As global markets show optimism with U.S. stocks nearing record highs and growth stocks outperforming value shares, the tech sector is particularly buoyed by enthusiasm around artificial intelligence investments. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that are well-positioned to capitalize on emerging technologies and market trends, such as AI infrastructure development.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Beijing Vastdata Technology (SHSE:603138)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Vastdata Technology Co., Ltd. offers data technology services in China with a market capitalization of CN¥4.11 billion.

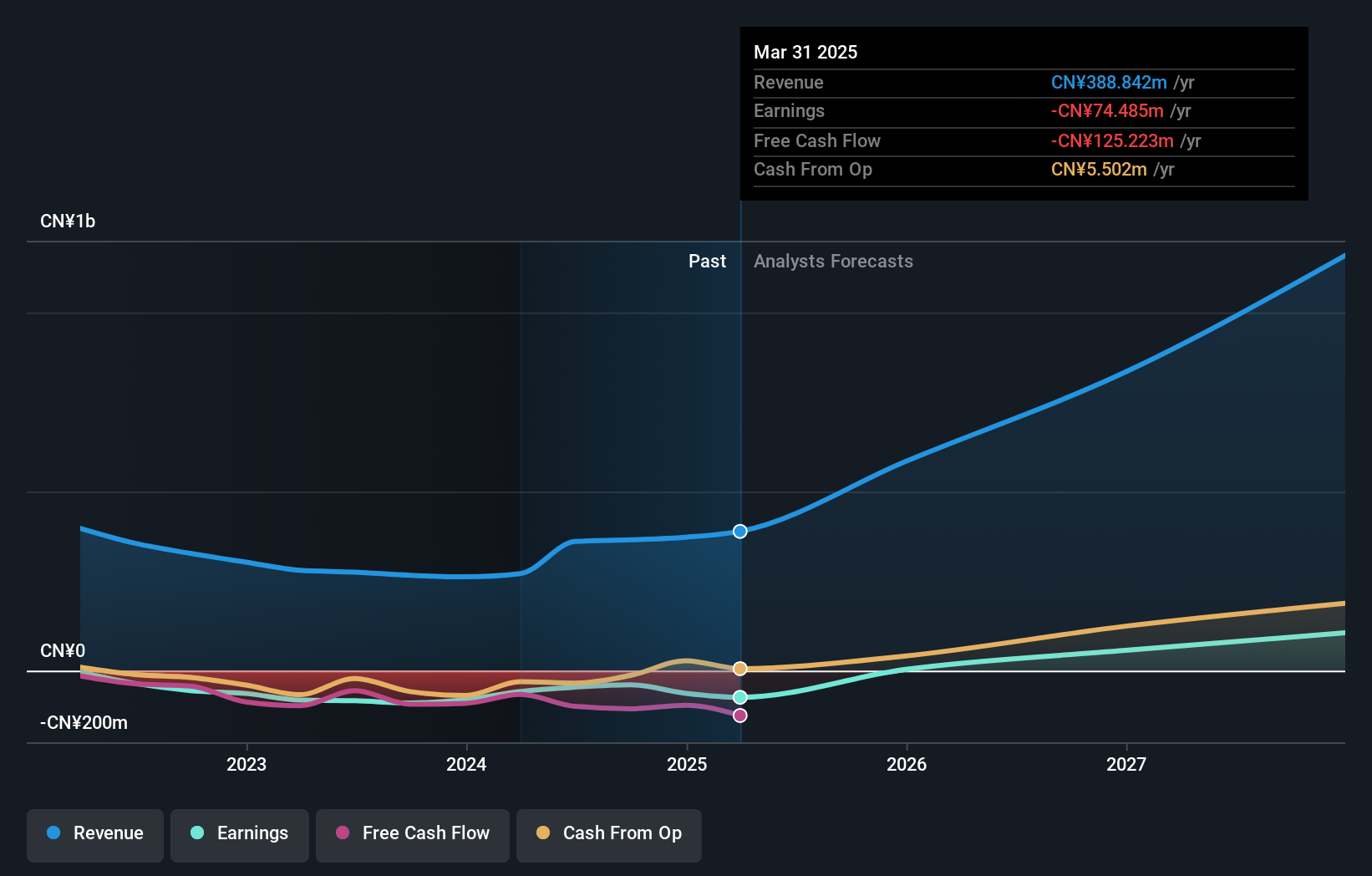

Operations: Vastdata generates revenue primarily from its Software and Information Technology Services segment, amounting to CN¥365.24 million. The company's market capitalization stands at CN¥4.11 billion.

Despite being dropped from the S&P Global BMI Index recently, Beijing Vastdata Technology shows a promising trajectory with expected revenue growth of 41.8% annually, outpacing the Chinese market's average of 13.4%. This growth is significant in a sector where rapid expansion is crucial. However, challenges persist as the company remains unprofitable with volatile share prices and low forecasted return on equity at 9.3%. On a positive note, earnings are anticipated to surge by approximately 119.7% annually over the next three years, positioning Beijing Vastdata for potential profitability and making it a noteworthy case in high-growth tech sectors driven by innovation and market demands.

- Get an in-depth perspective on Beijing Vastdata Technology's performance by reading our health report here.

Gain insights into Beijing Vastdata Technology's past trends and performance with our Past report.

Chengdu Jiafaantai Education TechnologyLtd (SZSE:300559)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Jiafaantai Education Technology Co., Ltd. engages in the provision of information services and computer applications, with a market capitalization of CN¥4.65 billion.

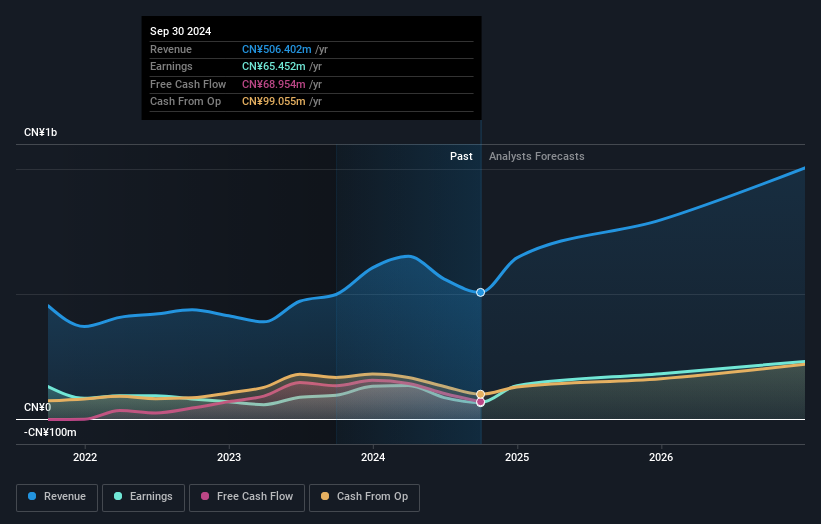

Operations: Chengdu Jiafaantai focuses on offering information services and computer applications, generating revenue of CN¥506.40 million from these segments.

Chengdu Jiafaantai Education Technology Ltd., despite its recent exclusion from the S&P Global BMI Index, is charting a robust growth path with an expected annual revenue increase of 27.7% and earnings projected to surge by 42.5% per year. This performance is notably above the Chinese market averages of 13.4% and 25.1%, respectively, underscoring the company's potential in a competitive landscape. The firm's commitment to innovation is evident in its R&D spending trends, which have consistently aligned with or exceeded industry benchmarks, positioning it well for future technological advancements and market demands.

- Click here to discover the nuances of Chengdu Jiafaantai Education TechnologyLtd with our detailed analytical health report.

Learn about Chengdu Jiafaantai Education TechnologyLtd's historical performance.

PKSHA Technology (TSE:3993)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PKSHA Technology Inc. focuses on developing algorithmic solutions in Japan and has a market capitalization of ¥105.49 billion.

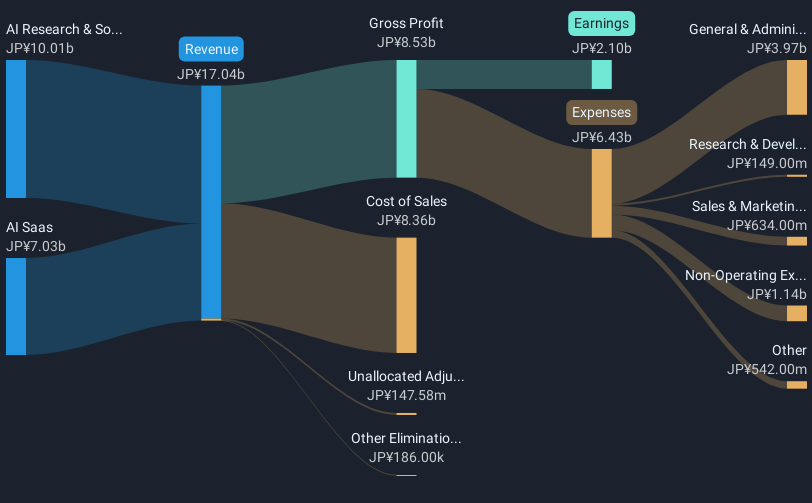

Operations: PKSHA Technology Inc. generates revenue primarily through its AI SaaS and AI Research & Solutions segments, with ¥7.03 billion and ¥10.01 billion respectively. The company's focus on algorithmic solutions positions it within the technology sector in Japan.

PKSHA Technology's trajectory in the tech sector is underscored by its robust earnings growth of 176.3% over the past year, significantly outpacing the software industry's average of 12.1%. This performance is bolstered by a projected annual revenue increase of 14.8% and earnings growth forecast at 21% per year, both figures surpassing Japan's market averages of 4.3% and 8.1%, respectively. The company’s focus on innovation is evident from its R&D spending trends which align with industry benchmarks, ensuring it remains competitive in evolving tech landscapes. Recent corporate guidance anticipates substantial financial outcomes for FY2025, with expected net sales reaching JPY 20 billion and profits attributable to owners at JPY 2.6 billion, reflecting PKSHA’s strategic initiatives and operational efficiency in harnessing AI technologies for scalable solutions.

- Click here and access our complete health analysis report to understand the dynamics of PKSHA Technology.

Assess PKSHA Technology's past performance with our detailed historical performance reports.

Where To Now?

- Dive into all 1225 of the High Growth Tech and AI Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Vastdata Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603138

Beijing Vastdata Technology

Provides database products and services in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives