Nomura Research Institute (TSE:4307): Margin Expansion Reinforces Bullish Growth Thesis

Reviewed by Simply Wall St

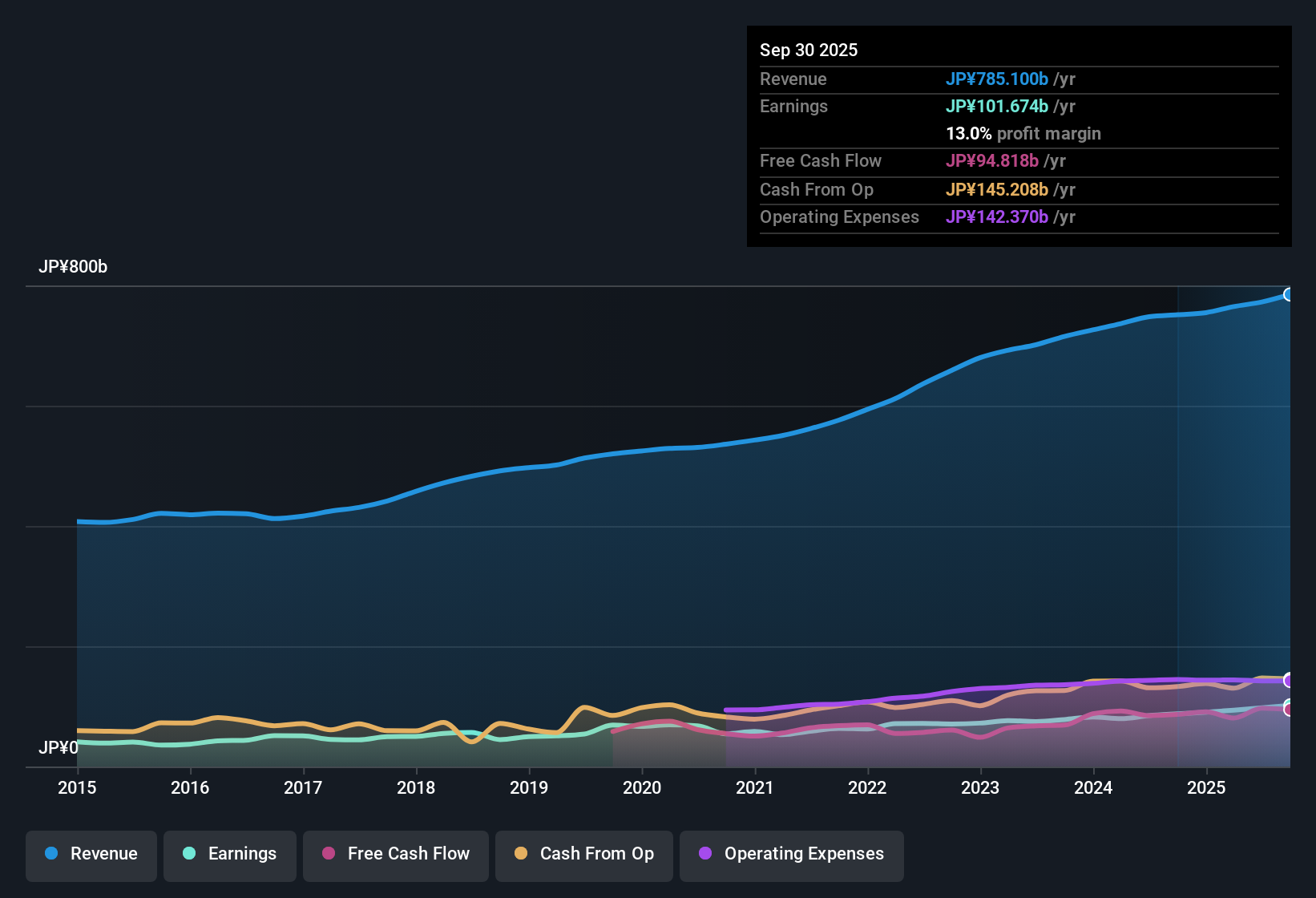

Nomura Research Institute (TSE:4307) posted annual revenue growth of 5.2%, outpacing the Japanese market's 4.5% rate. EPS is forecasted to climb 8.6% per year, just ahead of the national estimate of 7.9%. Net profit margins expanded to 13% from 11.7% as earnings rose 16% over the last year. With shares currently trading at ¥6,030 and recent margin improvements, investors are eyeing the company’s consistent outperformance but weighing it against an elevated valuation versus industry peers.

See our full analysis for Nomura Research Institute.Now, let’s see how these headline results measure up against the market narratives to spot where the consensus view might be bolstered or face new questions.

See what the community is saying about Nomura Research Institute

Profit Margins Rise Above 13%

- Net profit margins increased to 13%, a noteworthy jump from 11.7% the prior year. This marks a sizable improvement in operational profitability compared to both the company’s own five-year growth average of 11.8% and the broader Japanese IT market.

- Analysts' consensus view heavily supports Nomura Research Institute’s ability to sustain margin gains and emphasizes the following points:

- Upward profit forecasts across multiple business units back expectations for future earnings and profitability increases.

- Ongoing international expansion, especially in Vietnam and the U.S., is highlighted as a catalyst to further diversify and grow the profit base.

What stands out is how extending margin growth could re-rate the company’s narrative among analysts, especially if new markets fuel additional profit upside. 📈 Read the full Nomura Research Institute Consensus Narrative.📊 Read the full Nomura Research Institute Consensus Narrative.

DCF Fair Value Trails Market Price

- The current share price of ¥6,030 trades at a substantial 71% premium over the DCF fair value estimate of ¥3,528.10. The price-to-earnings ratio of 34x stands well above both peer (27.6x) and industry (17.4x) averages.

- Analysts' consensus view frames this valuation gap as a key tension and notes the following:

- The consensus analyst price target of ¥6,100.83 sits only marginally higher than today’s market price, reinforcing the idea that most believe the stock is already pricing in much of the growth story.

- However, the consensus also points to upside for those who see international investments and rising margins as drivers of continued outperformance. This suggests valuation may be justified if these trends persist.

Diversified Growth Drivers Take Shape

- Strategic international projects and upward profit revisions across multiple business segments are becoming increasingly central to Nomura Research Institute’s growth trajectory, with analysts forecasting annual revenue expansion of 5.7% and profit margin growth to 14.0% over the next three years.

- Analysts' consensus view identifies strengthening top-line expansion through the following:

- Diversification into Vietnam and the U.S., which is expected to bolster operating revenue and earnings stability by spreading risk across new geographic markets.

- A robust pipeline, including a ¥2 trillion land bank and business unit investments, suggests a foundation for long-term, quality growth relative to the market.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Nomura Research Institute on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on these results? In just a few minutes, you can use the latest data to create your unique narrative. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Nomura Research Institute.

Explore Alternatives

Despite strong margin improvement and growth drivers, Nomura Research Institute currently trades at a substantial premium to its fair value. Its price-to-earnings ratio is far above peers and industry benchmarks.

If paying too much for growth leaves you uneasy, discover better-priced opportunities by using these 834 undervalued stocks based on cash flows that may offer more upside at far less risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nomura Research Institute might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4307

Nomura Research Institute

Provides consulting, financial information technology (IT) solutions, industrial IT solutions, and IT platform services in Japan and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives