Why TIS (TSE:3626) Is Up After Raising Earnings Guidance and Boosting Dividend

Reviewed by Sasha Jovanovic

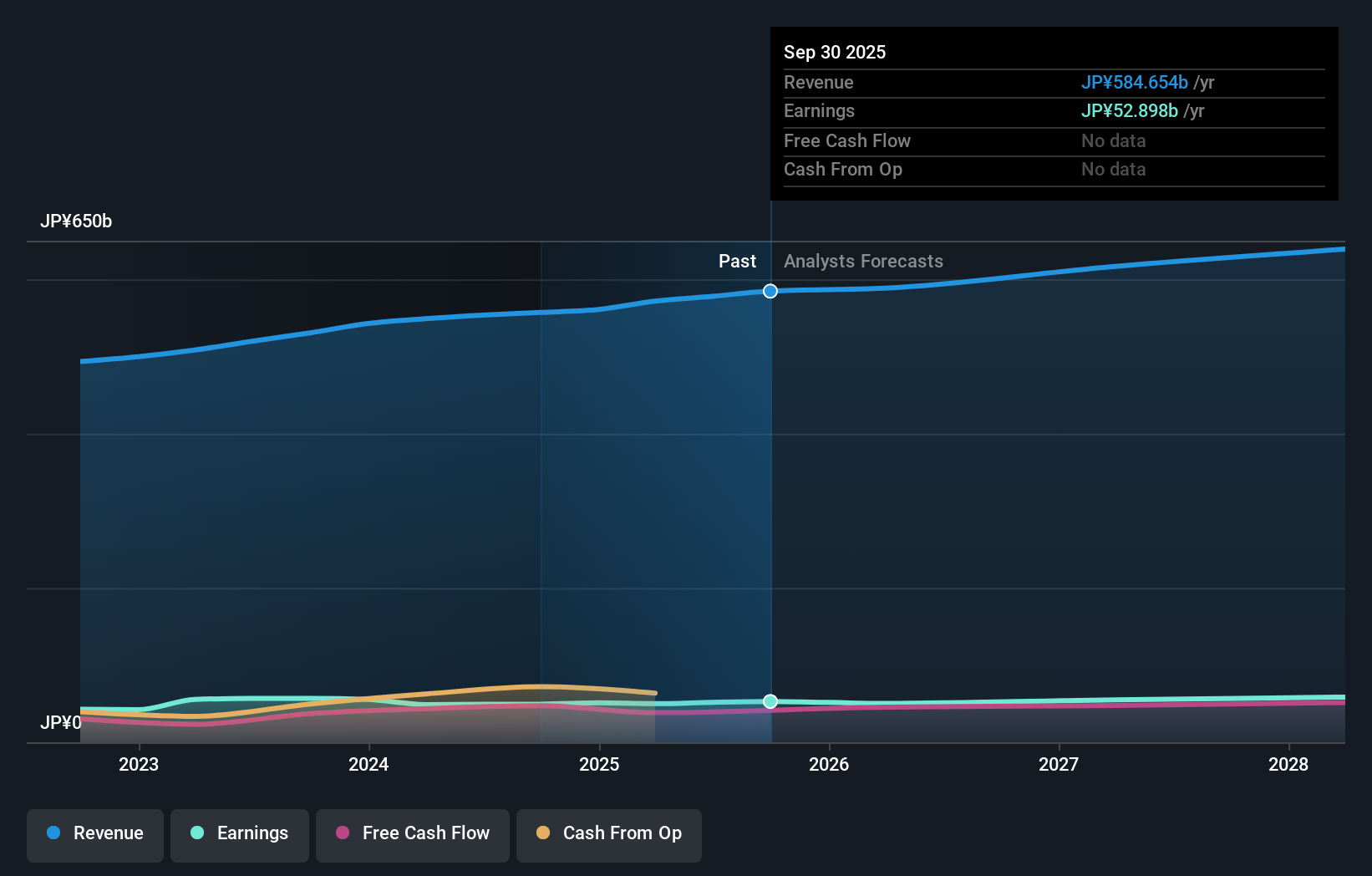

- On October 31, 2025, TIS Inc. raised its consolidated earnings guidance for the fiscal year ending March 31, 2026, projecting net sales of ¥588.00 billion and operating profit of ¥75.00 billion, alongside announcing a second-quarter dividend increase to ¥38 per share, payable December 5, 2025.

- This combination of upward earnings revision and a higher dividend signals management’s increased optimism about the company's outlook and operational momentum.

- We’ll examine how the raised full-year earnings guidance strengthens TIS Inc.’s investment narrative and future business confidence.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is TIS' Investment Narrative?

To be confident in TIS Inc. as a shareholder, you’d need to believe in its ability to continue steady growth in Japan’s IT services sector, where operational resilience and stable earnings matter more than rapid acceleration. The company’s recent earnings guidance upgrade and higher dividend signal that management sees momentum building, but these updates only modestly lift near-term catalysts given the incremental changes in revenue and profit forecasts. Previous analysis flagged slow revenue and earnings growth relative to the broader industry, and also highlighted risks around board inexperience and lower comparative returns on equity. After this latest news, investors may view the dividend increase as a vote of confidence, but the bumps in guidance haven’t fully shifted fundamental risks or altered the business’s pace compared to faster-growing peers. Still, for those focused on income and a measured growth trajectory, these signals could bring some reassurance.

However, board renewal and limited independence remain issues investors should keep in mind.

Exploring Other Perspectives

Explore another fair value estimate on TIS - why the stock might be worth 24% less than the current price!

Build Your Own TIS Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TIS research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free TIS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TIS' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TIS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3626

TIS

Provides information technology (IT) services in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives