eBASE Ltd. (TSE:3835) Margin Decline Challenges Dividend Narrative Despite Strong Valuation

Reviewed by Simply Wall St

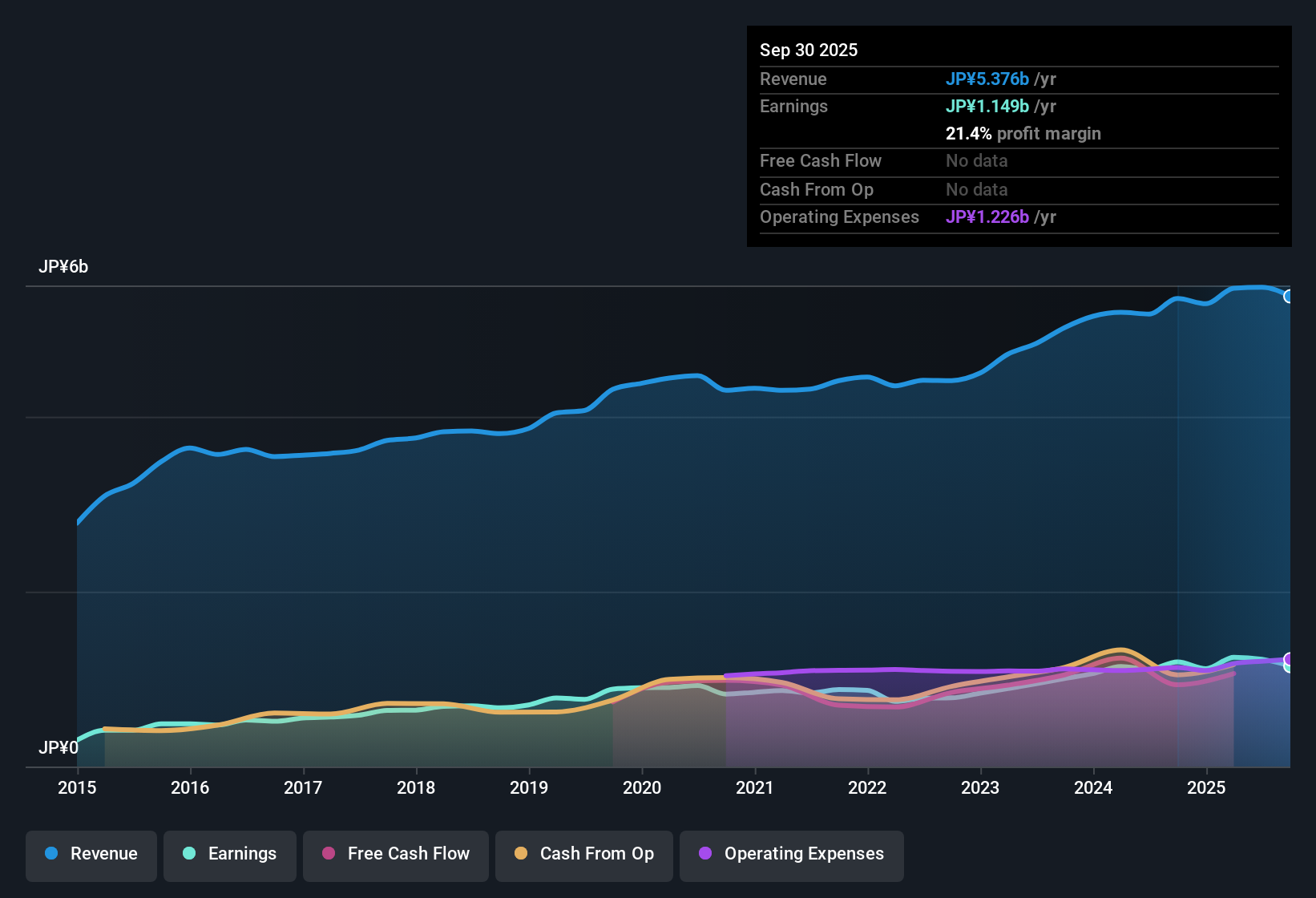

eBASE Ltd. (TSE:3835) reported net profit margins of 21.4%, slightly lower than the 22.4% recorded last year. Over the past five years, the company’s earnings have grown at an average annual rate of 9.5%, though the most recent year saw negative earnings, breaking from that upward trend. Investors are watching the interplay between margin pressure and the company’s history of high-quality returns as they weigh the current results.

See our full analysis for eBASELtd.Next up, we will see how eBASE’s latest results match up with the key narratives. It is often where the numbers and market stories meet that things get interesting.

Curious how numbers become stories that shape markets? Explore Community Narratives

P/E Ratio Sits Below Sector Average

- eBASE Ltd. trades at a Price-To-Earnings ratio of 17.7x, undercutting both the JP Software industry average of 20.8x and similar peers in the sector.

- The prevailing market view highlights that this discount reinforces eBASE’s status as a potential bargain. However, momentum in the share price will likely remain limited without clear catalysts.

- Despite the attractive P/E, the narrative suggests investors are mostly in a “wait-and-see” mode and note the absence of major news as a reason for caution, even when value screens flag the stock as cheap.

- With shares at ¥453, there is headroom versus sector multiples. Still, the current neutral tone in news flow suggests few are rushing in and chasing upside based solely on valuation.

DCF Fair Value Implies Upside

- The current share price of ¥453 is trading below the DCF fair value estimate of ¥494.56, indicating the market is pricing in a margin of safety of over 9% relative to this intrinsic valuation.

- The prevailing market view points out that, while a gap exists between current trading levels and fair value, investors are hesitant to act until new developments emerge to unlock that potential.

- Such a disconnect draws the attention of bargain hunters. However, persistent neutral sentiment could mean the value gap remains until the company delivers a clear positive catalyst.

- This tension between undervaluation and muted market excitement shows that investors want more than just numbers; they need a reason to believe in near-term change.

Dividend Sustainability Draws Scrutiny

- Despite solid historic earnings growth averaging 9.5% per year, the most recent statements reveal negative earnings, sparking questions about the dependability of ongoing dividend payments.

- The prevailing market view notes that concerns around dividend sustainability are dragging on sentiment, as investors assess whether the high-quality track record can offset a year in the red.

- Without signs of an imminent turnaround, even fans of the stock are weighing the risk that the latest earnings dip could pressure future dividends.

- While longer-term performance remains strong, scrutiny of the payout policy will likely increase unless the company quickly returns to profit.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on eBASELtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Although eBASE Ltd. offers a history of strong growth, the latest earnings dip and dividend uncertainty highlight risks for those seeking dependable income.

If reliable payouts are a priority, check out these 1993 dividend stocks with yields > 3% to discover companies with consistent dividends and yields that could better match your income goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3835

eBASELtd

eBase Co.,Ltd. engages in the planning, development, sale, and maintenance of content management software in Japan.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives