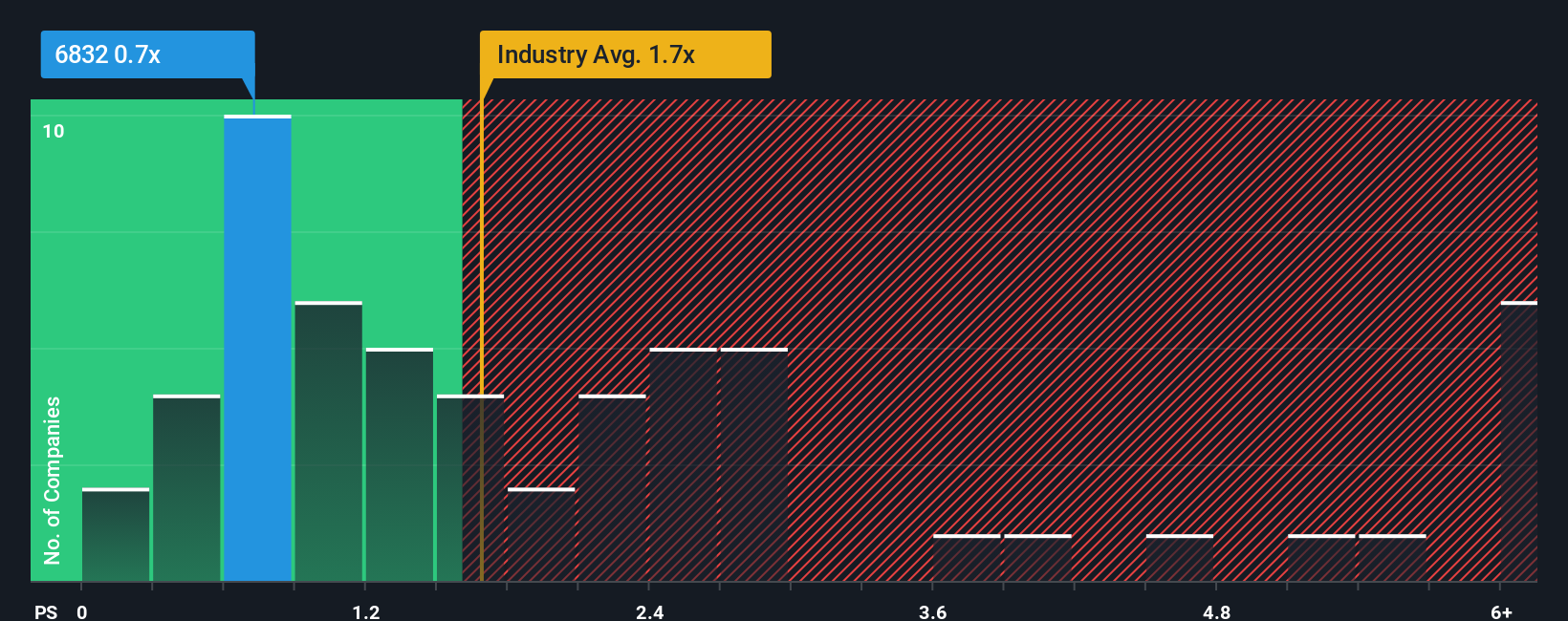

AOI Electronics Co., Ltd.'s (TSE:6832) price-to-sales (or "P/S") ratio of 0.7x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Semiconductor industry in Japan have P/S ratios greater than 1.7x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for AOI Electronics

How Has AOI Electronics Performed Recently?

With revenue growth that's inferior to most other companies of late, AOI Electronics has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on AOI Electronics will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For AOI Electronics?

The only time you'd be truly comfortable seeing a P/S as low as AOI Electronics' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.5%. However, this wasn't enough as the latest three year period has seen an unpleasant 17% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 4.3% as estimated by the only analyst watching the company. That's shaping up to be similar to the 2.7% growth forecast for the broader industry.

With this information, we find it odd that AOI Electronics is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From AOI Electronics' P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of AOI Electronics' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 1 warning sign for AOI Electronics you should be aware of.

If you're unsure about the strength of AOI Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6832

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives