Top Growth Stocks With High Insider Ownership On Japanese Exchange

Reviewed by Simply Wall St

Amid recent modest gains in Japan's stock markets, driven by the Bank of Japan's commitment to normalizing monetary policy and a strengthening yen, investors are increasingly looking for stable yet promising investment opportunities. In this environment, growth companies with high insider ownership often stand out as they combine potential for expansion with strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 32.7% |

| Hottolink (TSE:3680) | 27% | 61.9% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 43.3% |

| Medley (TSE:4480) | 34% | 30.5% |

| SHIFT (TSE:3697) | 35.4% | 32.8% |

| ExaWizards (TSE:4259) | 22% | 63% |

| Money Forward (TSE:3994) | 21.4% | 66.9% |

| Astroscale Holdings (TSE:186A) | 21.3% | 90% |

| AeroEdge (TSE:7409) | 10.7% | 25.3% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

We'll examine a selection from our screener results.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★★

Overview: SHIFT Inc. provides software quality assurance and testing solutions in Japan, with a market cap of ¥216.91 billion.

Operations: SHIFT Inc. generates revenue primarily from its software quality assurance and testing solutions in Japan.

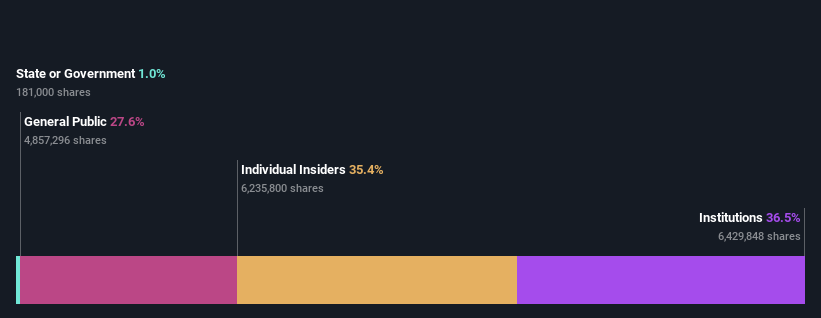

Insider Ownership: 35.4%

SHIFT, a Japanese growth company with substantial insider ownership, has shown significant earnings growth of 36.3% per year over the past five years and is forecasted to continue growing at 32.81% annually. Despite its highly volatile share price recently, SHIFT's revenue is expected to rise by 21.6% per year, outpacing the broader JP market's growth rate of 4.3%. Currently trading at a significant discount to its estimated fair value, SHIFT also boasts a high forecasted return on equity of 25.9%.

- Get an in-depth perspective on SHIFT's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that SHIFT's share price might be on the cheaper side.

Mercari (TSE:4385)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mercari, Inc. plans, develops, and operates marketplace applications in Japan and the United States with a market cap of ¥383.64 billion.

Operations: The company's revenue segments are ¥43.65 billion from the United States and ¥138.11 billion from Japan.

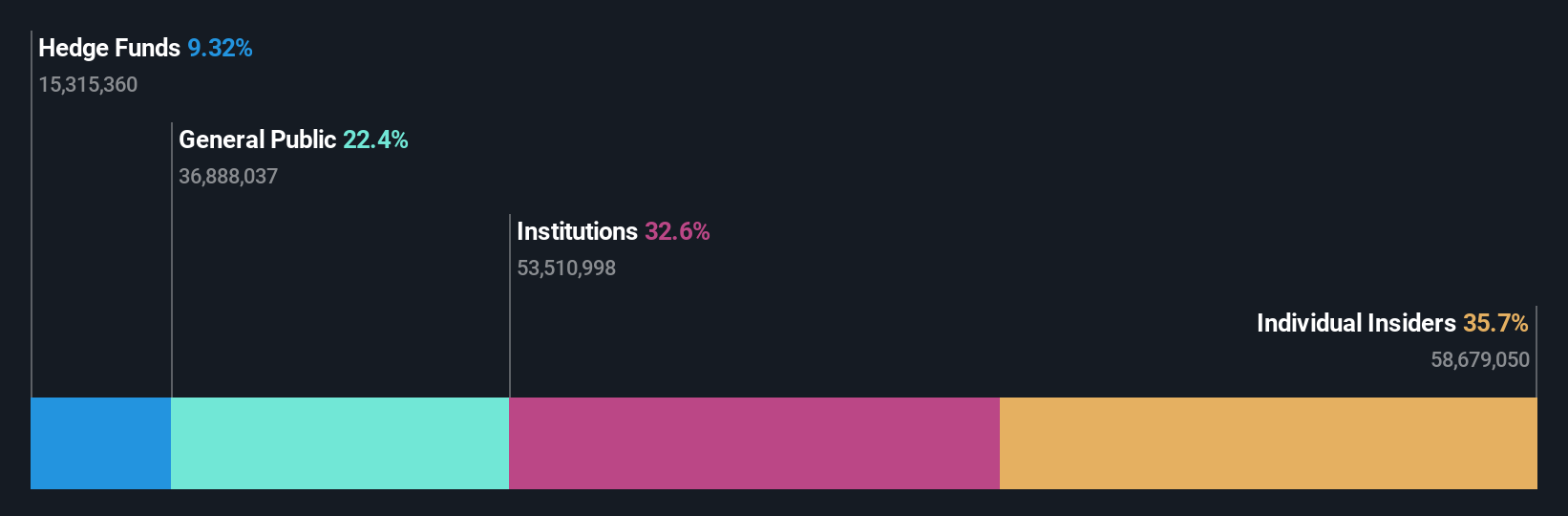

Insider Ownership: 36%

Mercari, a Japanese growth company with high insider ownership, expects revenue between ¥200 billion and ¥210 billion for the fiscal year ending June 30, 2025. Forecasted earnings growth of 19.6% annually surpasses the JP market's average of 8.5%. Despite a highly volatile share price recently, Mercari's revenue is projected to grow at 8% per year. Historical earnings have grown by 66.5% annually over the past five years, indicating strong performance potential despite non-cash earnings concerns.

- Click here to discover the nuances of Mercari with our detailed analytical future growth report.

- Our valuation report here indicates Mercari may be overvalued.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors both in Japan and internationally with a market cap of approximately ¥2.03 trillion.

Operations: Revenue Segments (in millions of ¥): E-commerce: ¥1,304,567 Fintech: ¥1,234,890 Digital Content: ¥456,789 Communications: ¥678,123 Rakuten Group's revenue is derived from e-commerce (¥1.30 billion), fintech (¥1.23 billion), digital content (¥456.79 million), and communications services (¥678.12 million).

Insider Ownership: 17.3%

Rakuten Group's revenue is forecast to grow 7.6% annually, outpacing the JP market's 4.3%. Earnings are projected to increase by 82.87% per year, with profitability expected within three years, indicating strong growth potential despite a low future Return on Equity of 9.5%. The share price has been highly volatile over the past three months, but no substantial insider trading activity was reported recently.

- Take a closer look at Rakuten Group's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Rakuten Group's share price might be too optimistic.

Turning Ideas Into Actions

- Access the full spectrum of 103 Fast Growing Japanese Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4385

Mercari

Plans, develops, and operates Mercari marketplace applications in Japan and the United States.

Reasonable growth potential with adequate balance sheet.