- Japan

- /

- Semiconductors

- /

- TSE:6526

Why Socionext (TSE:6526) Expects Higher Sales But Lower Profits for Fiscal 2026

Reviewed by Sasha Jovanovic

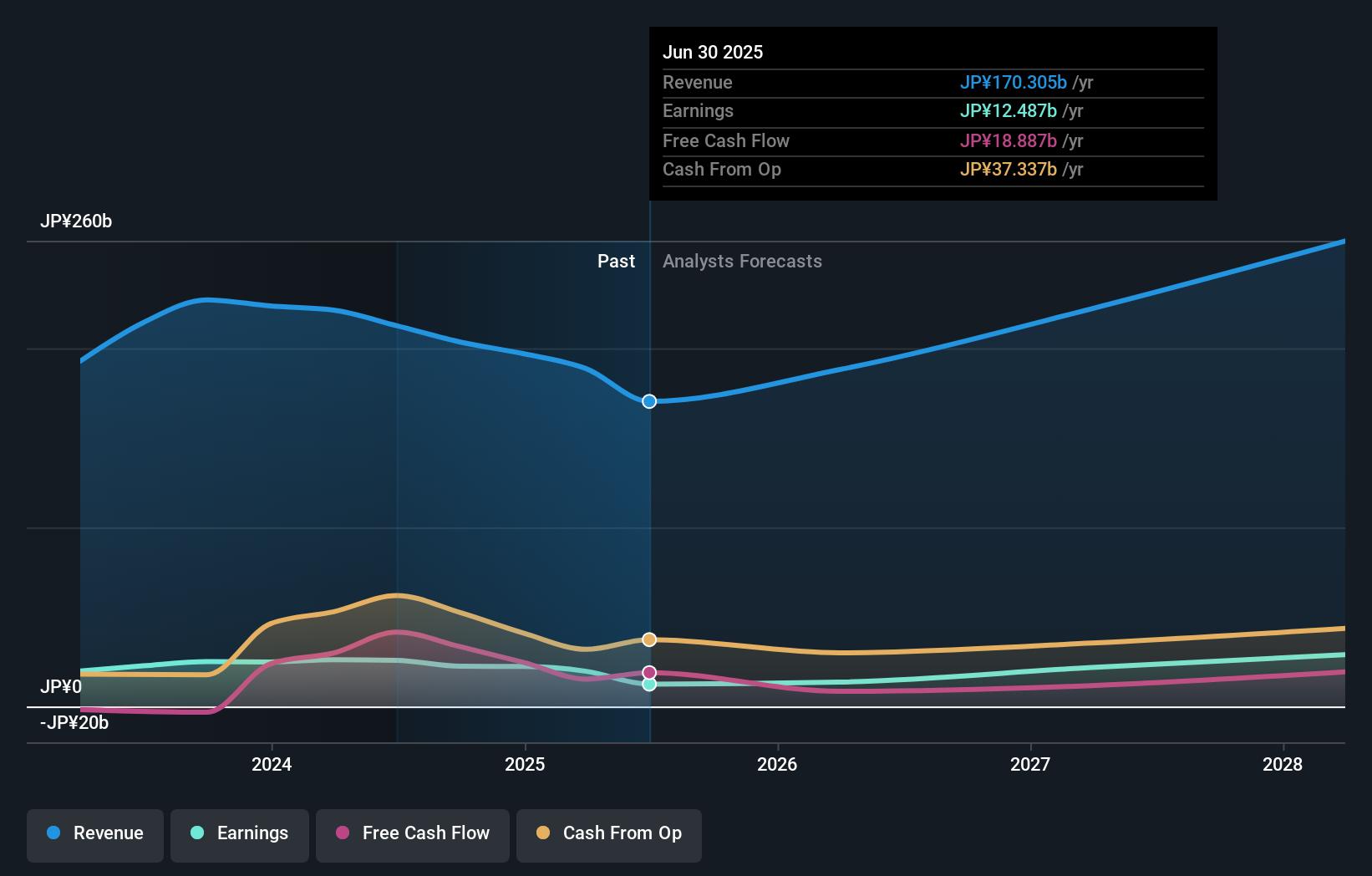

- On October 31, 2025, Socionext Inc. announced a downward revision of its profit forecast for the fiscal year ending March 2026, projecting higher net sales of ¥190 billion but reduced profits and basic earnings per share due to lower gross margins and increased development expenses.

- This adjustment, influenced by the ramp-up of a newly mass-produced product and delayed cost reductions, underscores the operational pressures faced despite robust top-line demand and a weaker yen.

- We'll explore how Socionext's profitability concerns, despite elevated sales outlook, shape its current investment narrative for shareholders.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

What Is Socionext's Investment Narrative?

Being a Socionext shareholder today means believing in both the long-term innovation narrative and the company's ability to manage changing profit dynamics. The rapid commercial rollout of its new Flexlets technology, highlighted in the latest update, has driven sales projections even higher, but profitability now faces more pressure than previously expected due to slim gross margins and an uptick in development costs. This fundamentally shifts the most immediate catalysts and risks for the stock: while top-line demand looks robust, the fast ramp and slower cost reduction temper near-term earnings and margin recovery hopes. The sharp share price fall, over 30% in a week, suggests the market sees these headwinds as significant and potentially longer-lasting than anticipated in previous forecasts. For now, the maintained dividend offers some stability, but it's profit margins that command center stage for risk-conscious investors.

But despite the strong sales narrative, margin pressure is now an even bigger risk to watch. Despite retreating, Socionext's shares might still be trading 26% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Socionext - why the stock might be worth just ¥3030!

Build Your Own Socionext Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Socionext research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Socionext research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Socionext's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6526

Socionext

Designs, develops, manufactures, and sells system-on-chip (SoC), and solutions/services centering on SoC worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives