- Japan

- /

- Semiconductors

- /

- TSE:6728

Can ULVAC's (TSE:6728) Steadfast Profit Outlook Reinforce Management Credibility Amid Weaker Q1 Results?

Reviewed by Sasha Jovanovic

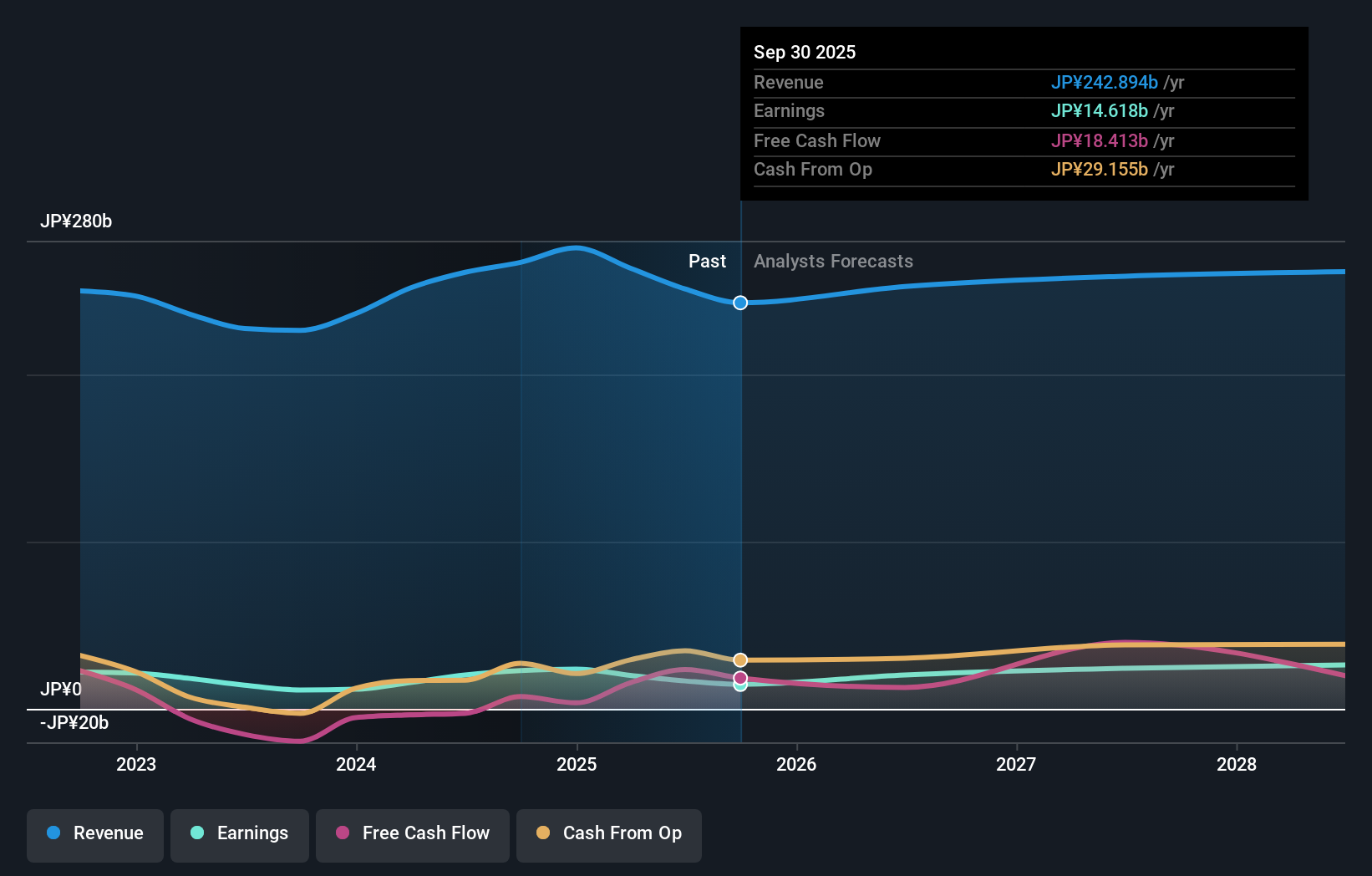

- ULVAC, Inc. recently reported its first quarter results for the period ended September 30, 2025, revealing a large year-on-year decrease in net sales and operating profit despite retaining its full-year profit outlook.

- The company's commitment to its full-year profit forecast, despite early setbacks, suggests management is anticipating a turnaround in the following quarters.

- We'll examine how management's confidence in profit recovery shapes ULVAC's investment narrative after the latest financial performance update.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is ULVAC's Investment Narrative?

If you’re considering ULVAC as an investment, the big picture has always centered around its role supplying vacuum equipment to the tech sector, a business driven by demand cycles for semiconductors and new production technology. The recent earnings disappointment, with sharp year-on-year declines in both sales and profit, makes it clear that cyclical headwinds are hitting results right now. What stands out, however, is management’s decision to stick with their full-year profit outlook. That signals conviction in a recovery, which could become a key short-term catalyst if improving orders or cost controls materialize in coming quarters. At the same time, sustained margin pressure, delivered profit misses, or weak follow-up from the JOINT3 consortium collaboration could weigh on sentiment. While the sharp earnings drop raises the stakes, the latest news doesn’t yet appear to change the critical risks and catalysts already in focus, especially around execution and the timing of industry rebounds.

But margin pressure remains a real risk that investors should keep in mind. ULVAC's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on ULVAC - why the stock might be worth as much as 11% more than the current price!

Build Your Own ULVAC Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ULVAC research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free ULVAC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ULVAC's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6728

ULVAC

Engages in the vacuum equipment and applications business in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives