GMO GlobalSign Holdings K.K. (TSE:3788) Stocks Pounded By 26% But Not Lagging Market On Growth Or Pricing

GMO GlobalSign Holdings K.K. (TSE:3788) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 25% share price drop.

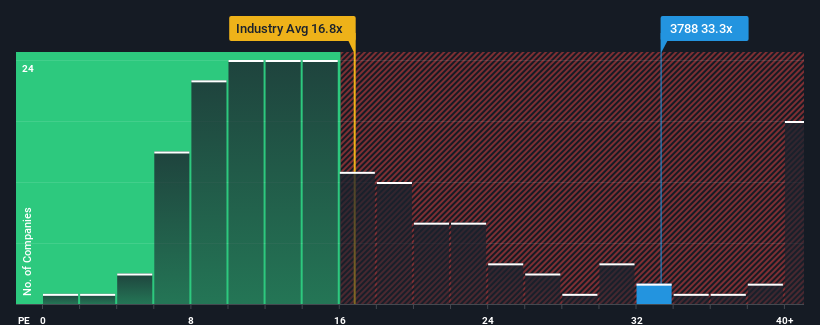

Although its price has dipped substantially, given close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 13x, you may still consider GMO GlobalSign Holdings K.K as a stock to avoid entirely with its 33.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

GMO GlobalSign Holdings K.K could be doing better as it's been growing earnings less than most other companies lately. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for GMO GlobalSign Holdings K.K

What Are Growth Metrics Telling Us About The High P/E?

GMO GlobalSign Holdings K.K's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a decent 5.0% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen an unpleasant 25% overall drop in EPS. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 14% each year as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 9.6% each year growth forecast for the broader market.

With this information, we can see why GMO GlobalSign Holdings K.K is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On GMO GlobalSign Holdings K.K's P/E

Even after such a strong price drop, GMO GlobalSign Holdings K.K's P/E still exceeds the rest of the market significantly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that GMO GlobalSign Holdings K.K maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with GMO GlobalSign Holdings K.K, and understanding should be part of your investment process.

If you're unsure about the strength of GMO GlobalSign Holdings K.K's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3788

GMO GlobalSign Holdings K.K

Provides digital authentication and electronic signature technologies to government agencies and enterprises worldwide.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives