Softcreate Holdings (TSE:3371) Earnings Growth Slows, Undercuts Bullish Five-Year Track Record

Reviewed by Simply Wall St

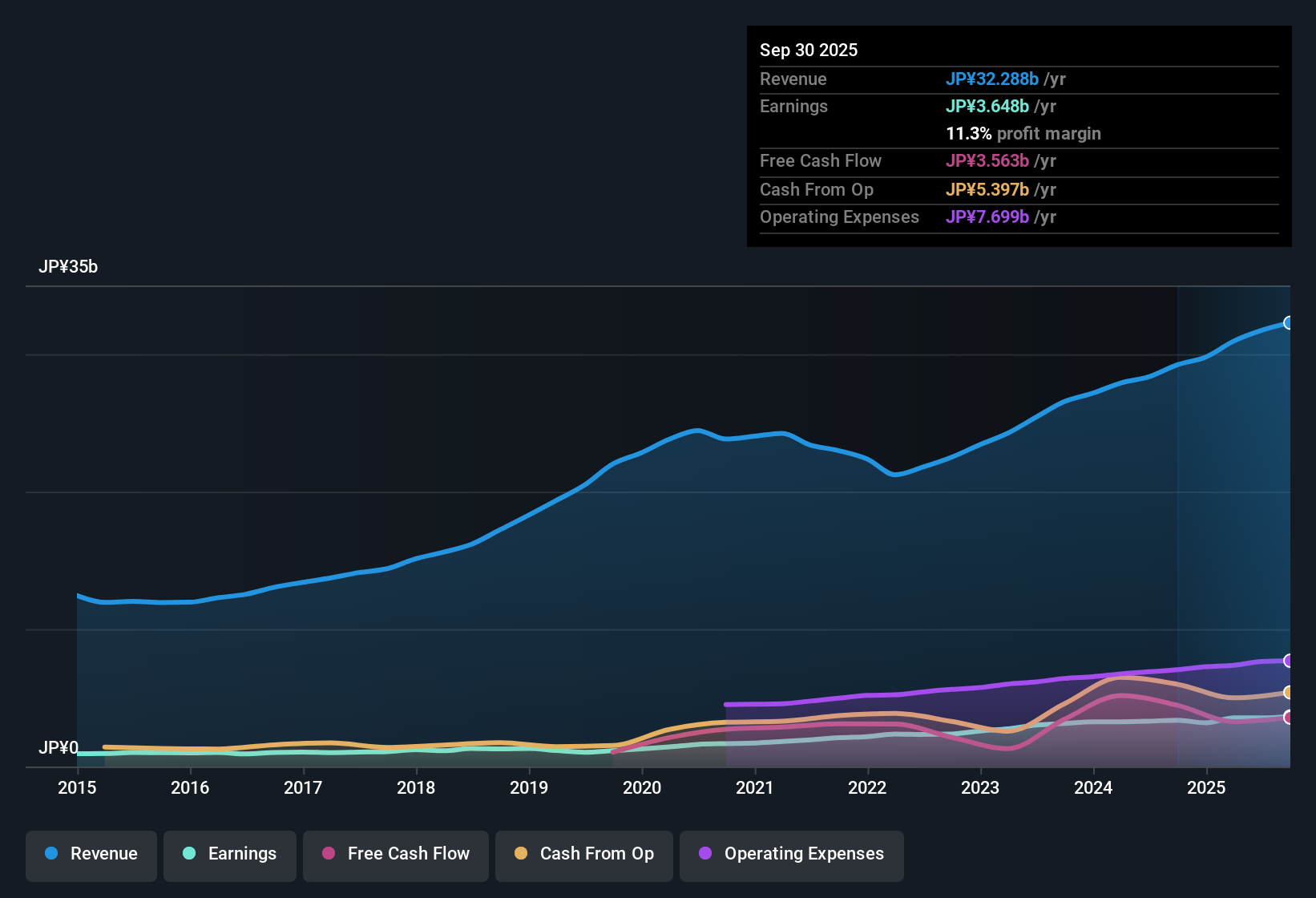

Softcreate Holdings (TSE:3371) posted earnings growth of 7.1% over the past year, coming in below its five-year average of 15.9% annual growth. The net profit margin narrowed slightly to 11.1%, compared with 11.6% a year ago. Investors will note the company’s earnings quality remains high, valuation appears attractive on a price-to-earnings basis at 14.2x, and the current share price of ¥2,022 sits below an estimated fair value of ¥2,346.85. This has contributed to positive sentiment around its results and outlook.

See our full analysis for Softcreate Holdings.Next up, we’ll see how these numbers compare to the prevailing narratives in the Simply Wall St community. This will highlight where consensus meets reality and where surprises might lurk.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Softening Not Dimming Profit Track

- Net profit margin narrowed to 11.1% this year from 11.6% a year ago, suggesting a modest compression but still holding near double-digit territory.

- Viewed through the prevailing market perspective, Softcreate Holdings continues to deliver profitability that stands out for its steadiness:

- Despite reduced margin, the company’s reputation for consistent enterprise IT service performance is reinforced by stable profit levels.

- Analysts and investors see continued reliability getting rewarded by steady digital transformation demand, with no adverse surprises weighing on the bottom line.

Five-Year Growth Outpaces Latest Result

- Annual earnings have increased by an average of 15.9% over five years, outpacing the most recent year’s 7.1% gain and highlighting strong multi-year momentum.

- According to the prevailing market view, Softcreate’s long-term track record is a major draw:

- Moderate optimism centers on the company’s reliability and staying power in a competitive sector, even as year-on-year growth rates moderate compared to past performance.

- Investors highlight the alignment with wider IT upgrade cycles in Japan. Steady, if unspectacular, growth keeps Softcreate “on the radar” as a solid holding.

Attractive Valuation Continues Versus Peers

- Softcreate trades at a price-to-earnings ratio of 14.2x, cheaper than both the Japanese IT peer average of 15.7x and the broader industry’s 17.5x. Its share price of ¥2,022 remains below the DCF fair value of ¥2,346.85.

- The prevailing market view finds support in these discounts:

- Stable dividend payments, coupled with shares trading below estimated intrinsic value, appeal to investors looking for predictability and value in the sector.

- The company’s “business as usual” results are viewed favorably next to costlier sector peers, suggesting ongoing upside potential if industry momentum persists.

Curious how numbers become stories that shape markets? Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Softcreate Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Softcreate’s latest year saw earnings growth slow to 7.1%, a figure that is well below its impressive five-year average and suggests momentum is moderating.

If you want to stay focused on companies delivering consistency, use stable growth stocks screener (2080 results) to find stocks with a steady earnings track record and predictable trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3371

Softcreate Holdings

Through its subsidiaries, provides system integration and other IT-related services in Japan.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives