- Japan

- /

- Semiconductors

- /

- TSE:6525

Kokusai Electric (TSE:6525) Valuation in Focus as KKR's Lock-Up Expiry Raises Secondary Sale Prospects

Reviewed by Kshitija Bhandaru

Kokusai Electric (TSE:6525) is suddenly in the spotlight as KKR’s lock-up period is set to expire in just three weeks, opening the door for a possible $700 million share sale. If you hold the stock or are considering jumping in, this pending event is more than just corporate news. It could shake up the supply-demand balance, with traders watching closely to see how much, if any, of the overhang hits the open market.

This comes after a whirlwind ascent in Kokusai Electric’s share price, which surged nearly 48% in the past month. The move follows a year marked by substantial gains and several sharp bouts of volatility. While this recent push suggests momentum is building, it also raises the stakes around the lock-up expiry, since rapid gains often come hand in hand with shifting risk perceptions among both new and long-term investors.

The big question now, as the market digests the looming share sale, is whether this sets up a rare buying window or if the recent outperformance has already baked in every bit of future growth.

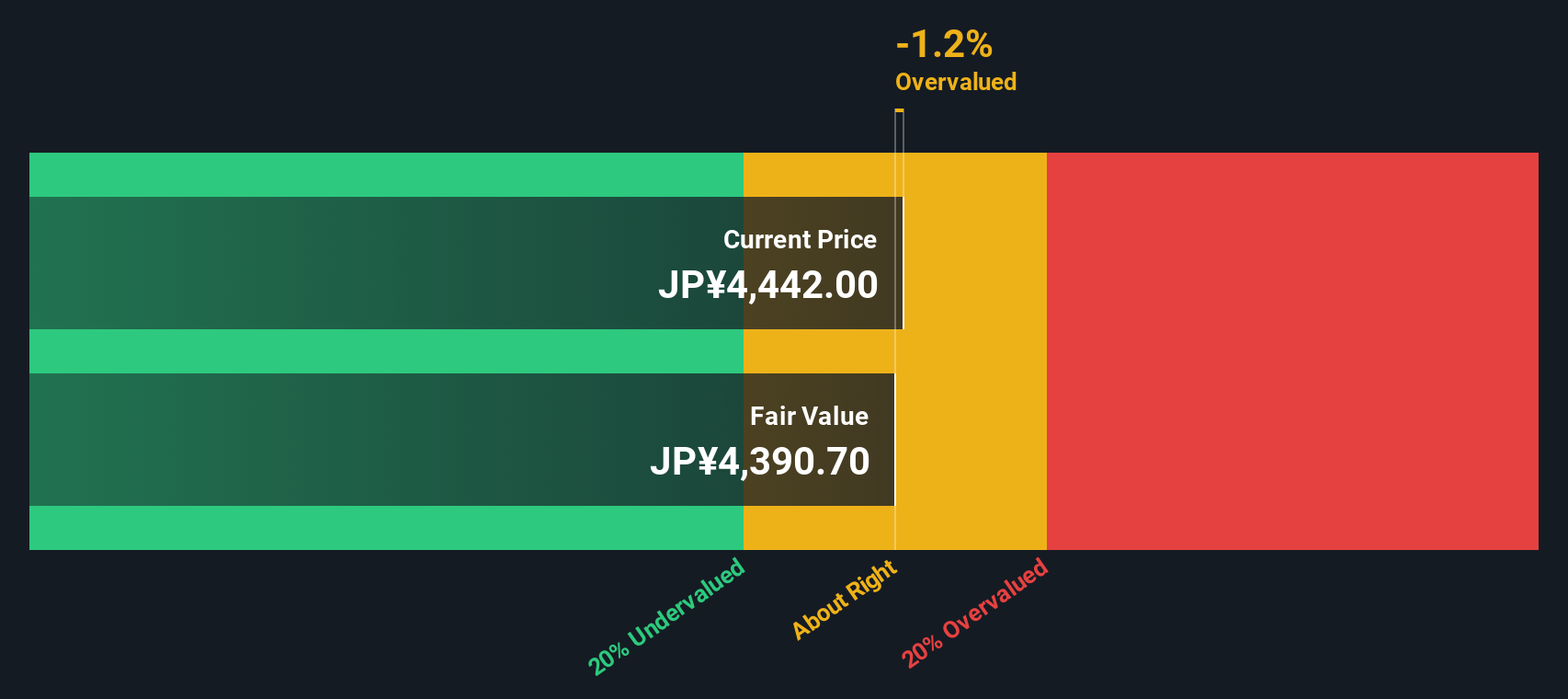

Most Popular Narrative: 19.9% Overvalued

The most widely followed narrative suggests that Kokusai Electric is trading above its calculated fair value, as current market optimism may have gotten ahead of fundamentals.

Strong and sustained capital investment in semiconductor manufacturing for advanced technologies (AI, HBM DRAM, next-generation NAND, and GAA logic nodes) is driving Kokusai Electric's robust order pipeline. This positions the company to benefit from the transition toward more complex and miniaturized chips, supporting top-line revenue growth and higher ASPs through FY26 and beyond.

What is underpinning this ambitious valuation? The narrative leans on growth forecasts, expanding operating margins, and future profitability multiples that rival the industry’s leaders. Wonder which aggressive assumptions are at the core of this projection? Prepare to uncover the specific growth factors and financial expectations that shape this bullish outlook. These details are only available in the full narrative.

Result: Fair Value of ¥3,737 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, several factors could unsettle this outlook, as Kokusai’s heavy reliance on China and recent revenue declines cast a shadow over its growth assumptions.

Find out about the key risks to this Kokusai Electric narrative.Another View: Discounted Cash Flow Perspective

Taking a step back from market optimism, our SWS DCF model offers a different perspective and suggests Kokusai Electric is still trading above what the company's future cash flows might justify. Which valuation approach truly captures the current risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kokusai Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kokusai Electric Narrative

If these perspectives don't fully align with your view, you can dive into the data and shape your own forecast in just minutes. Do it your way.

A great starting point for your Kokusai Electric research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Great investors never stop searching for their next opportunity. Don’t limit your strategy to just one story. These hand-picked themes could put exciting new stocks on your radar.

- Catch momentum early and spot growth stories you might have missed. Check out undervalued stocks based on cash flows shaping markets with unexpected value.

- Boost your portfolio with companies poised to benefit from advances in measurement, encryption, and next-gen computing by starting with quantum computing stocks.

- Secure a steady income stream by focusing on firms rewarding shareholders. Start building your shortlist with dividend stocks with yields > 3% paying above-average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kokusai Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6525

Kokusai Electric

Engages in the development, manufacture, sale, repair, and maintenance of semiconductor manufacturing equipment worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives