increase in earnings annually, surpassing the Japanese market average of 8.5%. Notably, I'LL's commitment to innovation is evident from its R&D spending which significantly contributes to its dynamic market position; however, specific figures on R&D expenses were not disclosed. Despite a revenue growth forecast of 9% per year—modest compared to high-growth benchmarks—the company maintains a competitive edge with high-quality earnings marked by substantial non-cash components and positive free cash flow. As I'LL prepares to announce FY2024 results soon, these factors collectively suggest a solid footing for future performance within an increasingly digital global landscape.

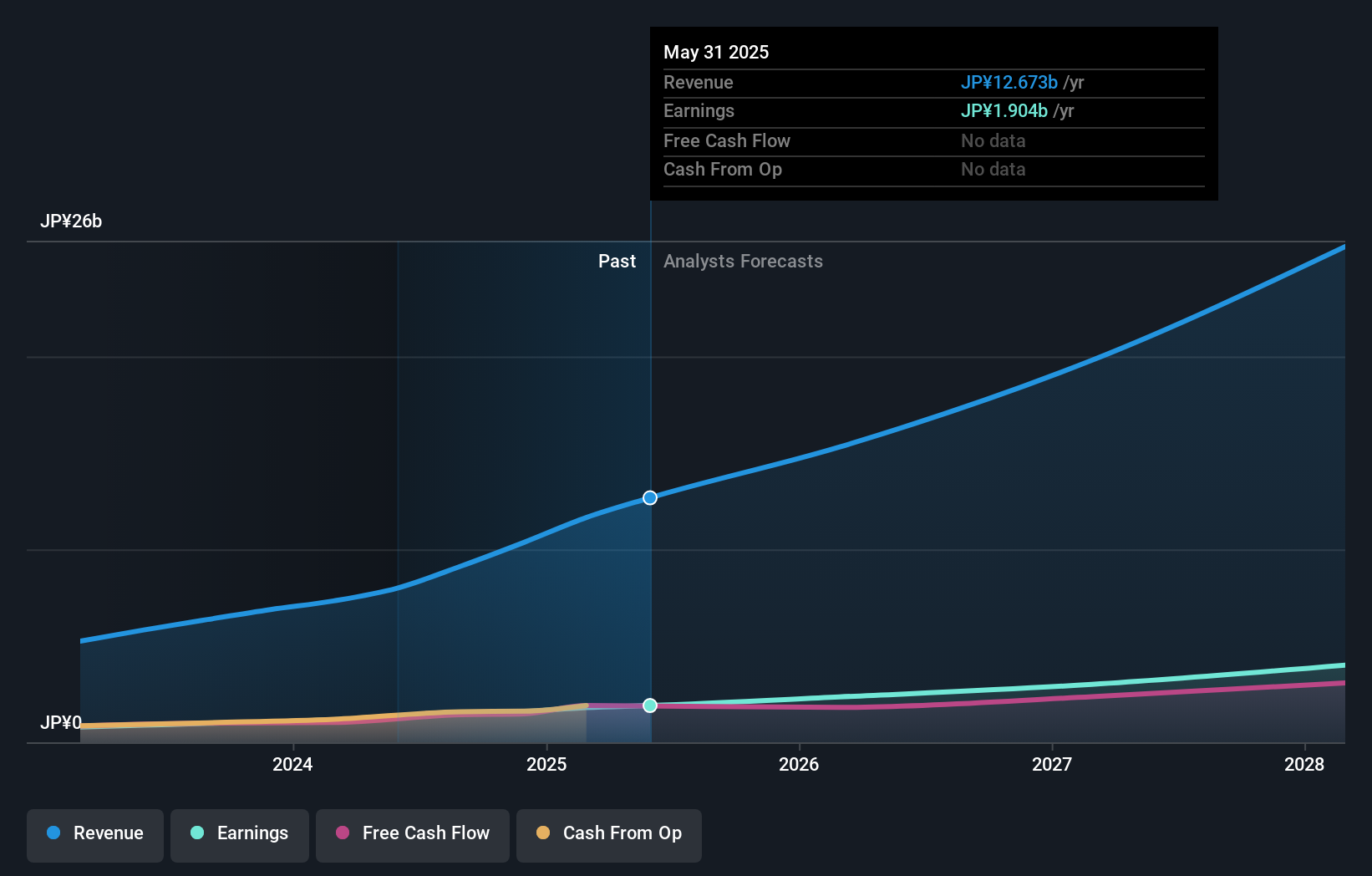

Plus Alpha ConsultingLtd (TSE:4071)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Plus Alpha Consulting Ltd (TSE:4071) specializes in offering marketing solutions and has a market cap of ¥91.95 billion.

Operations: The company generates revenue primarily from HR Solutions, amounting to ¥9.27 billion. A segment adjustment of ¥3.73 billion is also noted in the financials.

Plus Alpha ConsultingLtd, amidst Japan's competitive tech landscape, has shown notable financial dynamics with a projected annual earnings growth of 21.3%, significantly outpacing the broader market's average of 8.5%. This growth trajectory is bolstered by a strong focus on R&D, where expenses have been strategically allocated to foster innovation—critical in maintaining their edge. With revenue expected to increase by 16.1% annually, Plus Alpha is not just keeping pace but setting benchmarks in a market that values constant technological advancement. As they continue to expand their footprint, particularly through strategic partnerships and client acquisitions like TSMC, the company’s prospects look promising despite the highly volatile share price observed over the past three months.

baudroieinc (TSE:4413)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Baudroie, Inc. provides optimal IT solutions in Japan and has a market cap of ¥89.43 billion.

Operations: The company specializes in delivering IT solutions within Japan. It operates with a market capitalization of ¥89.43 billion and generates revenue through its various IT service offerings.

BaudroieInc, amidst Japan's burgeoning tech sector, has demonstrated robust financial metrics with revenue forecasted to surge by 30.6% annually, significantly outstripping the Japanese market's average growth of 4.2%. This impressive expansion is underpinned by a strategic emphasis on R&D, which has seen expenses climb to foster pivotal innovations—evident from their annual earnings growth projection of 28.1%, dwarfing the broader market's expectation of 8.5%. With such dynamic growth coupled with a focus on evolving technological capabilities, BaudroieInc stands poised to capture further market share even as it navigates a highly volatile share price landscape observed in recent months.

- Click here and access our complete health analysis report to understand the dynamics of baudroieinc.

Understand baudroieinc's track record by examining our Past report.

Summing It All Up

- Dive into all 123 of the Japanese High Growth Tech and AI Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3854

Flawless balance sheet with reasonable growth potential.