Stock Analysis

Unveiling 3 Top Insider-Owned Japanese Companies With Earnings Growth Of 81%

Reviewed by Sasha Jovanovic

Amid a backdrop of modest gains in Japan's stock markets, buoyed by a historically weak yen and dovish monetary policy stances from the Bank of Japan, investors continue to seek solid opportunities within this evolving landscape. In such a market environment, companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those closest to the company's operations in its growth prospects.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Growth Rating |

| SHIFT (TSE:3697) | 35.5% | ★★★★★★ |

| Medley (TSE:4480) | 34.1% | ★★★★★★ |

| Hottolink (TSE:3680) | 27% | ★★★★★★ |

| Micronics Japan (TSE:6871) | 15.3% | ★★★★★★ |

| Kasumigaseki CapitalLtd (TSE:3498) | 35.5% | ★★★★★★ |

| Money Forward (TSE:3994) | 21.4% | ★★★★★★ |

| ExaWizards (TSE:4259) | 24.8% | ★★★★★★ |

| en-japan (TSE:4849) | 14.7% | ★★★★★☆ |

| freee K.K (TSE:4478) | 24% | ★★★★★☆ |

| Soracom (TSE:147A) | 17.2% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

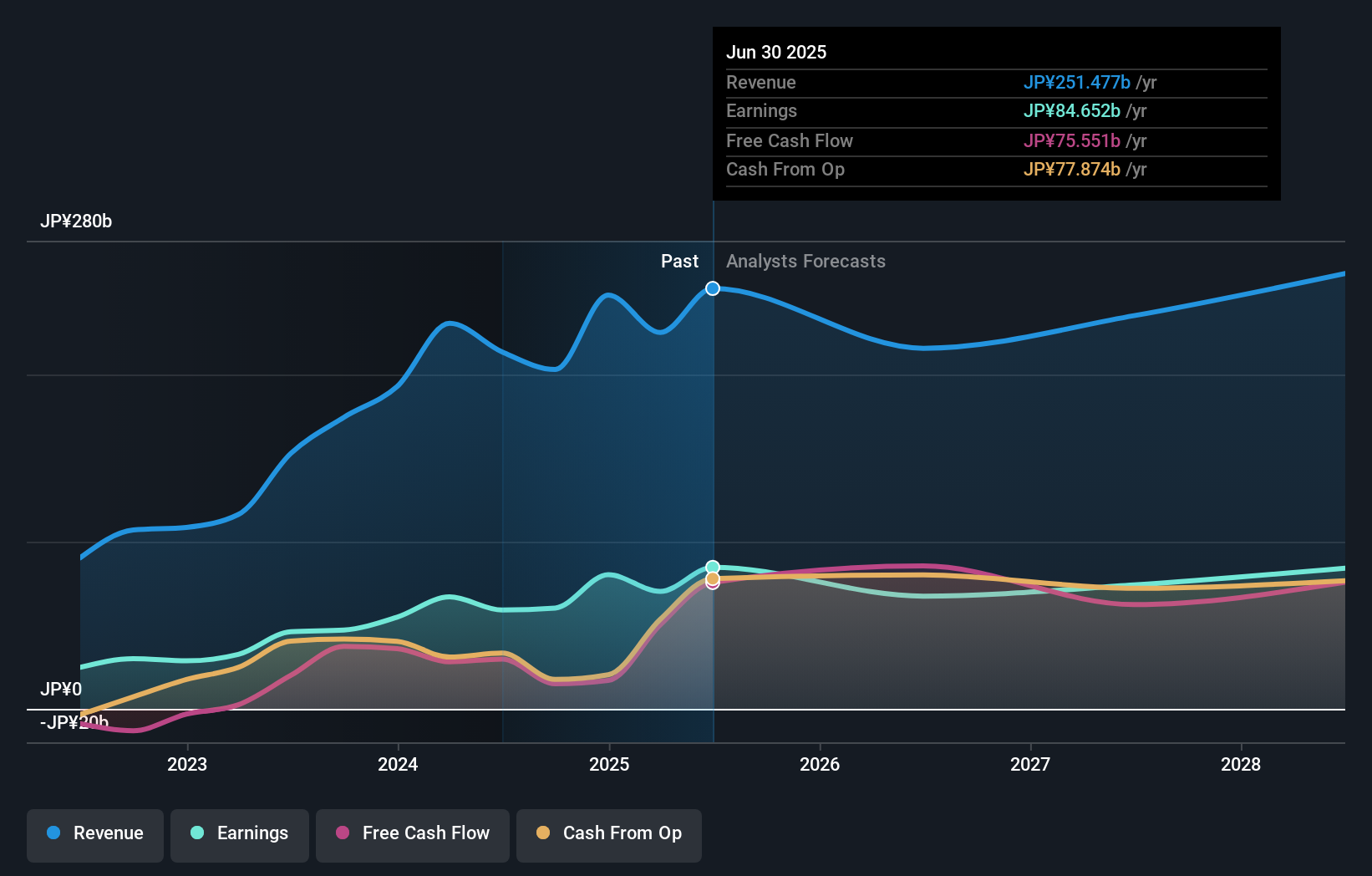

PeptiDream (TSE:4587)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PeptiDream Inc. is a biopharmaceutical company focused on the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics, with a market capitalization of approximately ¥258.57 billion.

Operations: The company primarily generates revenue from the development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics.

Insider Ownership: 26.1%

Earnings Growth Forecast: 27% p.a.

PeptiDream, a Japanese growth company with high insider ownership, is set to expand its collaboration with Novartis, enhancing its peptide discovery endeavors. This partnership includes a substantial upfront payment of US$180 million and potential future payments up to US$2.71 billion based on milestone achievements. Despite PeptiDream's volatile share price and reduced profit margins from the previous year, its earnings are expected to grow significantly at 27% per year, outpacing the Japanese market forecast of 9.4%. Additionally, the company's revenue growth is projected at 12.5% annually, also above the national average of 4.4%.

- Get an in-depth perspective on PeptiDream's performance by reading our analyst estimates report here.

- Our valuation report here indicates PeptiDream may be overvalued.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

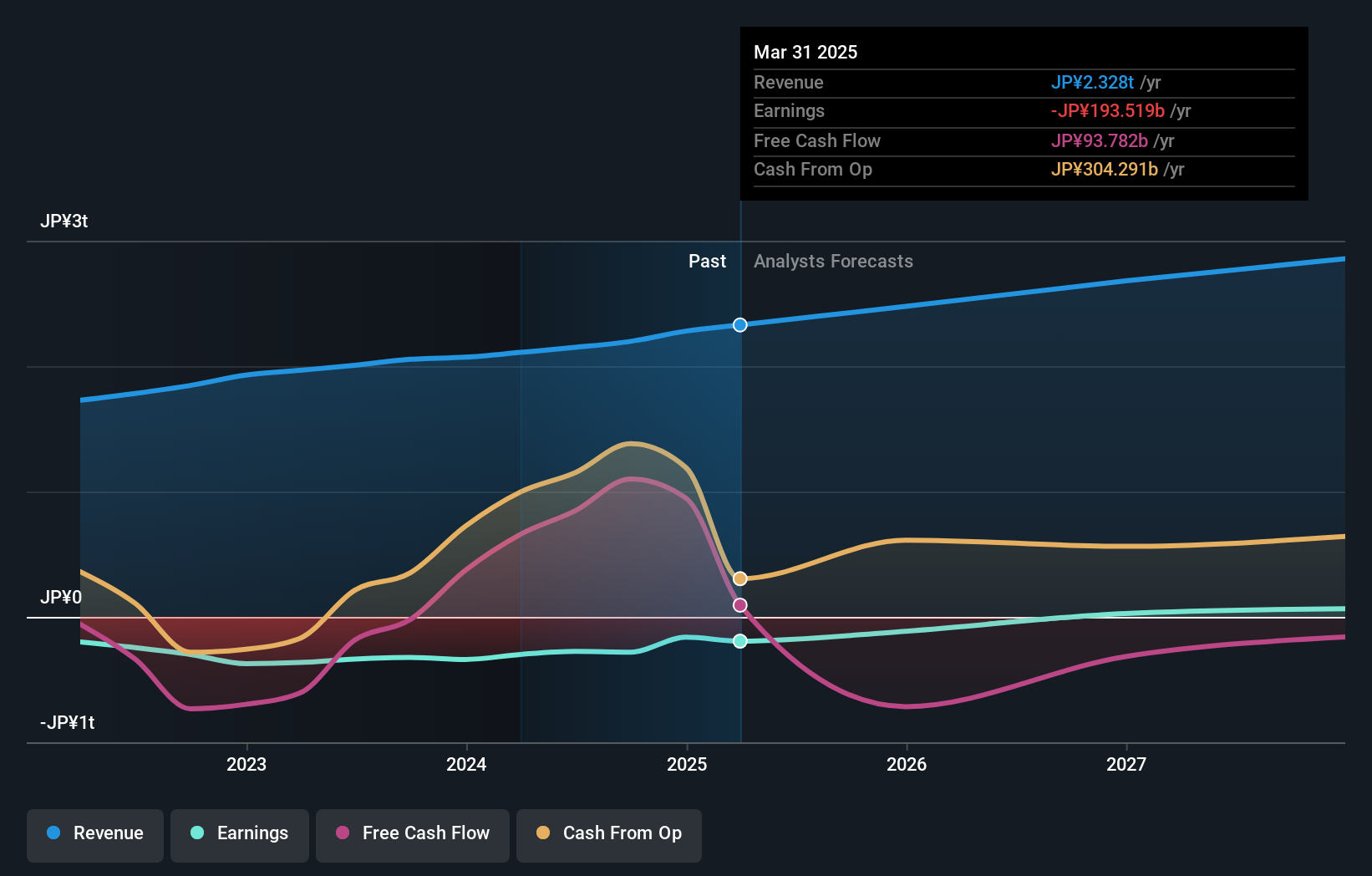

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors serving users globally with a market capitalization of approximately ¥1.61 trillion.

Operations: The company generates revenue through its diverse operations in online retail, financial services, digital media, and telecommunications.

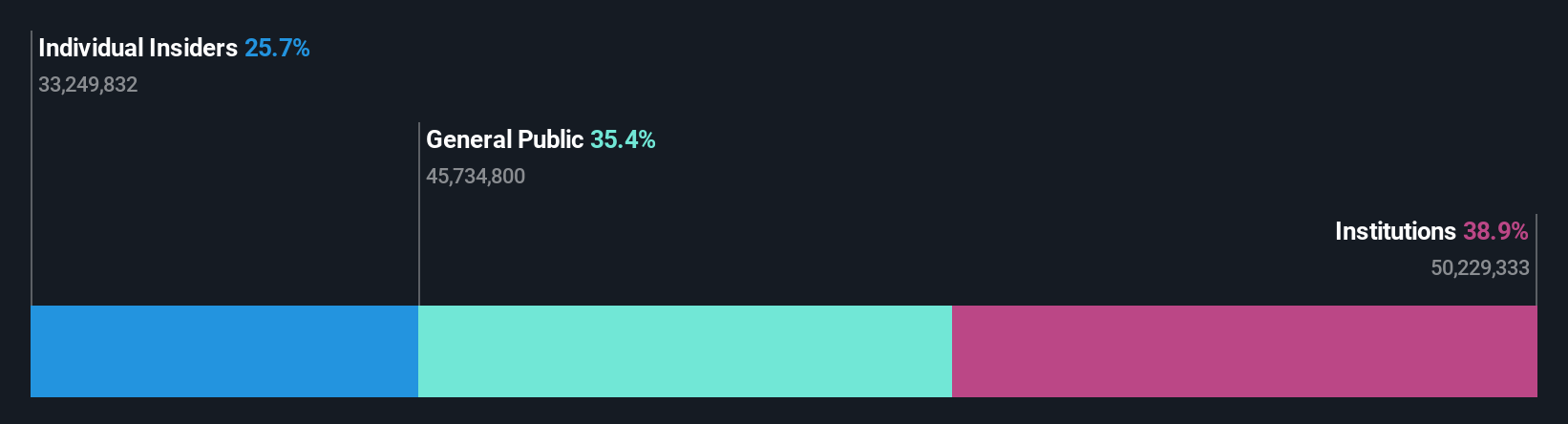

Insider Ownership: 17.3%

Earnings Growth Forecast: 81.6% p.a.

Rakuten Group, a notable player in Japan's growth company landscape with high insider ownership, recently raised US$1.99 billion through a fixed-income offering, signaling robust financial maneuvering despite not paying dividends to focus on reinvestment for growth. The firm is projected to turn profitable within three years with expected revenue growth at 7.5% annually, outpacing the Japanese market average of 4.4%. However, its share price remains highly volatile and return on equity is forecasted low at 6.5% in three years.

- Dive into the specifics of Rakuten Group here with our thorough growth forecast report.

- The analysis detailed in our Rakuten Group valuation report hints at an inflated share price compared to its estimated value.

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lasertec Corporation, with a market cap of ¥3.67 trillion, specializes in designing, manufacturing, and selling inspection and measurement equipment both in Japan and globally.

Operations: The company generates ¥230.60 billion in revenue from its core activities, which involve the creation and distribution of inspection and measurement systems worldwide.

Insider Ownership: 12.1%

Earnings Growth Forecast: 20.7% p.a.

Lasertec Corporation, a growth-oriented firm in Japan with significant insider ownership, is experiencing robust earnings expansion, with a 105.6% increase over the past year and projected annual earnings growth of 20.7%. This outpaces the Japanese market's average of 9.4%. Despite its highly volatile share price recently, Lasertec's revenue growth at 17% annually still surpasses the national market rate of 4.4%. Additionally, its Return on Equity is expected to be very high at 40.7% in three years.

- Click here to discover the nuances of Lasertec with our detailed analytical future growth report.

- Our expertly prepared valuation report Lasertec implies its share price may be too high.

Next Steps

- Explore the 107 names from our Fast Growing Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Valuation is complex, but we're helping make it simple.

Find out whether Rakuten Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4755

Rakuten Group

Provides services in e-commerce, fintech, digital content, and communications to various users in Japan and internationally.

Reasonable growth potential with adequate balance sheet.