- Japan

- /

- Semiconductors

- /

- TSE:6857

Advantest (TSE:6857) Launches E3660 for Enhanced 2nm Node Mask Manufacturing

Reviewed by Simply Wall St

Advantest (TSE:6857) recently introduced the next-generation CD-SEM E3660, which is designed to meet the stringent requirements of semiconductor manufacturing. This release is aligned with ongoing industry trends and strengthens the company's presence in the metrology sector. The Nasdaq index reaching all-time highs and the tech sector's robust performance partly fueled by increased AI demand contributed to positive market sentiment. Advantest’s recent 58% stock price increase over the last quarter reflects strong investor confidence in the company's strategic innovations, further supported by a share buyback initiative completed in mid-2025.

We've identified 1 possible red flag for Advantest that you should be aware of.

The release of Advantest's next-generation CD-SEM E3660 is likely to reinforce its position in the semiconductor testing market and could further accelerate its revenue and earnings growth in alignment with industry trends. Over the past five years, Advantest shares have generated a very large total return of 967.12%, reflecting steady growth and investor confidence in its market strategies. Recently, the company's stock price has surged by 58% over the last quarter, outpacing the broader JP Semiconductor industry, which reported a 13.3% return over the past year. This indicates strong relative performance and may correlate with the heightened demand driven by AI advancements.

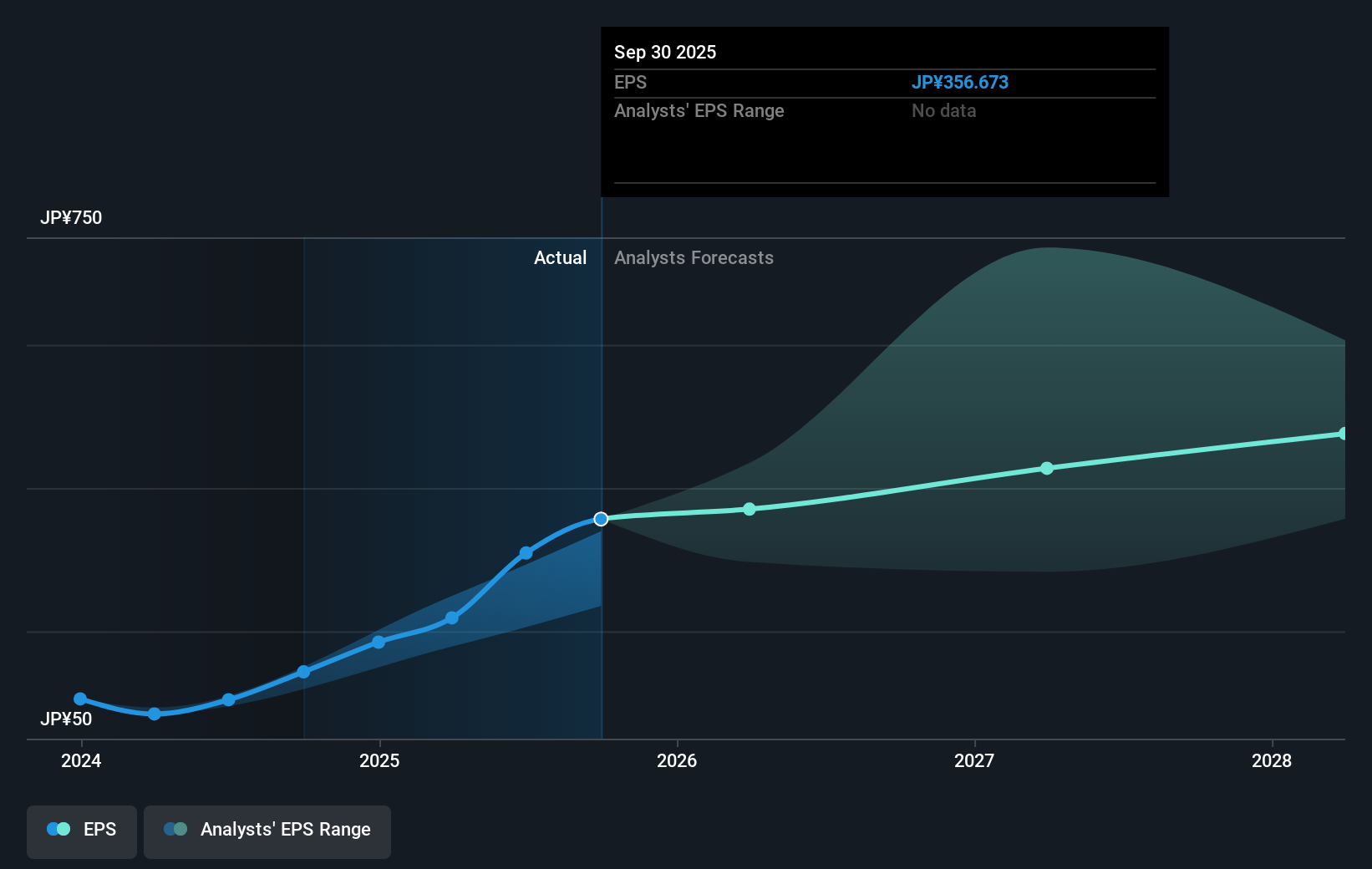

Potential impacts on revenue and earnings forecasts hinge on the successful adoption of the E3660 and Advantest's ability to manage risks such as margin erosion and geopolitical uncertainties. While analysts forecast a moderate annual revenue growth of 5.2% and earnings growth of 6.9%, execution will be key to sustaining this trajectory. In terms of valuation, the current share price of ¥13125.00 remains above the consensus price target of ¥11562.11, suggesting the stock is trading at a premium. This indicates a cautious market sentiment about future earnings growth and risk management, which could influence potential correction if forecasted growth is not realized.

Explore historical data to track Advantest's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6857

Advantest

Manufactures and sells semiconductors, component test systems, and mechatronics-related products in Japan, rest of Asia, the Americas, and Europe.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives