- Japan

- /

- Semiconductors

- /

- TSE:6677

Improved Earnings Required Before SK-Electronics CO.,LTD. (TSE:6677) Stock's 25% Jump Looks Justified

The SK-Electronics CO.,LTD. (TSE:6677) share price has done very well over the last month, posting an excellent gain of 25%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

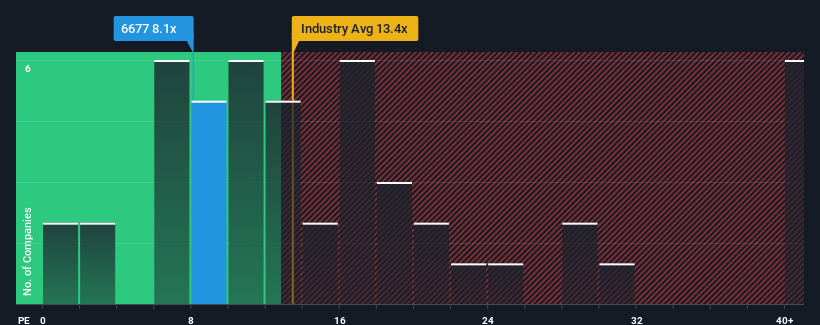

Even after such a large jump in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 14x, you may still consider SK-ElectronicsLTD as an attractive investment with its 8.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for SK-ElectronicsLTD as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for SK-ElectronicsLTD

How Is SK-ElectronicsLTD's Growth Trending?

In order to justify its P/E ratio, SK-ElectronicsLTD would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a worthy increase of 11%. The latest three year period has also seen an excellent 203% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings growth is heading into negative territory, declining 13% each year over the next three years. Meanwhile, the broader market is forecast to expand by 9.6% each year, which paints a poor picture.

With this information, we are not surprised that SK-ElectronicsLTD is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Despite SK-ElectronicsLTD's shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of SK-ElectronicsLTD's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for SK-ElectronicsLTD (1 is concerning!) that you should be aware of before investing here.

If you're unsure about the strength of SK-ElectronicsLTD's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6677

SK-ElectronicsLTD

Manufactures and sells large-format photomasks in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success