Stock Analysis

- Canada

- /

- Healthtech

- /

- TSX:VHI

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with key indices like the S&P 500 and Nasdaq Composite closing out strong annual performances despite recent economic challenges, investors are keenly observing how high-growth tech stocks might fare amidst fluctuating economic indicators such as the Chicago PMI and GDP forecasts. In this dynamic environment, identifying promising tech stocks often involves looking for companies that demonstrate robust innovation potential and resilience in adapting to market shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| AVITA Medical | 33.76% | 52.47% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.47% | 56.38% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1255 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market capitalization of HK$4.93 billion.

Operations: The company generates revenue primarily through the sale of SD-WAN routers, with significant contributions from both fixed first connectivity (HK$15.19 million) and mobile first connectivity (HK$59.87 million). Additionally, it earns from software licenses and warranty and support services, amounting to HK$31.86 million.

Plover Bay Technologies has demonstrated robust growth, with earnings surging by 41.4% over the past year, outpacing the Communications industry's average. This uptick is anchored in significant sales increases of their SD-WAN router products and new connectivity solutions, as highlighted in their recent guidance predicting a net profit jump of at least 10% for the ten months ending October 2024 compared to the entire previous year. Additionally, with an impressive forecasted Return on Equity of 73.3% in three years and consistent investment in R&D to innovate within the tech landscape, Plover Bay is positioning itself strongly within high-growth sectors despite facing intense market competition.

- Delve into the full analysis health report here for a deeper understanding of Plover Bay Technologies.

Explore historical data to track Plover Bay Technologies' performance over time in our Past section.

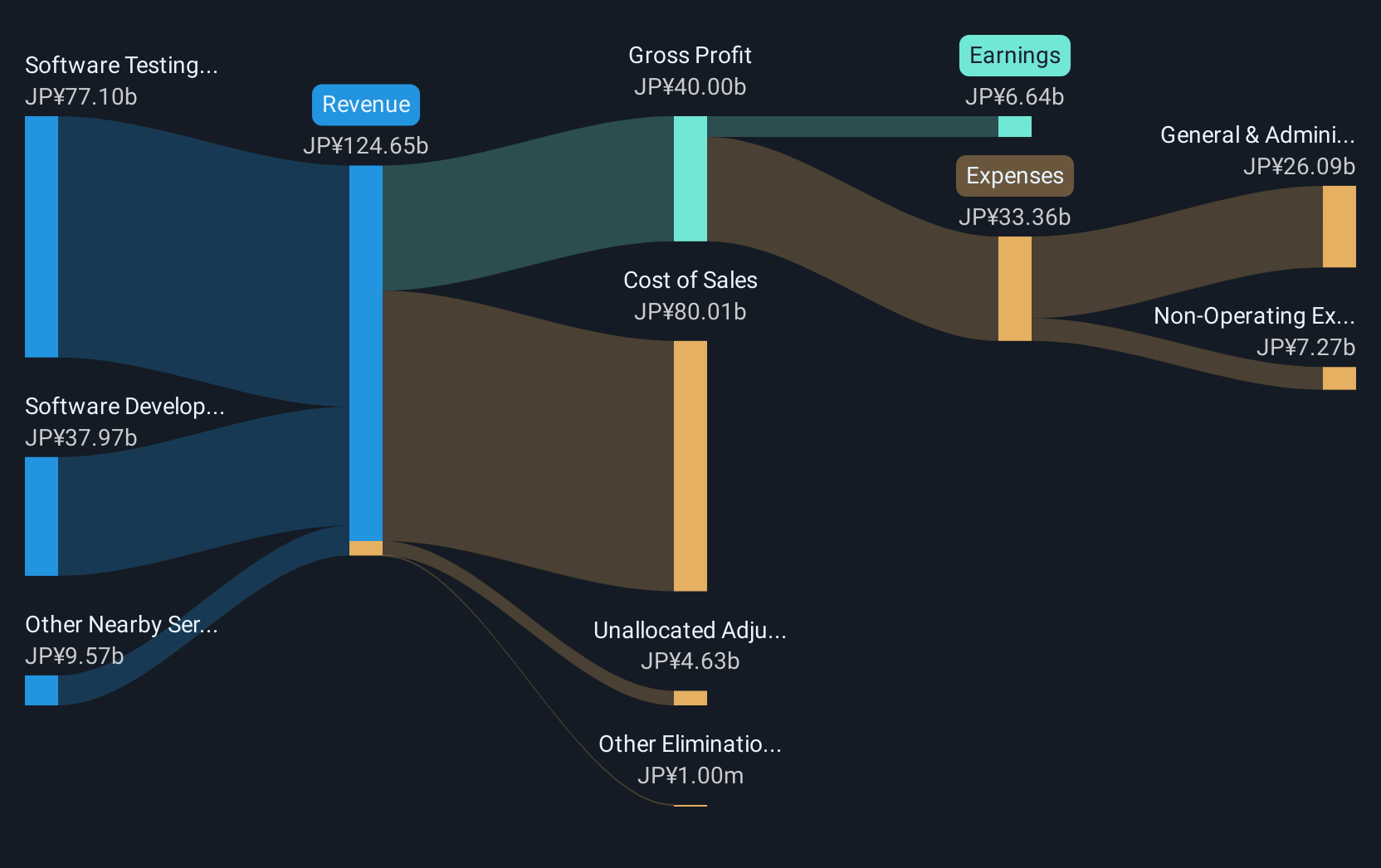

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan, with a market capitalization of approximately ¥320.43 billion.

Operations: SHIFT Inc. generates revenue primarily from software testing related services, contributing ¥71.34 billion, and software development related services, adding ¥35.01 billion. The company focuses on providing quality assurance solutions within the Japanese market.

SHIFT's recent strategic maneuvers, including a share repurchase program for up to 80,000 shares at ¥1 billion, underscore its commitment to enhancing shareholder value amidst a challenging market. This move coincides with an impressive revenue growth forecast of 16.2% annually, outpacing the Japanese market average significantly. Despite a dip in past earnings growth by 17.9%, SHIFT is poised for a robust recovery with expected earnings growth surging to 30.1% per year. The firm continues to prioritize innovation and efficiency, as evidenced by its substantial R&D investments aimed at securing a competitive edge in the tech industry.

- Click to explore a detailed breakdown of our findings in SHIFT's health report.

Evaluate SHIFT's historical performance by accessing our past performance report.

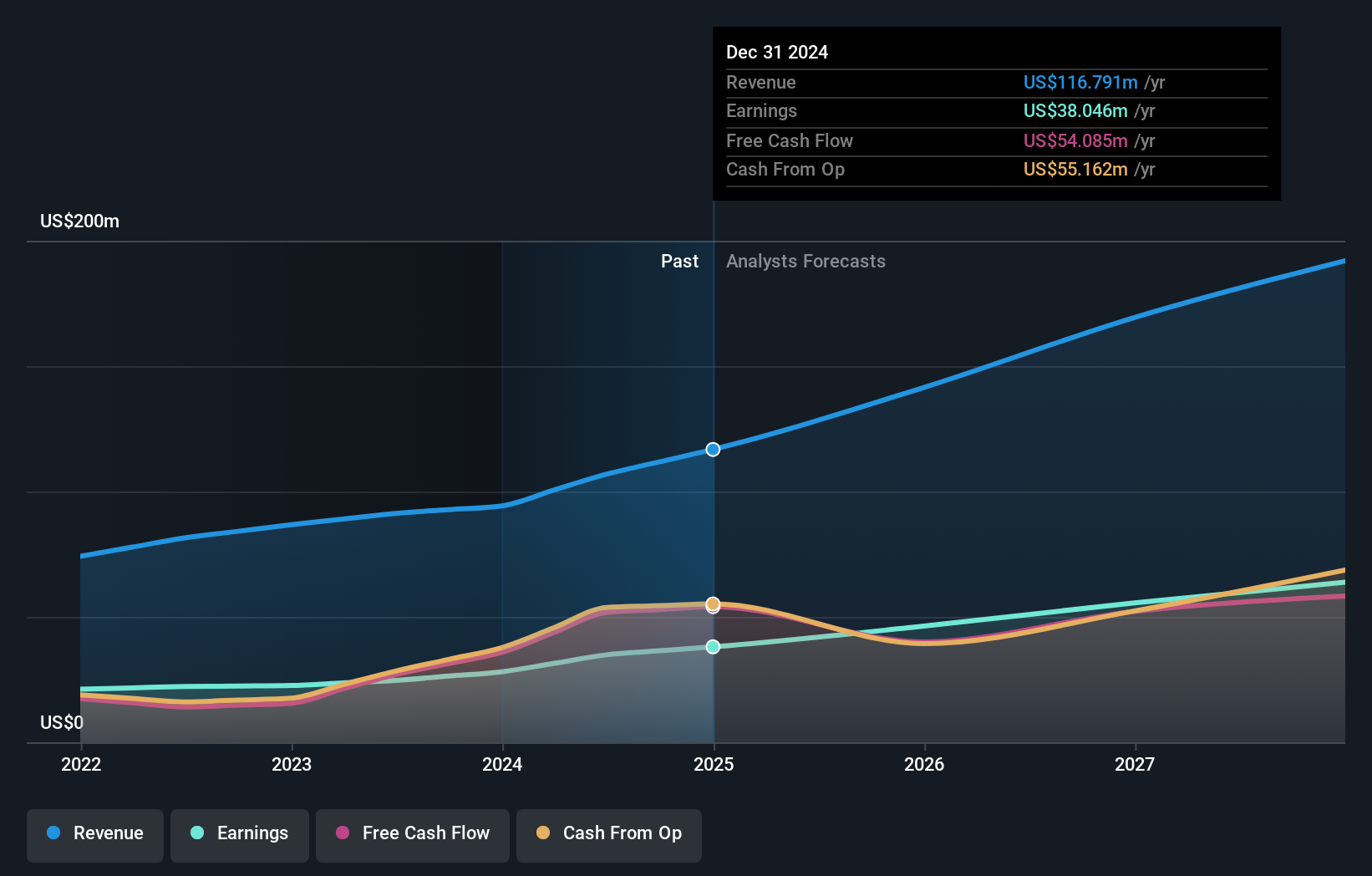

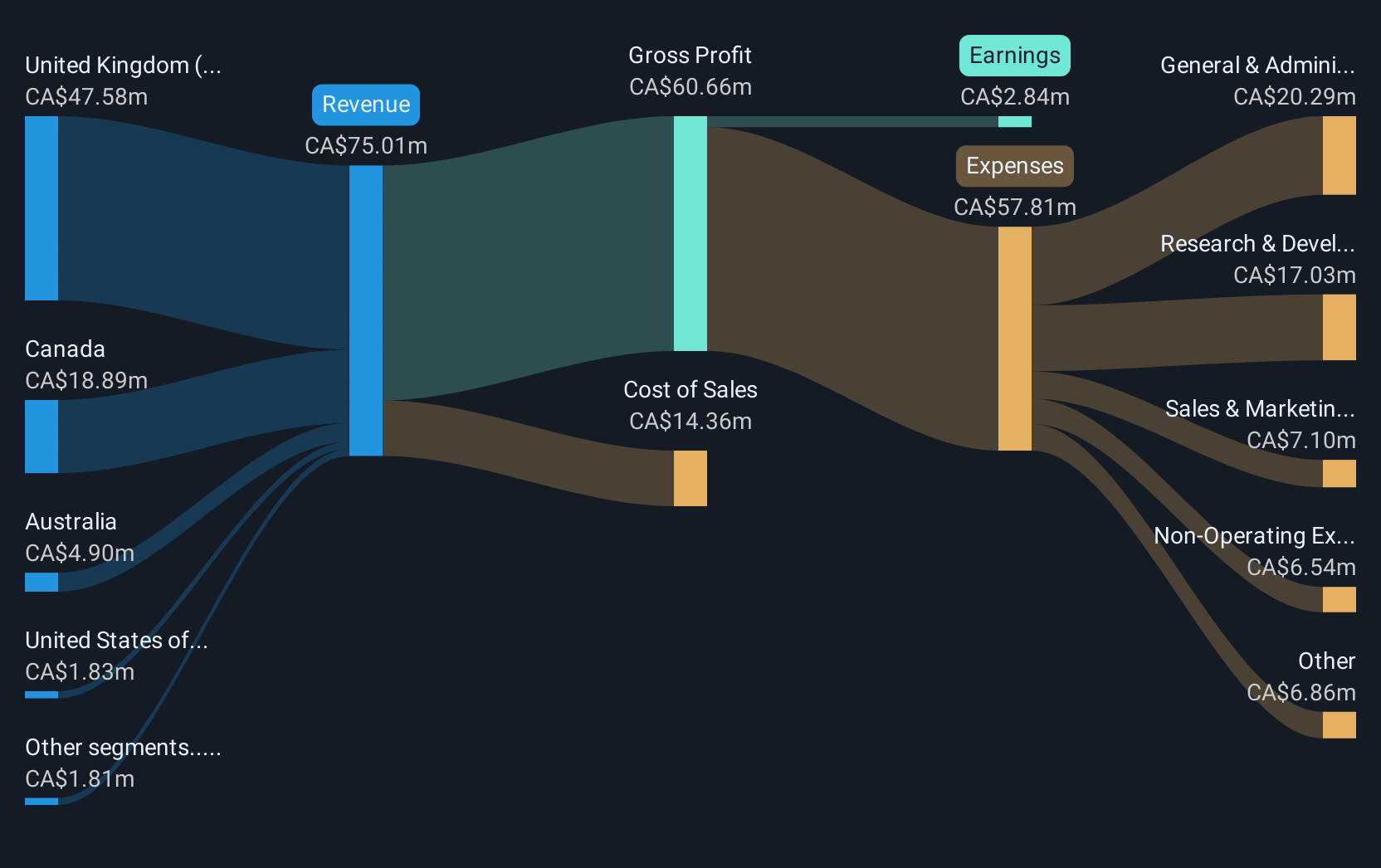

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. offers technology solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market cap of CA$586.14 million.

Operations: Vitalhub Corp., along with its subsidiaries, generates revenue primarily from healthcare software solutions, amounting to CA$61.61 million.

Vitalhub, with its recent strategic expansion and innovative technology solutions, is making notable strides in the healthcare tech sector. The company recently increased its credit facilities to CAD 65 million, enhancing financial flexibility crucial for future growth. This move aligns with a robust earnings forecast projecting an annual increase of 111.9%, significantly outpacing the Canadian market average. Moreover, Vitalhub's implementation of the SHREWD platform in Winnipeg showcases its commitment to improving healthcare management systems, potentially setting new standards in patient care coordination across regions.

- Click here to discover the nuances of Vitalhub with our detailed analytical health report.

Gain insights into Vitalhub's historical performance by reviewing our past performance report.

Where To Now?

- Navigate through the entire inventory of 1255 High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VHI

Vitalhub

Provides technology solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally.