High Growth Tech Stocks in Japan Featuring SHIFT and Two Others

Reviewed by Simply Wall St

Japan's stock markets have seen a positive trajectory recently, with the Nikkei 225 Index rising by 2.45% and the broader TOPIX Index up by 0.45%, supported by a weaker yen that has enhanced the profit outlook for exporters. In this environment, high-growth tech stocks like SHIFT are drawing attention, as investors look for companies with strong innovation capabilities and adaptability to capitalize on favorable market conditions.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| GMO AD Partners | 69.79% | 97.87% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| freee K.K | 18.18% | 74.08% | ★★★★★☆ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

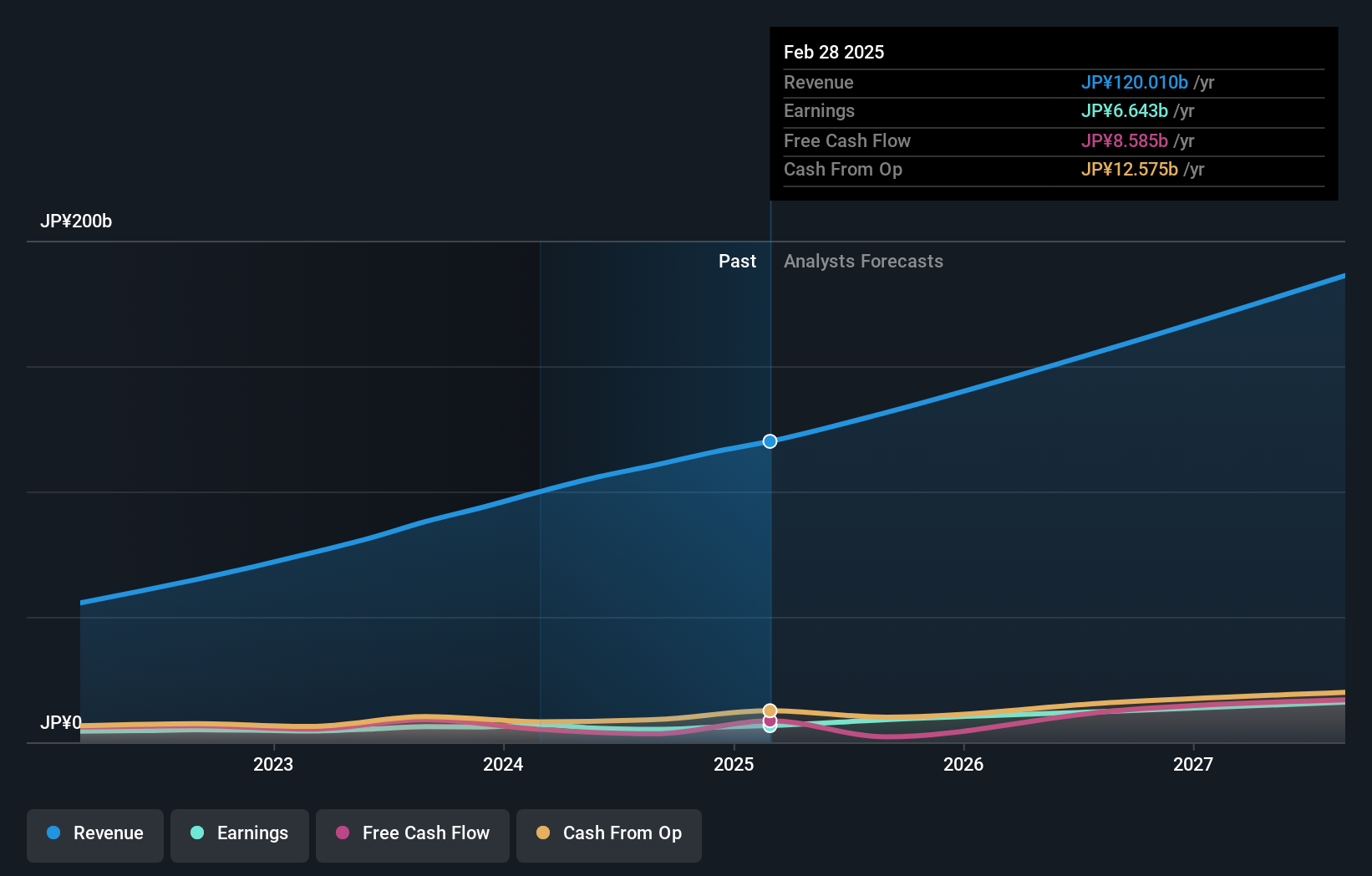

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan with a market cap of ¥275.54 billion.

Operations: SHIFT Inc. primarily generates revenue through software testing-related services, contributing ¥68.64 billion, and software development-related services at ¥33.55 billion. The company focuses on providing specialized solutions within the software quality assurance sector in Japan.

SHIFT Inc. demonstrates robust potential in Japan's tech sector with its strategic focus on R&D, allocating significant resources to foster innovation. In 2024, the company dedicated a substantial portion of its revenue to R&D efforts, underscoring its commitment to advancing technological capabilities. This investment is reflected in SHIFT's projected earnings growth of 32.6% annually, outpacing the Japanese market average of 8.8%. Moreover, SHIFT recently announced a share repurchase program valued at ¥1 billion, aiming to enhance shareholder value and affirming confidence in its financial health and future prospects. The firm’s ability to grow earnings by 36.3% annually over the past five years positions it well within the competitive landscape of high-tech industries in Japan. Despite facing challenges like market volatility—evident from recent fluctuations—SHIFT maintains a positive outlook with expected revenue growth rates surpassing national averages (19.7% vs 4.3%). This strategic positioning is likely bolstered by their latest buyback announcement and ongoing innovations driven by their increased R&D spending—a testament to their resilience and forward-thinking approach in a rapidly evolving sector.

- Click here and access our complete health analysis report to understand the dynamics of SHIFT.

Examine SHIFT's past performance report to understand how it has performed in the past.

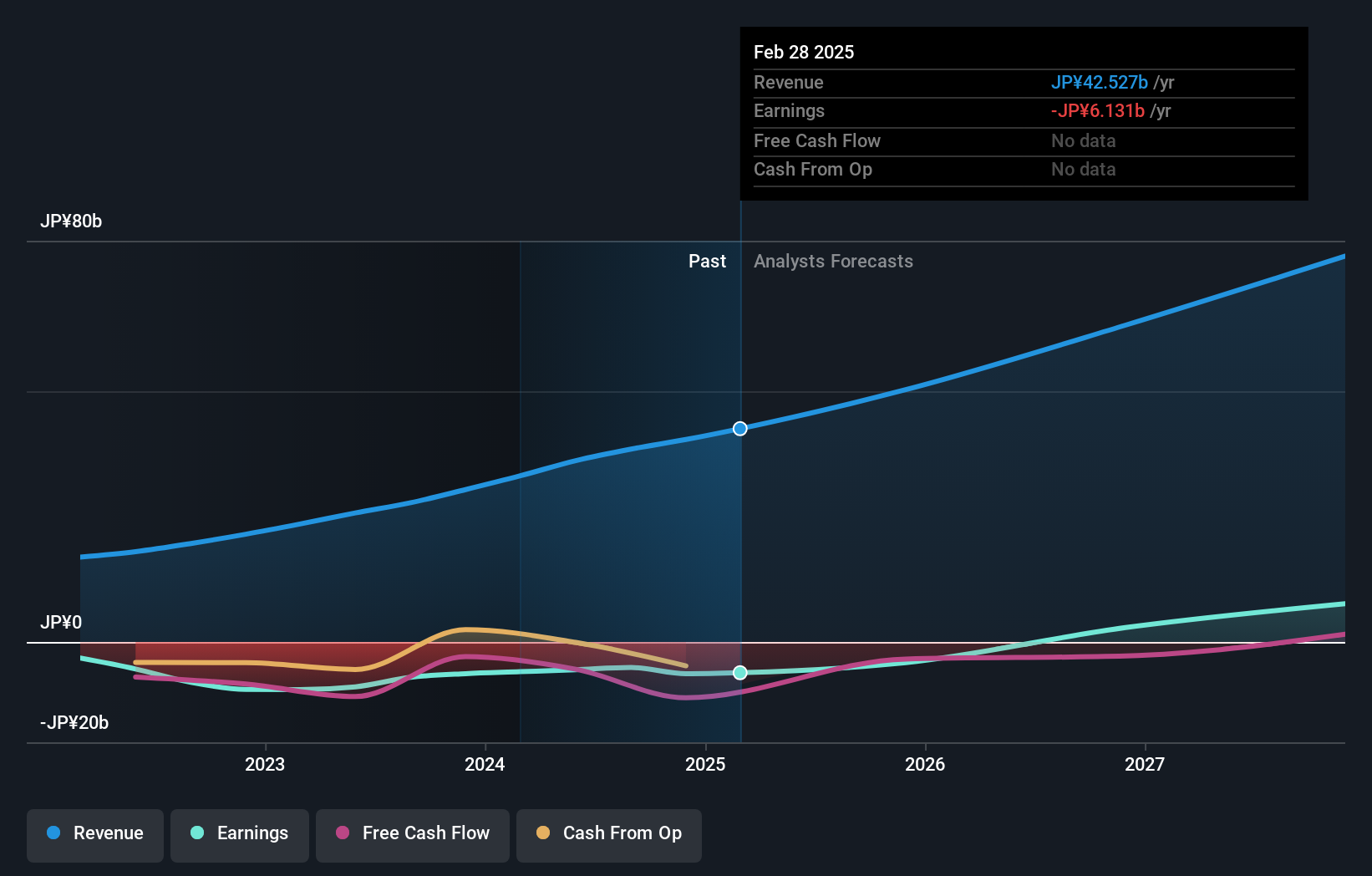

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★★★

Overview: Money Forward, Inc. is a Japanese company offering financial solutions for individuals, financial institutions, and corporations with a market cap of ¥340.35 billion.

Operations: The company's Platform Services Business generated ¥36.16 billion in revenue, focusing on providing financial solutions primarily in Japan.

Money Forward, a key player in Japan's fintech scene, is navigating through strategic transformations and partnerships, notably with Sumitomo Mitsui Card Company to enhance its personal financial management services. The company's commitment to innovation is evident from its substantial R&D investment, which has been crucial in supporting a forecasted revenue growth of 20.7% annually—surpassing the Japanese market average of 4.3%. Despite current unprofitability, Money Forward is poised for significant future earnings growth at an expected rate of 68.1% per year. These moves are part of a broader strategy to not only expand but also solidify its foothold in the competitive tech landscape through targeted business segment transitions and potential market share expansion.

- Click here to discover the nuances of Money Forward with our detailed analytical health report.

Understand Money Forward's track record by examining our Past report.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market capitalization of ¥197.19 billion.

Operations: The company focuses on delivering cloud-based accounting and HR software solutions in Japan. Its revenue model primarily revolves around subscription fees for its software services, targeting small to medium-sized enterprises.

Freee K.K. is navigating a transformative phase with strategic executive changes and a proactive amendment of its bylaws to broaden business scopes, reflecting agility in adapting to market demands. The company's commitment to innovation is underscored by its robust R&D spending, crucial for supporting the forecasted revenue growth of 18.2% annually. Despite current unprofitability, Freee K.K.'s earnings are expected to surge by 74.1% per year, positioning it for future profitability and making it a notable entity in Japan's tech landscape amidst high-profile leadership transitions set for late 2024.

- Click to explore a detailed breakdown of our findings in freee K.K's health report.

Assess freee K.K's past performance with our detailed historical performance reports.

Make It Happen

- Gain an insight into the universe of 119 Japanese High Growth Tech and AI Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3994

Money Forward

Provides financial solutions for individuals, financial institutions, and corporations primarily in Japan.

Exceptional growth potential and good value.