Top Growth Companies With High Insider Ownership On Japanese Exchanges September 2024

Reviewed by Simply Wall St

Japan’s stock markets have seen a notable rise in September 2024, with the Nikkei 225 Index gaining 3.1% and the broader TOPIX Index up 2.8%, buoyed by a weakening yen following the U.S. Federal Reserve's significant rate cut. Against this backdrop, identifying growth companies with high insider ownership can be particularly appealing to investors seeking stability and confidence in management's commitment to their firms' success. In such an environment, stocks that combine robust growth potential with substantial insider ownership often signal strong alignment between company executives and shareholders, fostering trust and long-term value creation.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 31.5% |

| Hottolink (TSE:3680) | 27% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 43.5% |

| Medley (TSE:4480) | 34% | 30.4% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 68.1% |

| Loadstar Capital K.K (TSE:3482) | 33.8% | 24.3% |

| AeroEdge (TSE:7409) | 10.7% | 25.3% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Shima Seiki Mfg.Ltd (TSE:6222)

Simply Wall St Growth Rating: ★★★★☆☆

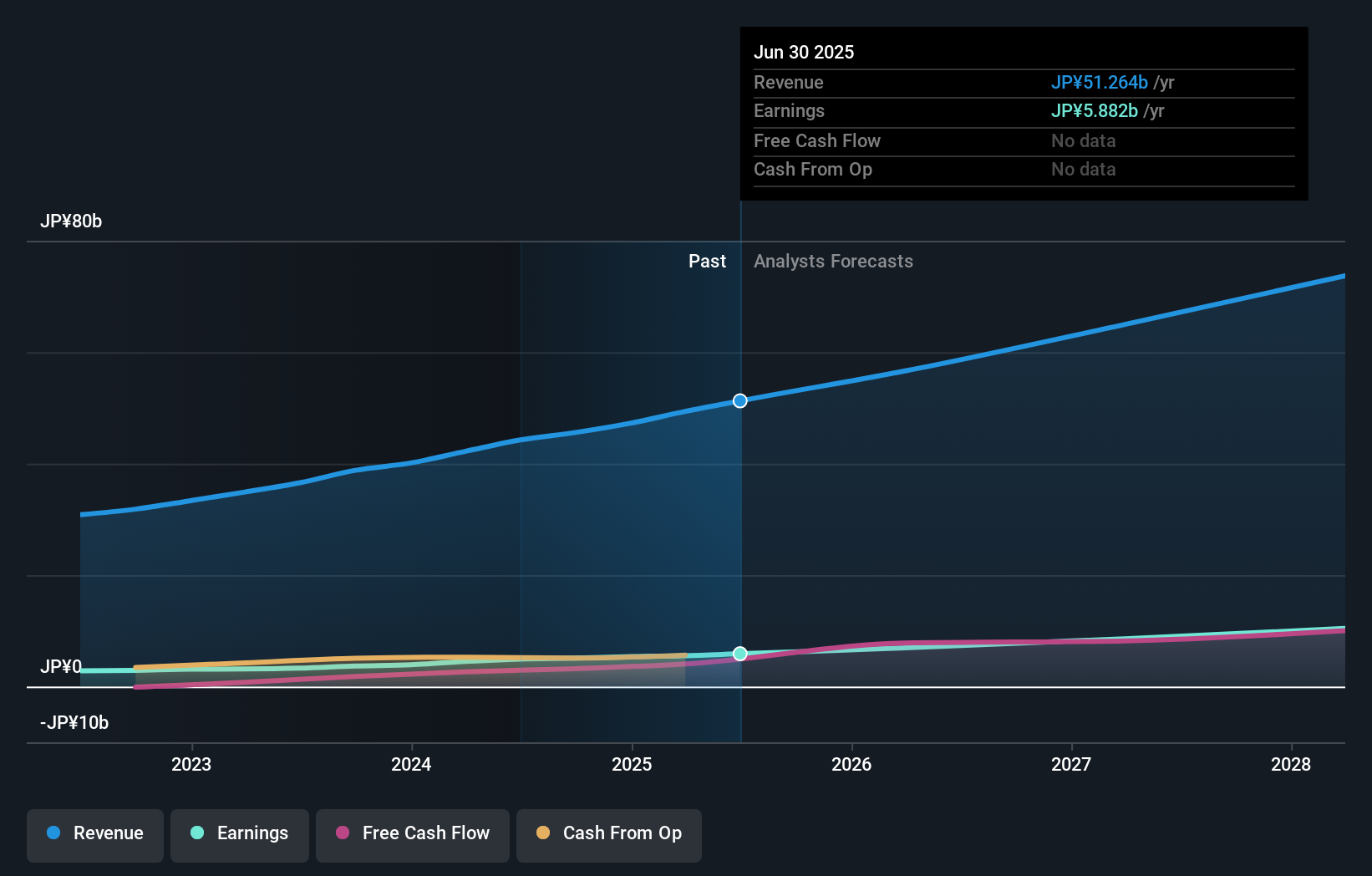

Overview: Shima Seiki Mfg., Ltd., with a market cap of ¥46.19 billion, develops, manufactures, sells, markets, and services computerized flat knitting machines, automatic fabric cutting machines, glove and sock knitting machines, and design systems globally.

Operations: The company's revenue segments include computerized flat knitting machines, automatic fabric cutting machines, glove and sock knitting machines, and design systems.

Insider Ownership: 10.4%

Earnings Growth Forecast: 65.6% p.a.

Shima Seiki Mfg. Ltd. exhibits notable growth potential with high insider ownership, despite some mixed signals. Revenue is expected to grow at 15.9% per year, faster than the Japanese market average of 4.3%. The company is forecast to become profitable within three years, with earnings projected to grow by 65.6% annually over this period. However, its return on equity is anticipated to remain low at 2.5%. No significant insider trading activity has been reported in the last three months.

- Take a closer look at Shima Seiki Mfg.Ltd's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Shima Seiki Mfg.Ltd's current price could be inflated.

Japan Elevator Service HoldingsLtd (TSE:6544)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Japan Elevator Service Holdings Co., Ltd. (TSE:6544) provides repair, maintenance, and modernization services for elevators and escalators in Japan, with a market cap of ¥267.17 billion.

Operations: Revenue from the maintenance business for elevators and escalators in Japan is ¥44.27 billion.

Insider Ownership: 22.4%

Earnings Growth Forecast: 18.5% p.a.

Japan Elevator Service Holdings Ltd. shows promising growth potential with substantial insider ownership. The company’s revenue is forecast to grow at 11.8% per year, outpacing the Japanese market average of 4.3%. Earnings grew by 49.7% over the past year and are expected to increase by 18.5% annually, surpassing market expectations of 8.6%. Recent expansions include new branches and service offices in Hiroshima and Kyushu, enhancing customer service capabilities despite a high debt level.

- Click to explore a detailed breakdown of our findings in Japan Elevator Service HoldingsLtd's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Japan Elevator Service HoldingsLtd shares in the market.

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment in Japan and internationally, with a market cap of ¥2.22 trillion.

Operations: Revenue from the design, manufacture, and sale of inspection and measurement equipment totals ¥213.51 billion.

Insider Ownership: 11.8%

Earnings Growth Forecast: 20.1% p.a.

Lasertec Corporation demonstrates strong growth potential with high insider ownership. The company's earnings are forecast to grow at 20.1% annually, significantly outpacing the Japanese market's 8.6%. Revenue is expected to rise by 16.7% per year, also surpassing market averages. Recent guidance projects net sales of ¥240 billion and net income of ¥74 billion for FY2025. Despite recent board resignations, Lasertec announced increased dividends, reflecting confidence in its financial health and future growth prospects.

- Dive into the specifics of Lasertec here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Lasertec is trading beyond its estimated value.

Next Steps

- Delve into our full catalog of 103 Fast Growing Japanese Companies With High Insider Ownership here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6222

Shima Seiki Mfg.Ltd

Engages in the development, manufacture, sale, marketing, and service of computerized flat knitting, automatic fabric cutting, glove and sock knitting machines, and design systems in Japan, Europe, the Middle East, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.