As the global economic landscape shifts, Asia's tech sector is capturing attention with its potential for high growth, particularly amidst easing U.S.-China trade tensions and Japan's record stock market highs. In this dynamic environment, identifying promising tech stocks involves assessing their innovation capabilities and adaptability to changing geopolitical and economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 36.36% | 39.76% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.14% | 35.43% | ★★★★★★ |

| Accton Technology | 25.20% | 28.91% | ★★★★★★ |

| Zhongji Innolight | 29.30% | 30.93% | ★★★★★★ |

| Fositek | 37.50% | 48.51% | ★★★★★★ |

| Eoptolink Technology | 39.55% | 35.84% | ★★★★★★ |

| PharmaEssentia | 31.33% | 49.43% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Wasion Holdings (SEHK:3393)

Simply Wall St Growth Rating: ★★★★☆☆

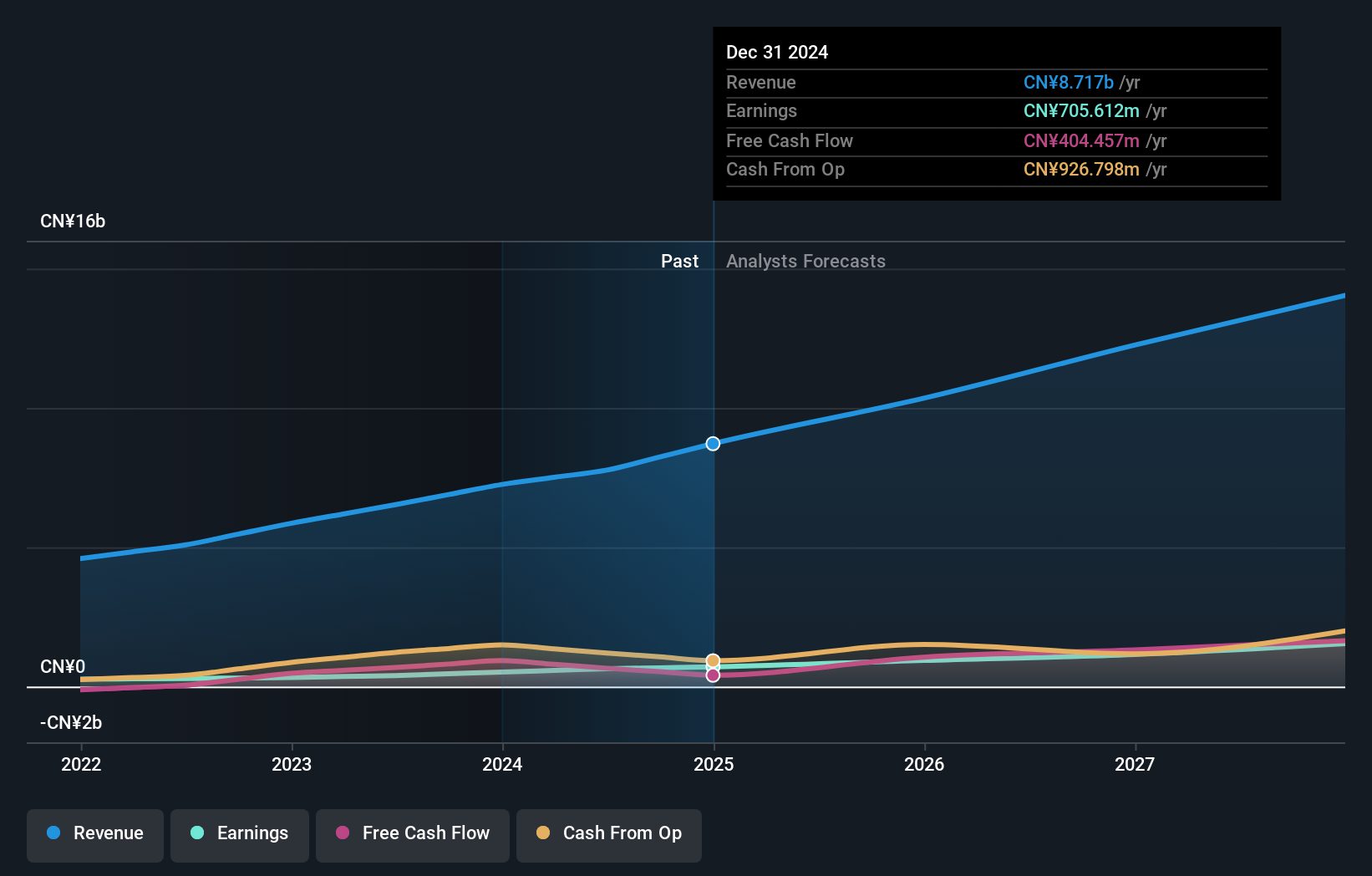

Overview: Wasion Holdings Limited is an investment holding company focused on the research, development, production, and sale of energy metering and energy efficiency management solutions for the energy supply industries, with a market cap of HK$13.35 billion.

Operations: The company generates revenue primarily from three segments: Power Advanced Metering Infrastructure (CN¥3.65 billion), Advanced Distribution Operations (CN¥2.98 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.88 billion).

Wasion Holdings has demonstrated robust growth, with a notable 27.5% increase in earnings over the past year, outpacing the electronic industry's average of 9.2%. This trend is underscored by recent substantial contract wins totaling approximately RMB370 million, positioning it as a leader in its sector for such tenders. Furthermore, its commitment to innovation is evident from its R&D investments which align closely with revenue growth forecasts of 17.9% annually, suggesting a strategic focus on sustainable long-term growth in high-tech sectors. The company's financial health is further highlighted by an impressive forecasted annual earnings growth rate of 24.2%, significantly above the Hong Kong market average of 11.7%. Wasion’s ability to secure high-profile contracts and deliver consistent financial performance enhances its standing within Asia’s competitive tech landscape. With these factors combined—strategic R&D allocation and strong market performance—Wasion Holdings is well-positioned to capitalize on future technological advancements and demand increases in its sector.

- Dive into the specifics of Wasion Holdings here with our thorough health report.

Evaluate Wasion Holdings' historical performance by accessing our past performance report.

Digital Arts (TSE:2326)

Simply Wall St Growth Rating: ★★★★★☆

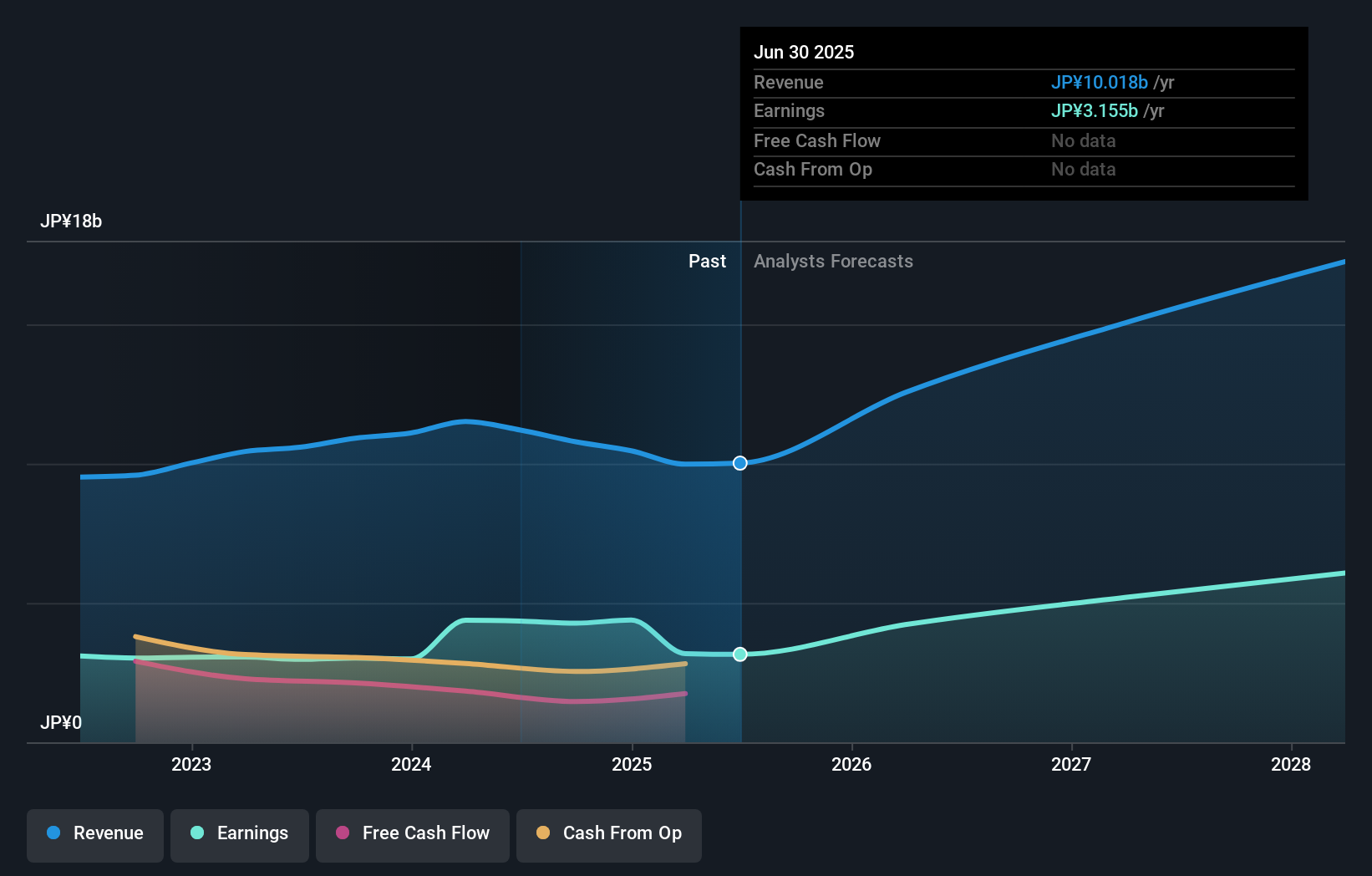

Overview: Digital Arts Inc. is a company that develops and markets internet security software and appliances across Japan, the United States, Europe, and the Asia Pacific with a market capitalization of ¥102.69 billion.

Operations: Digital Arts generates revenue primarily through the sale of internet security software and related appliances. The company operates in key markets including Japan, the United States, Europe, and the Asia Pacific.

Digital Arts has shown resilience and adaptability in a challenging market, with its recent share repurchase program aimed at enhancing shareholder value by buying back 60,000 shares for ¥500 million. Despite revising its earnings guidance downward, the company's strategic pivot towards cloud services under the GIGA School Concept indicates a focus on sustainable revenue streams. This shift aligns with industry trends towards SaaS models and positions Digital Arts to capitalize on long-term growth opportunities in tech education solutions. The firm’s commitment to innovation is reflected in its R&D investments which are crucial for maintaining competitive advantage in the rapidly evolving tech landscape.

- Navigate through the intricacies of Digital Arts with our comprehensive health report here.

Gain insights into Digital Arts' past trends and performance with our Past report.

Accton Technology (TWSE:2345)

Simply Wall St Growth Rating: ★★★★★★

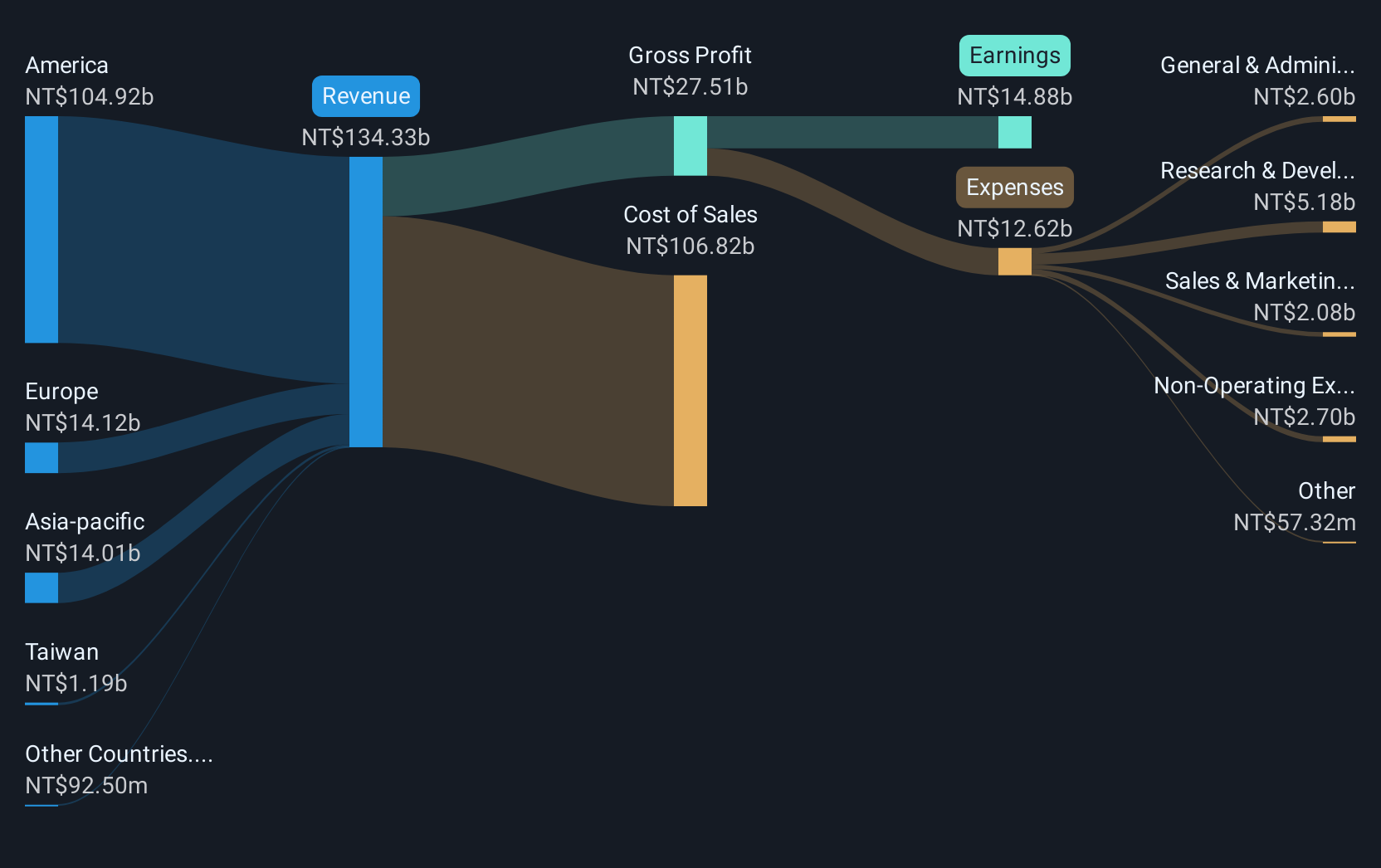

Overview: Accton Technology Corporation is engaged in the development, manufacturing, and sale of computer network systems and wireless LAN hardware and software products across Taiwan, the United States, the Asian-Pacific region, Europe, and globally with a market capitalization of approximately NT$584.06 billion.

Operations: The company primarily generates revenue from its computer network systems segment, amounting to NT$170.52 billion. Its operations span various regions, including Taiwan, the United States, and Europe.

Accton Technology's recent performance underscores its robust position in Asia's tech landscape, with a stunning revenue surge from TWD 24.4 billion to TWD 60.6 billion in Q2 2025 alone, paralleling a net income boost from TWD 2.58 billion to over TWD 5.03 billion. This financial uplift is mirrored by an impressive annual earnings growth forecast of 28.9%, significantly outpacing the broader Taiwanese market's expectation of 19.2%. The company not only excels in financial metrics but also leads with high non-cash earnings and an anticipated return on equity of a striking 49% in three years, reflecting superior management efficiency and profitability potential amidst volatile market conditions.

Turning Ideas Into Actions

- Take a closer look at our Asian High Growth Tech and AI Stocks list of 176 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2326

Digital Arts

Develops and markets internet security software and appliances in Japan, the United States, Europe, and the Asia Pacific.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives